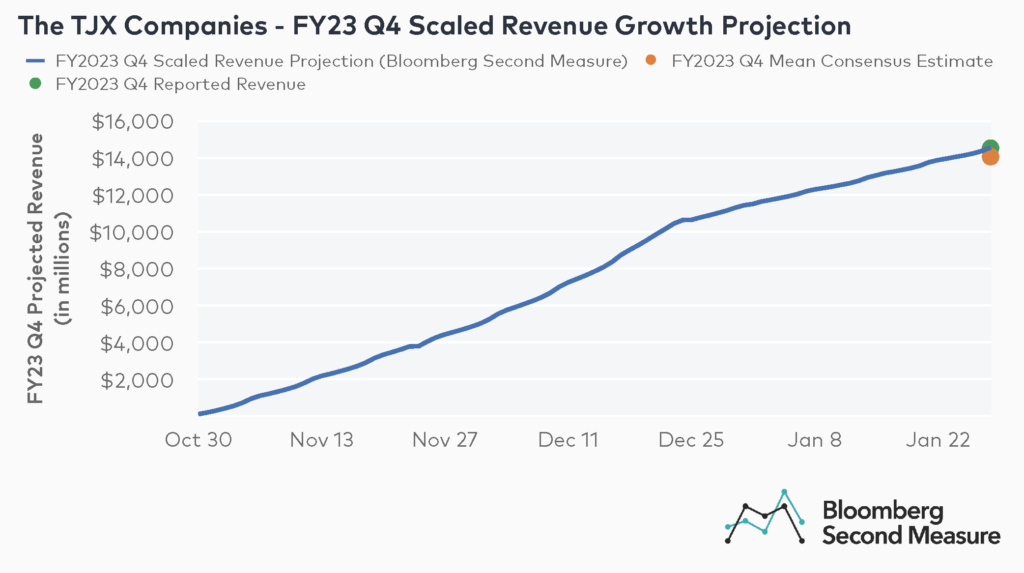

On February 22, 2023, The TJX Companies (NYSE: TJX) announced that its revenue for the fiscal quarter ending on January 28, 2023 (FY23 Q4) was $14.52 billion, a 5 percent increase from the previous year. The report, which was the first among major off-price retailers during the first earnings season of 2023, exceeded analysts’ revenue expectations. Prior to the TJX earnings surprise announcement, Bloomberg Second Measure transaction data projected $14.55 billion in revenue—within half a percent of reported revenue—while the mean consensus estimate was more than 3 percent lower than reported revenue, at $14.08 billion.

Ahead of the TJX earnings surprise, how did customer growth stack up among its main subsidiaries?

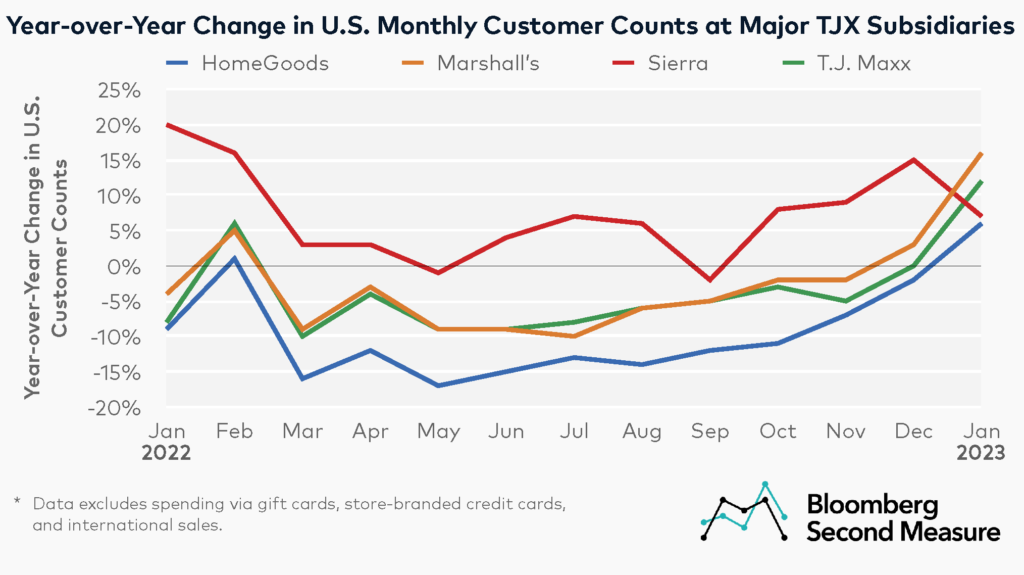

With inflation putting pressure on U.S. consumers’ discretionary spending, off-price retailers were poised to attract more bargain-hunting shoppers. In fact, The TJX Companies’ CEO cited an increase in U.S. customer traffic in the fourth quarter earnings call. Consumer transaction data further shows that The TJX Companies’ year-over-year customer growth trends throughout 2022 varied by month, as well as by subsidiary.

