NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Department stores showed signs of sales recovery during the recent holiday season. Consumer transaction data reveals that 2021 holiday sales at several major U.S. department store parent companies approached pre-pandemic levels, and a few companies such as Dillard’s (NYSE: DDS) and Hudson’s Bay Company even exceeded holiday sales before the pandemic. At the same time, U.S. consumers who shopped at department store companies spent more on average in November and December 2021 than they did during the same months in 2019.

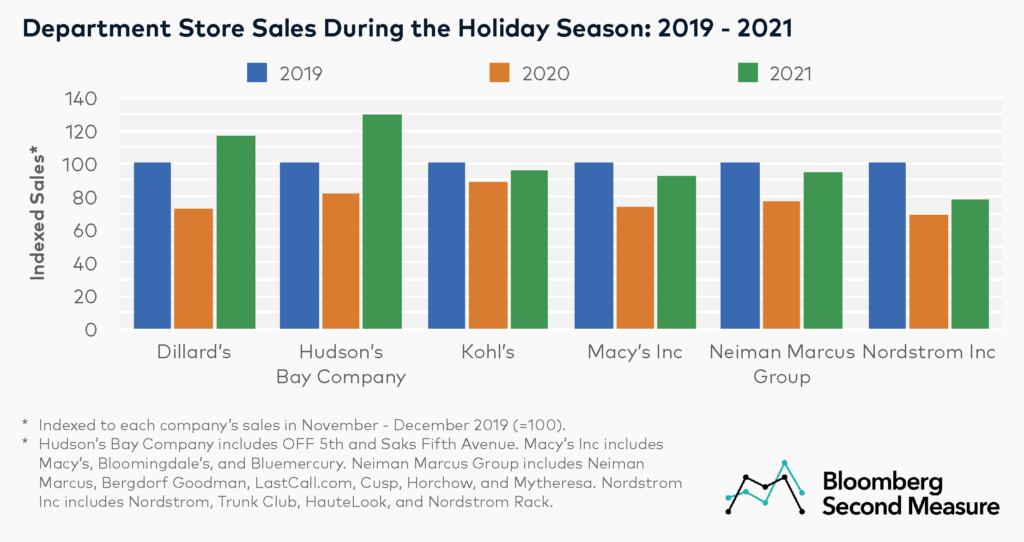

Holiday sales at Dillard’s and Hudson’s Bay Company were higher in 2021 than in 2019

Looking at holiday spending (defined here as November through December), U.S. sales at department store chain Dillard’s grew 16 percent between the holiday season in 2019 and the holiday season in 2021. For Hudson’s Bay Company, U.S. sales increased 30 percent during the same time frame. Hudson’s Bay Company, which includes the brands Saks Fifth Avenue and Saks OFF 5th, was taken private in early 2020.

On the other hand, 2021 holiday sales at Macy’s Inc (NYSE: M), Neiman Marcus Group (NYSE: NMGA), and Kohl’s Corporation (NYSE: KSS) remained just below pre-pandemic levels. Holiday sales at Macy’s Inc were 8 percent lower in 2021 compared to 2019. Earlier in 2021, Macy’s Inc’s strong sales performance exceeded consensus estimates and indicated a gradual return to brick-and-mortar. At Neiman Marcus Group, holiday sales in 2021 were 5 percent lower than in 2019, while 2021 holiday sales at Kohl’s Corporation were 4 percent below holiday sales in 2019. Interestingly, among these department store companies, Kohl’s also had the smallest dip in holiday sales between 2019 and 2020, with a decrease of 11 percent.

Nordstrom Inc (NYSE: JWN) experienced the least growth in holiday sales compared to pre-pandemic levels. The company’s holiday sales in 2021 were 21 percent below holiday sales in 2019.

