NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

The pandemic has had a mixed impact on vitamin companies. While wellness giant GNC declared bankruptcy in June and announced it would close 1,200 stores, DTC vitamin companies are flourishing. More specifically, ecommerce vitamin companies like Ritual and Persona have seen their sales and market share increase during the pandemic—appealing to customers through a combination of personalized offerings, a focus on online sales, and influencer marketing.

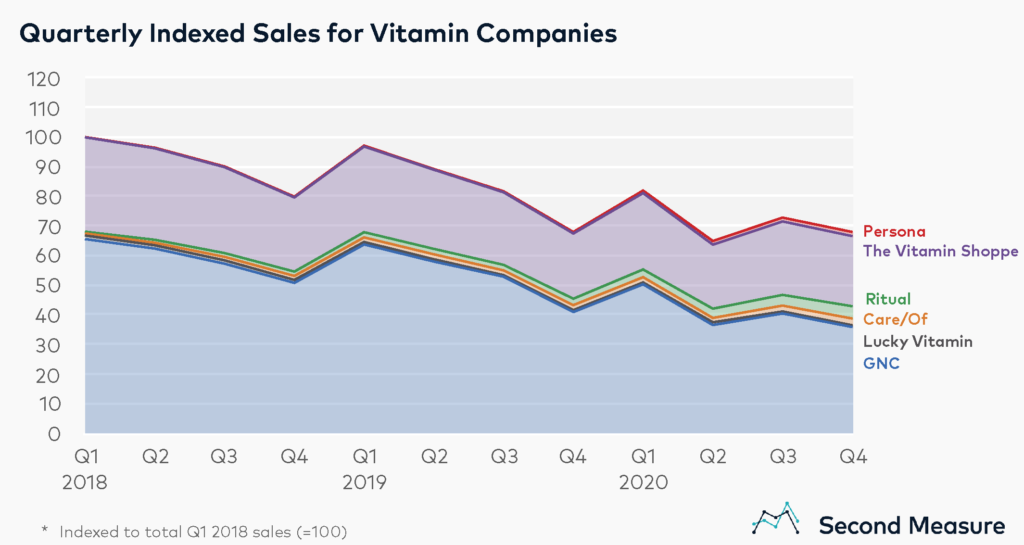

Vitamin sales spike in Q1 and decrease the rest of the year

For the past three years, sales for the vitamin category have been trending downward. By Q4 2020, vitamin sales were 68 percent of what they were in Q1 2018. Interestingly, the vitamin market follows a pattern every year, in which sales spike in Q1 before tapering off for the remaining three quarters. An outlier is Q3 2020, in which overall industry sales increased 12 percent quarter-over-quarter. Notably, in September Dr. Fauci recommended Vitamin C and Vitamin D supplements to keep the immune system healthy, which resulted in skyrocketing sales for these products.

Among our chosen competitive set of vitamin companies, GNC and The Vitamin Shoppe collectively accounted for 88 percent of sales in Q4 2020. However, this is down from 97 percent of sales in Q1 2018, as ecommerce competitors like Ritual, Persona and Care/of have gained traction.

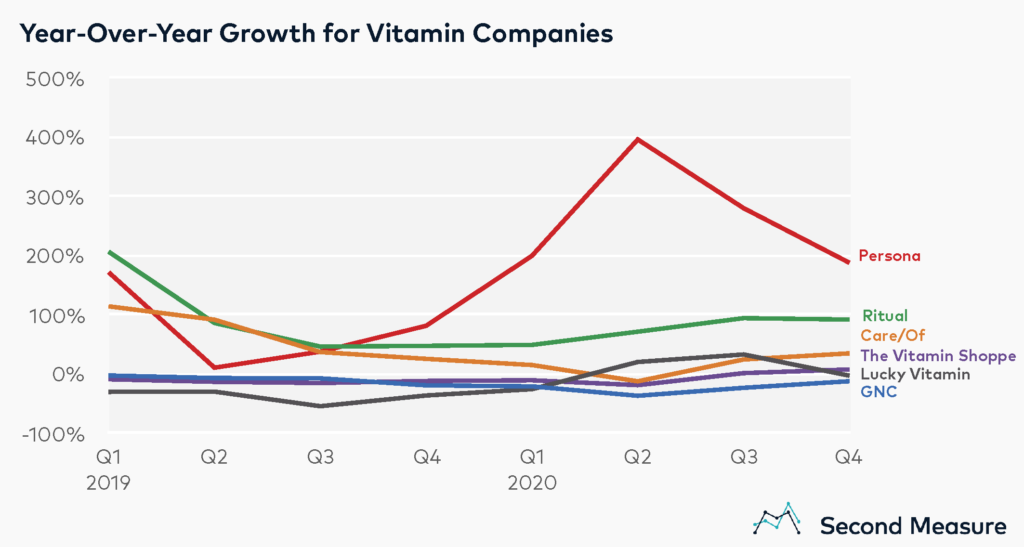

Persona had the highest year-over-year growth during COVID-19

Compared to the other companies in our analysis, DTC startup Persona experienced the biggest growth in 2020. In Q2 2020, Persona’s year-over-year growth rate was almost 400 percent, more than five times that of its nearest competitor, Ritual (also a DTC brand). Founded in 2017, Persona is the newest vitamin company in the competitive set, which could be a contributing factor to its high growth rate. Similarly, Ritual and Care/of were both founded in 2016 and are still expanding quickly. Care/of was acquired by Bayer in 2020.

By contrast, the more established vitamin companies saw negative year-over-year growth over the past two years. Quarterly sales growth for both GNC and The Vitamin Shoppe averaged -16 percent year-over-year for the past two years. Similarly, Lucky Vitamin fell an average of -9 year-over-year in the same time frame.

