NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Shortly before announcing its first quarter earnings results, DTC home furnishing company Wayfair Inc (NYSE: W) launched its fifth annual Way Day sales event. Bucking its trend of increasing sales every year, consumer transaction data shows that Wayfair sales during Way Day week in 2022 were lower compared to Way Day week sales during the previous two years. However, zooming out, average transaction values at Wayfair Inc have been on the rise in 2022.

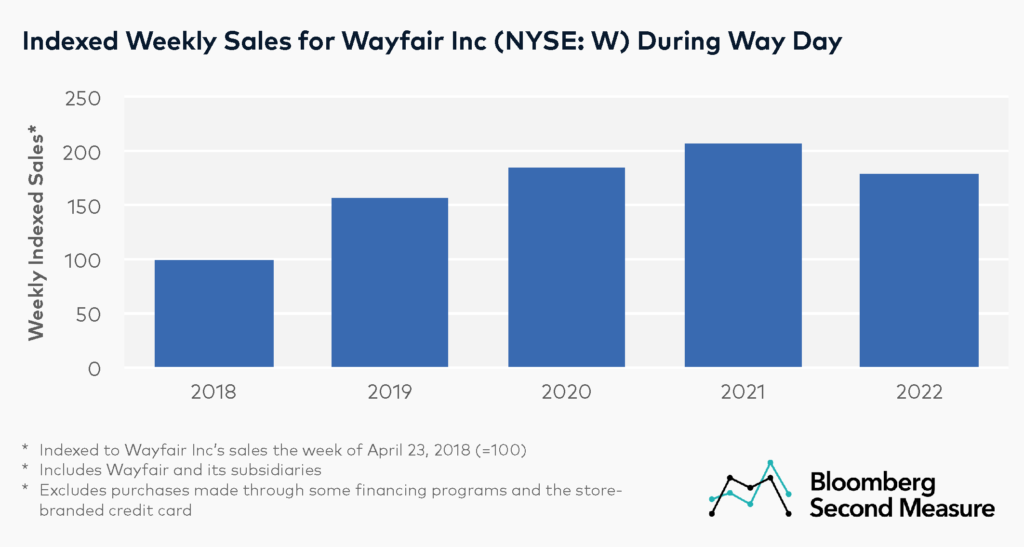

Way Day 2022 weekly sales exceeded the first two Way Day events in 2018 and 2019, but were lower than in 2020 and 2021

Way Day is a sales event that usually takes place in April. The annual sale launched in 2018 as a 24-hour event, and was subsequently expanded to 36 hours in 2019 and then 48 hours in 2020. In 2020, Way Day was pushed from April to September due to the COVID-19 pandemic.

While Way Day week sales had been increasing each year since the event’s inception, our data shows that sales at Wayfair and its subsidiaries during the week of Way Day 2022 were lower than sales during Way Day week in the last two years. Specifically, Wayfair Inc sales during the week of Way Day 2022 were 13 percent lower compared to Way Day week in 2021 and 4 percent lower compared to Way Day week in 2020.

However, the DTC company’s sales the week of Way Day 2022 were 79 percent higher than sales from the week of the first event in 2018 and 14 percent higher than the week of the event in 2019. It is worth noting that Bloomberg Second Measure’s data excludes Wayfair sales made through some financing programs, as well as purchases made via Wayfair’s store-branded credit card.

Early in the pandemic, sales growth at DTC furniture companies like Wayfair outpaced that of traditional furniture retailers. But in recent months, furniture companies have been facing supply chain issues and declining consumer demand, exacerbated by inflation that has affected housing prices as well as home furnishings.

Amazon, one of Wayfair’s main ecommerce competitors, is expected to launch its annual Prime Day sales event in July 2022.

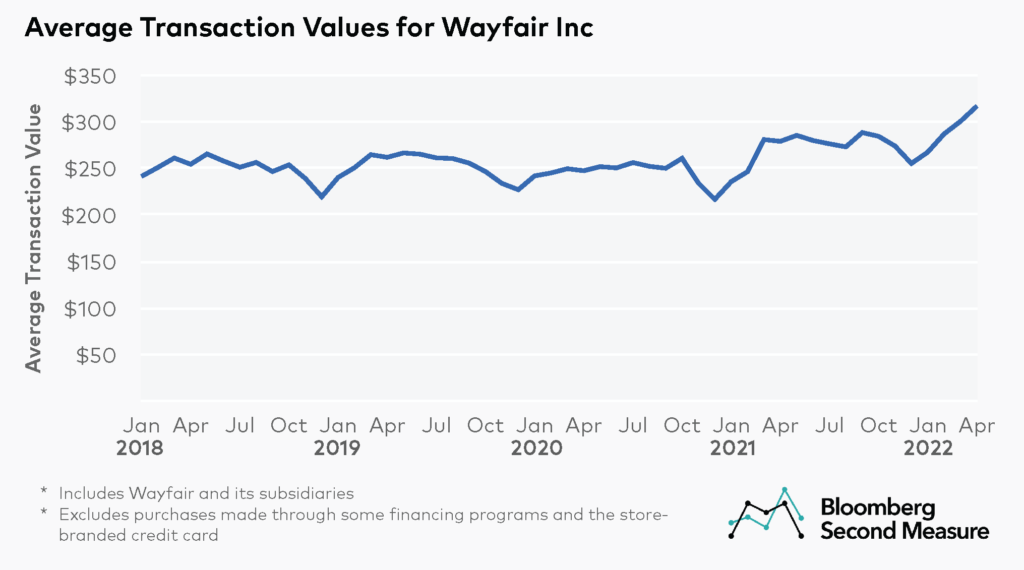

Average transaction values at Wayfair Inc have been increasing in 2022

In April 2022, the average transaction value at Wayfair Inc was $317, a 14 percent increase year-over-year and a 28 percent increase compared to the same month in 2020. Wayfair has also experienced month-over-month increases of at least 5 percent in average transaction value every month so far in 2022. Looking specifically at the week of Way Day 2022, average transaction values were 4 percent higher than the previous week and 19 percent higher than the week of Way Day 2021.

Interestingly, Wayfair experiences a dip in average transaction values toward the end of each year. One potential factor could be that some consumers may be purchasing lower-priced holiday gifts or gift cards rather than more expensive furniture items in December.

What’s next for Wayfair Inc?

In a departure from its roots as a digitally native DTC company, Wayfair has announced plans to expand into brick and mortar with some of its subsidiary brands. At the same time, Wayfair is experimenting with new online channels like video commerce with its recently launched Wayfair on Air app. The company also announced some upcoming leadership changes the same day that its earnings report was released, and recently implemented a corporate hiring freeze in an effort to control rising costs.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.