NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Rent the Runway has brought the sharing economy to fashion. Its monthly clothing rental plan sits at the intersection of the retail shift toward subscription spending and the rising trend of non-ownership. In the first quarter of 2019, Rent the Runway’s sales grew 40 percent year over year, and its subscribers are more likely to stick around after one year than those of Stitch Fix, the preeminent clothing subscription service.

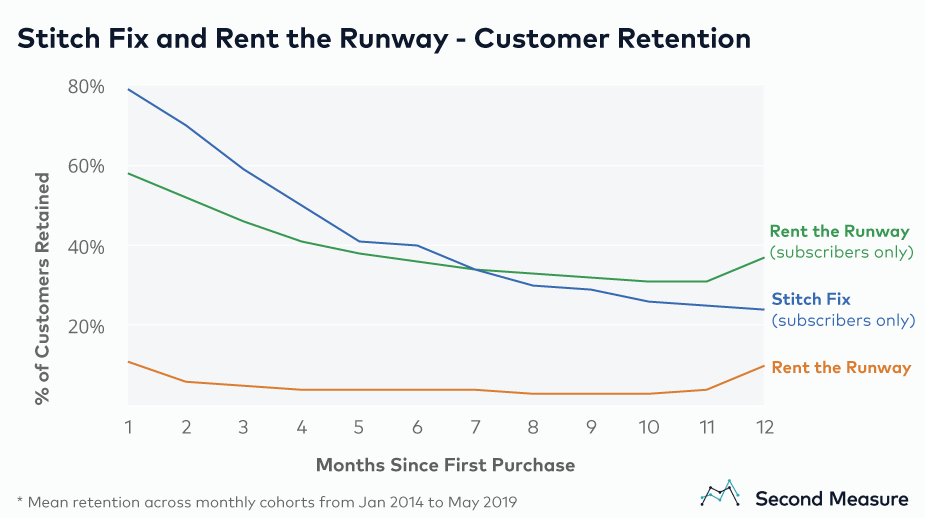

Rent the Runway launched in 2009 as a service for designer formalwear rentals. In 2016, it introduced a subscription plan for renting everyday clothing, and its success at retaining shoppers has rivaled Stitch Fix. Twelve months after their first purchase, 24 percent of Stitch Fix subscribers return to purchase again from the service. That number is just 10 percent among all Rent the Runway customers, but climbs to 37 percent among its subscribers.

Stitch Fix is still the much larger operation—last quarter its sales were more than five times greater than Rent the Runway’s. But, in 2019, Rent The Runway has grown faster, with year-over-year growth 12 percentage points higher than Stitch Fix in the first quarter.

In addition to its ad hoc and subscription women’s wear rentals, Rent the Runway also offers accessory rentals and even experimented with an accessory-based subscription plan back in 2015. In April 2019, it launched a children’s rental collection and is currently promoting its upcoming collaboration with West Elm to rent home furnishings and decor.

