NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

With COVID-19 cases continuing to rise nationwide, holiday shopping is expected to further transition away from brick-and-mortar stores and toward e-commerce. The shift to purchasing gifts online has strong implications for DTC wine subscription companies, which have historically experienced significant sales increases during the holiday season and have further exploded in popularity during the pandemic.

Wine subscription sales consistently spike during the holidays

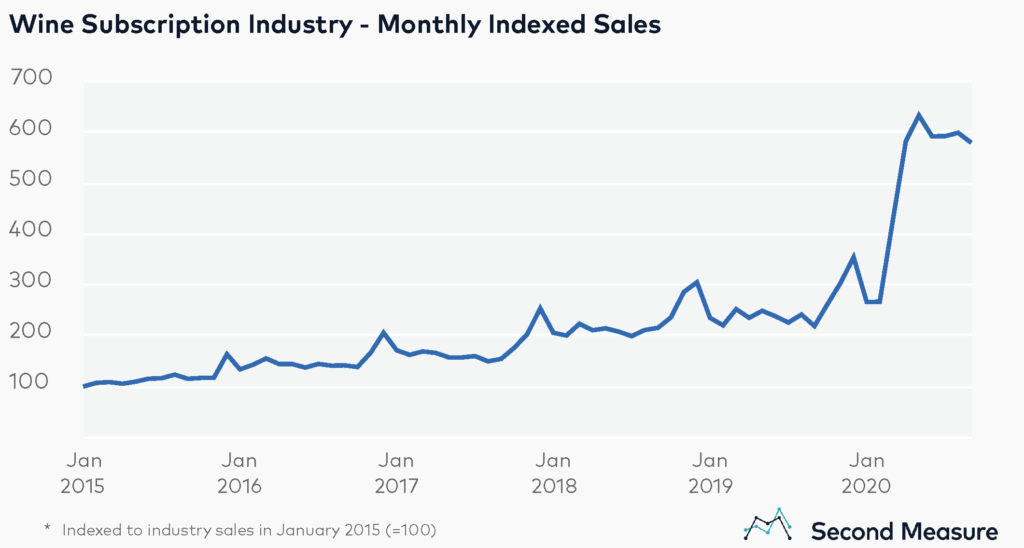

The wine subscription category has been growing over the past several years. Since 2015, the industry has experienced a spike in sales each November and December. In December 2019, total sales for the wine subscription industry were 45 percent greater than average monthly sales from the previous 11 months.

Wine subscription services have grown even more in 2020, coinciding with the COVID-19 outbreak. Industry sales reached an all-time high in May and have remained elevated throughout the pandemic. Even as spending has been leveling off over the past few months, total sales in September 2020 were more than one and a half times that of December 2019.

Wine subscription customers have doubled since 2019

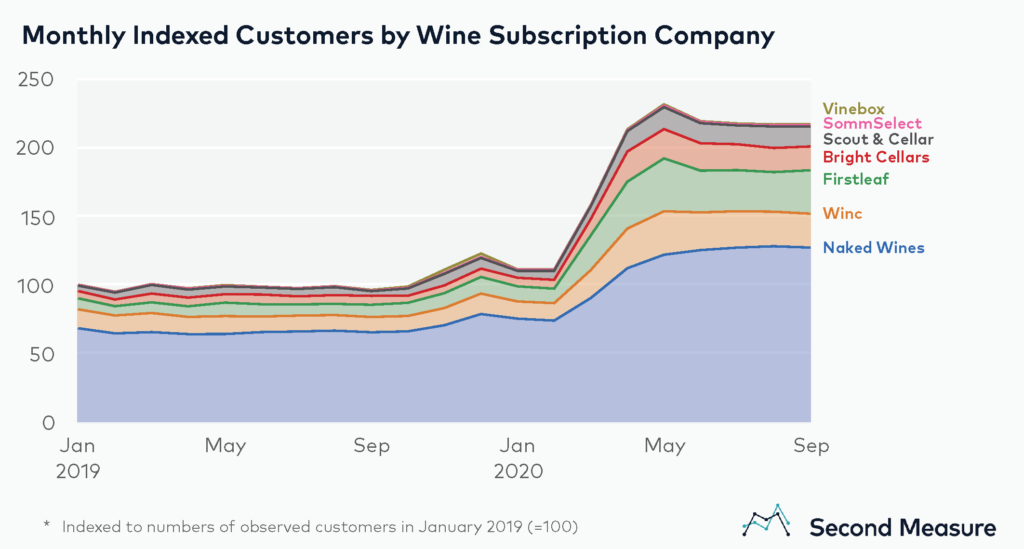

In addition to sales increasing during previous holiday seasons and the pandemic, so have the number of customers who are purchasing wine subscriptions. Further underscoring the trend of sales growth during the holidays, the number of unique customers in the category remained fairly steady throughout 2019 until the holiday spike in November and December.

In the months following the holiday peak, customers declined slightly before skyrocketing during the pandemic. Customers in the industry doubled by April 2020 during the height of the shelter-in-place orders. Even more striking, the increase in customers has been sustained over the past six months. Many of the major players in the industry, including Naked Wines, Firstleaf, and Winc, have experienced significant gains in customer acquisition in 2020.