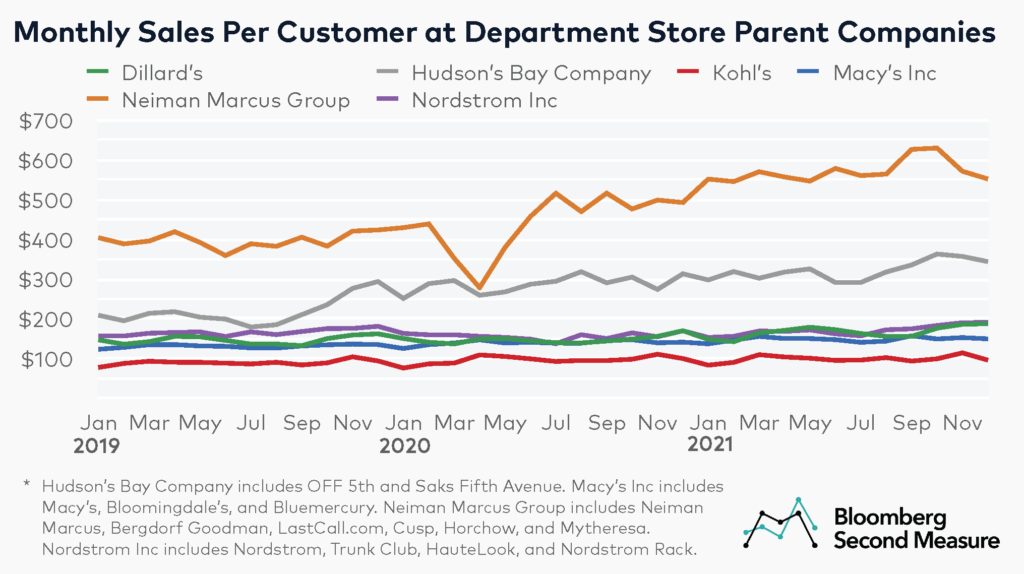

Monthly spending at department store companies has increased compared to pre-pandemic levels

In November and December of 2021, the average monthly sales per customer was higher at all companies in our analysis compared to the same months in 2019. Average spend per customer was also higher these two months compared to in 2020, except for Kohl’s, which decreased year-over-year in December 2021. A potential factor for the increasing sales across the board may be rising prices driven by supply chain issues and tighter inventories during the holidays.

Neiman Marcus Group had the highest average sales per customer, with $571 in November 2021 and $552 in December 2021. Interestingly, Neiman Marcus Group also saw the biggest dip in average sales per customer at the onset of shelter-in-place orders, dipping 20 percent between February and March of 2020 before rebounding over that summer.

Compared to pre-pandemic levels, Neiman Marcus Group experienced the most growth in average sales per customer. In December 2021, Neiman Marcus Group’s sales per customer were 30 percent higher than in December 2019. Aside from rising prices at retailers, another likely reason is that Neiman Marcus Group shuttered most of its discount chain Last Call in mid-2020 in order to focus more on its full-price, luxury offerings. Similarly, Hudson’s Bay Company’s late 2019 increase in monthly sales per customer could be partially attributed to its sale of Lord & Taylor to the clothing rental company Le Tote.

Kohl’s Corporation had the lowest monthly average sales per customer, with $115 in November 2021 and $96 in December 2021.

What department store trends will the New Year bring?

Inflation, supply chain issues, and labor shortages over the past several months have affected inventory availability, prices, and store performance, and there are signs that these challenges may continue for department stores into 2022. For example, Macy’s announced in early January that it would reduce store hours due to staffing shortages brought about by the omicron variant.

Another department store trend is the increased focus on digital. Macy’s has announced plans to close 125 stores by 2023 in favor of ramping up its omnichannel strategy. In 2021, Hudson’s Bay Company split Saks Fifth Avenue’s ecommerce site into a separate business from its brick and mortar, and the new Saks.com entity is reportedly planning for an IPO in the first half of 2022. Likewise, Kohl’s Corporation and Macy’s Inc have both reportedly been urged by activist hedge funds to separate their online and retail businesses, or, in Kohl’s case, consider a company sale. Nordstrom is also reportedly exploring a spin-off for its discount chain Nordstrom Rack.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.