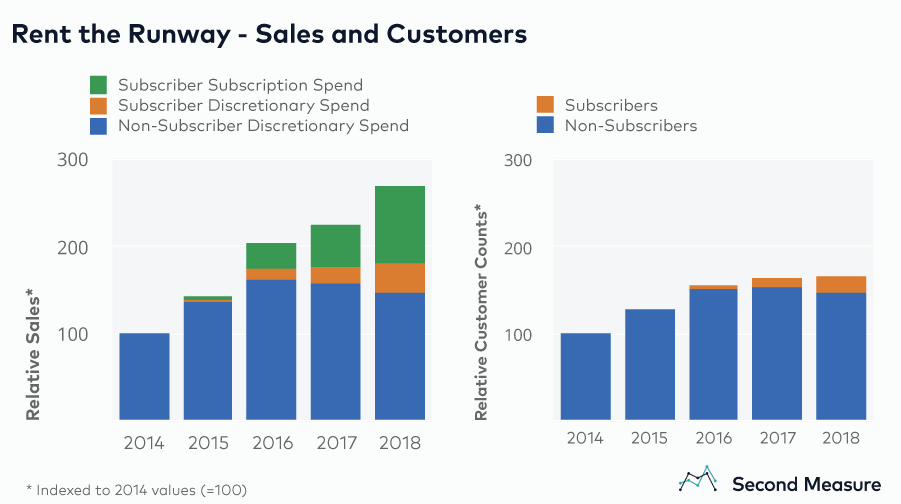

Almost half of sales at Rent the Runway come from subscribers

Since launching subscription rentals, Rent the Runway has captured an increasing share of its sales from subscribers. In 2018, despite only accounting for 11 percent of all customers, subscribers accounted for 45 percent of Rent the Runway’s total sales. Sales attributed to subscribers include both subscription fees and discretionary spending by subscribers, which might include a formalwear rental or the purchase of a beloved (or lost) rental item.

To infer subscribers, this analysis identifies purchases of the same amount occurring at regular billing intervals. Subscribers include customers of both Rent the Runway’s Unlimited and Update plans, which differ in both the number of items that can be rented at a time and the permitted frequency of swap outs. Subscribers of the pricier Unlimited plan spend significantly more each year on subscription fees—$845 last year, on average, versus $311 for Update subscribers.

Regardless of which plan tier they chose, subscribers spent far more on discretionary purchases than non-subscribers. In 2018, the average nonsubscriber spent $159 at Rent the Runway, verses $275 for Update subscribers and $293 for Unlimited subscribers.

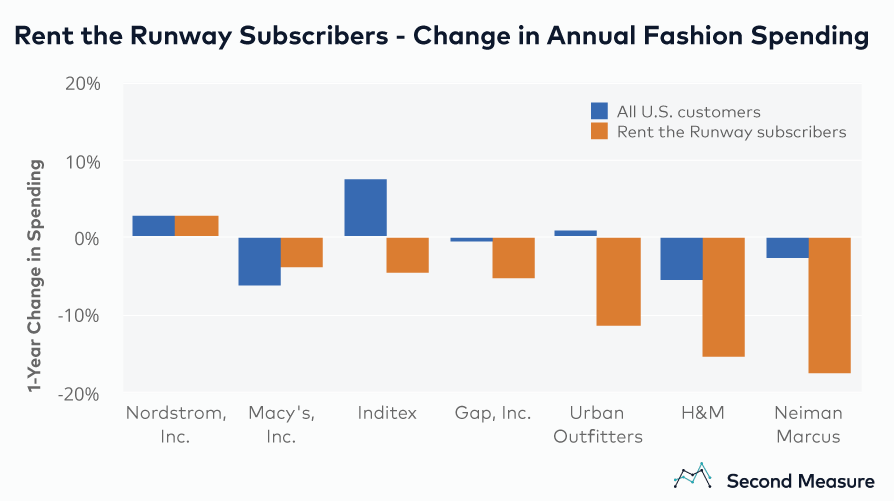

Fashion spending drops off after subscribing to Rent the Runway

While Rent the Runway continues to grow, traditional retailers Gap, Inditex, H&M, Macy’s, Neiman Marcus, Nordstrom, Urban Outfitters and their subsidiaries collectively saw sales fall by 3 percent year over year. A previous analysis found that joining some fashion disruptors, like Stitch Fix, actually aligns with an increase in spending at traditional retailers, but a similar analysis of Rent the Runway tells a different story around displacement of spend. On average, subscribers spent 4 percent less at select major fashion retailers in the year after joining Rent the Runway than they did in the year prior to joining.

The drop in spending was consistent across all analyzed retailers except Nordstrom, Inc., where subscribers increased spending by 3 percent. Neiman Marcus and H&M were hit the hardest, where Rent the Runway subscriber annual spending fell by 17 percent and 15 percent, respectively, compared against the year prior to joining.

Get in touch to start uncovering your own insights about Rent the Runway, Stitch Fix, and other fashion retailers.

Oh, and we’re hiring.