Some wine subscription companies rely on holiday sales more than others

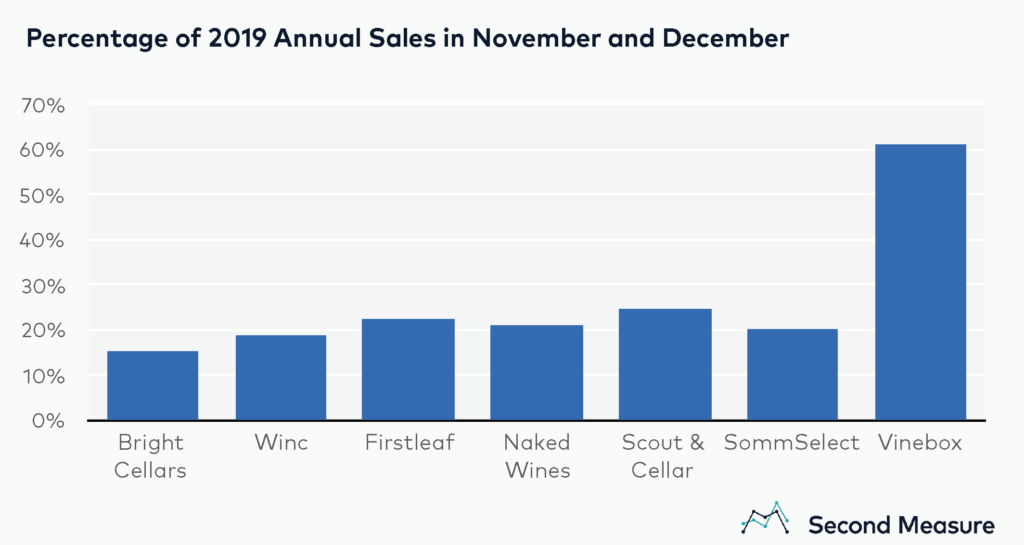

The surge in sales during the pandemic raises the question of how DTC wine subscriptions will perform this holiday season compared to years past. Notably, some of these companies have historically been more reliant on the holiday season for their sales. At Vinebox, for example, over 60 percent of 2019 annual sales came from November and December, compared to less than 20 percent at Bright Cellars, Winc, and SommSelect.

Customer retention has been a challenge for many DTC wine subscription companies

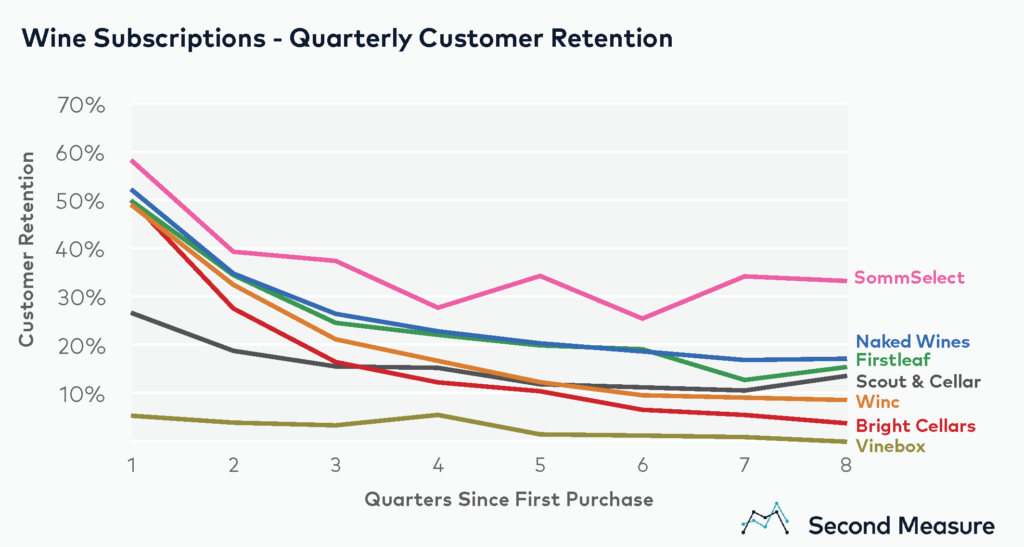

Even though sales have grown substantially during the pandemic, wine subscription companies see relatively low retention rates. After two years, a third of SommSelect customers returned to purchase again, more than any other competitor. At Vinebox, only 5 percent of customers made another purchase within one quarter of their first purchase, and less than one percent made another purchase after seven quarters. However, it is important to note that Vinebox and SommSelect have significantly smaller average customer counts compared to competitors like Naked Wines and Winc, and the impact of cohort dropout would be more pronounced for these smaller samples.

SommSelect also had the highest lifetime sales per customer, at nearly $2,500. This is more than twice as much as its nearest competitor, Scout & Cellar. With holiday shopping in full swing and COVID-19 cases still on the rise, the effect on customer retention and lifetime sales remains to be seen.