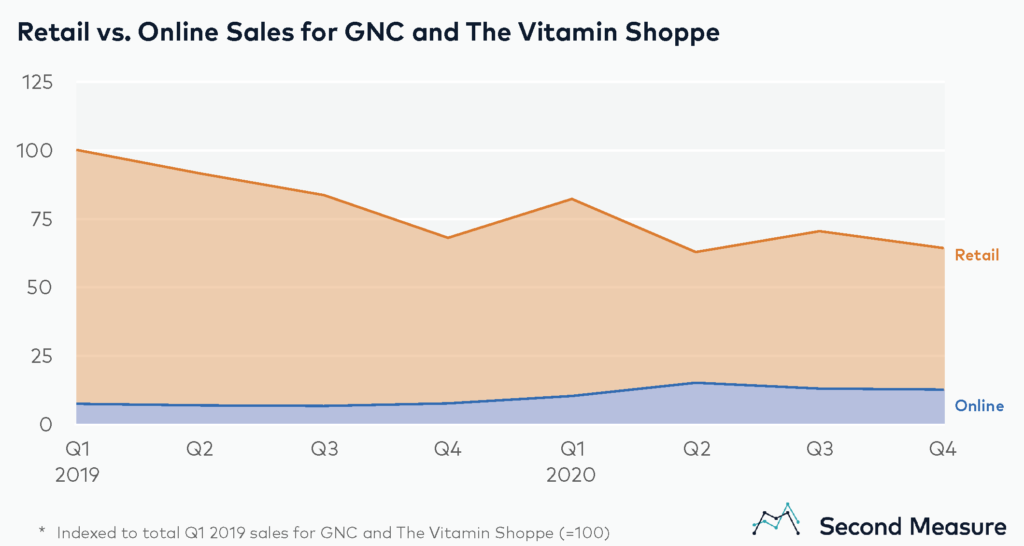

Online sales have grown during COVID, but retail still dominates

Both GNC and The Vitamin Shoppe rely primarily on retail sales rather than ecommerce. However, the share of online sales at these companies has increased and remained elevated since the onset of COVID-19. In Q2 2020, 32 percent of The Vitamin Shoppe’s sales came from online, compared to an average of 15 percent in 2019. For GNC, 19 percent of sales in Q2 2020 were online, compared to an average of 5 percent in 2019. As of Q4 2020, 20 percent of collective sales at GNC and The Vitamin Shoppe came from online, compared to only 11 percent in Q4 2019.

Unlike GNC and The Vitamin Shoppe, the other competitors in the set do not have brick-and-mortar stores and sell exclusively online. These DTC vitamin companies have also introduced subscription-based options for purchasing vitamins, with Persona and Care/of based on consumers’ personalized “wellness profiles.” This level of personalization combined with the convenience of shopping online has signalled a departure from the business model of traditional vitamin and wellness retailers.

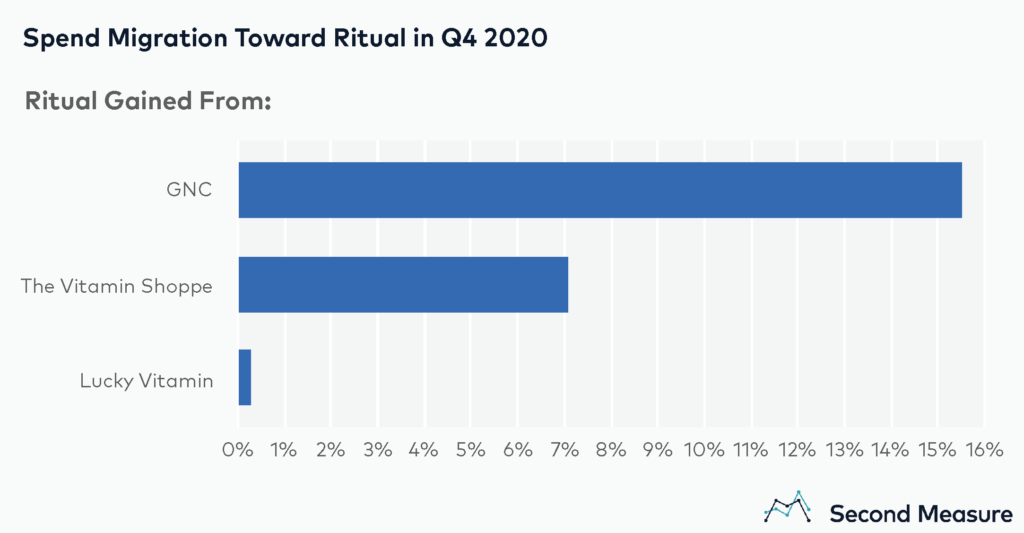

Ritual draws consumer spend from GNC and The Vitamin Shoppe

In Q4 2020, Ritual’s sales grew 15 percent quarter-over-quarter, outperforming the category, which declined 7 percent. Consequently, Ritual’s relative share growth — or its growth rate of market share — was 23 percent, the highest among the competitive set.

Of Ritual’s 23 percent relative share growth in Q4 2020, 16 percentage points came from GNC and 7 percentage points came from The Vitamin Shoppe. Ritual captured less than 1 percentage point of spend from Lucky Vitamin.

Over the past few years, DTC vitamin companies like Ritual have leveraged social media and influencer marketing to brand their products as “cool” and an essential part of self-care. As a result, Ritual and its DTC competitors are reaching younger consumers, especially millennials.

*Note: Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.