Looking at The TJX Companies’ main U.S.-based subsidiaries, Sierra (an outdoor retailer formerly known as Sierra Trading Post) had the biggest year-over-year increases in U.S. customer counts, with a monthly average increase of 7 percent year-over-year in 2022. On the other hand, major subsidiaries T.J. Maxx, Marshall’s, and HomeGoods experienced monthly average declines in U.S. customer counts in 2022.

However, year-over-year U.S. customer growth picked up for most of these subsidiaries at the end of 2022 and beginning of 2023. In December 2022, U.S. customer counts decreased 2 percent at HomeGoods and remained relatively consistent at T.J. Maxx, but grew 3 percent and 15 percent, respectively, at Marshall’s and Sierra. In January 2023, customer counts increased 16 percent at Marshall’s, 12 percent at T.J. Maxx, 7 percent at Sierra, and 6 percent at HomeGoods.

Aside from value hunting, another factor that could partially account for customer growth over the past year is new store openings. At the same time, TJX-branded stores may be benefitting from some competitors’ store closures—for example, higher-priced retailers such as Bed Bath & Beyond in the home decor space and department stores like Macy’s and Nordstrom in the apparel industry.

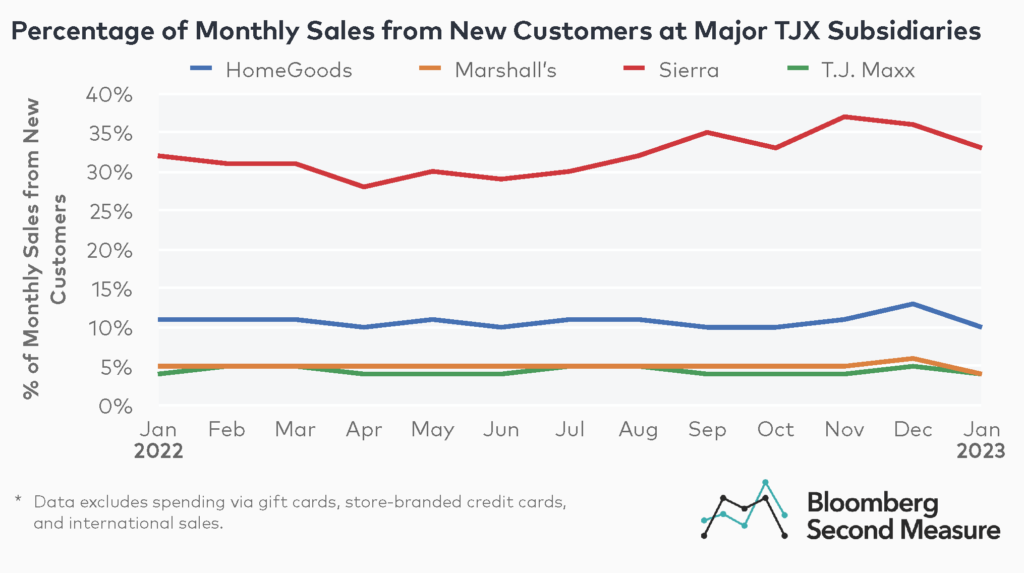

How do purchases from new customers contribute to overall sales for TJX brands?

Diving deeper into customer acquisition, Bloomberg Second Measure data reveals that each of The TJX Companies’ subsidiaries had a different share of sales originating from new customers. For every month in 2022, Sierra had the highest percentage of its sales from new customers, followed by HomeGoods. The off-price fashion retailers Marshalls and T.J. Maxx had the smallest percentage of their sales from new customers.

In January 2023, a third of Sierra’s sales came from new customers. For HomeGoods, 10 percent of sales that month were from new customers. Four percent of sales at Marshall’s and T.J. Maxx came from new customers.

Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest post in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.