Going into the 2023 holiday season, many retailers sounded notes of caution regarding consumer spending, as pressures such as student loan payment resumption and higher interest rates weighed on spending budgets of many U.S. consumers. Bloomberg Second Measure transaction data analytics show that amid such pressures, holiday shoppers turned to value retailers during the 2023 holiday season (defined here as the period between November and December of 2023). Our data analytics show that most dollar and discount stores in our analysis—Five Below (NASDAQ: FIVE), Ollie’s Bargain Outlet (NASDAQ: OLLI), Dollar General Corp (NYSE: DG), and Dollar Tree Inc (NASDAQ: DLTR)—experienced either double-digit or high-single digit year-over-year growth in observed U.S. sales during both months of the 2023 holiday season. Additionally, zooming in on Five Below, we found that the retailer’s observed sales, coming from both new and returning customers, grew double digits year-over-year over that period.

During the 2023 holiday season, observed sales at Five Below (NASDAQ: FIVE) and Ollie’s Bargain Outlet (NASDAQ: OLLI) grew the most

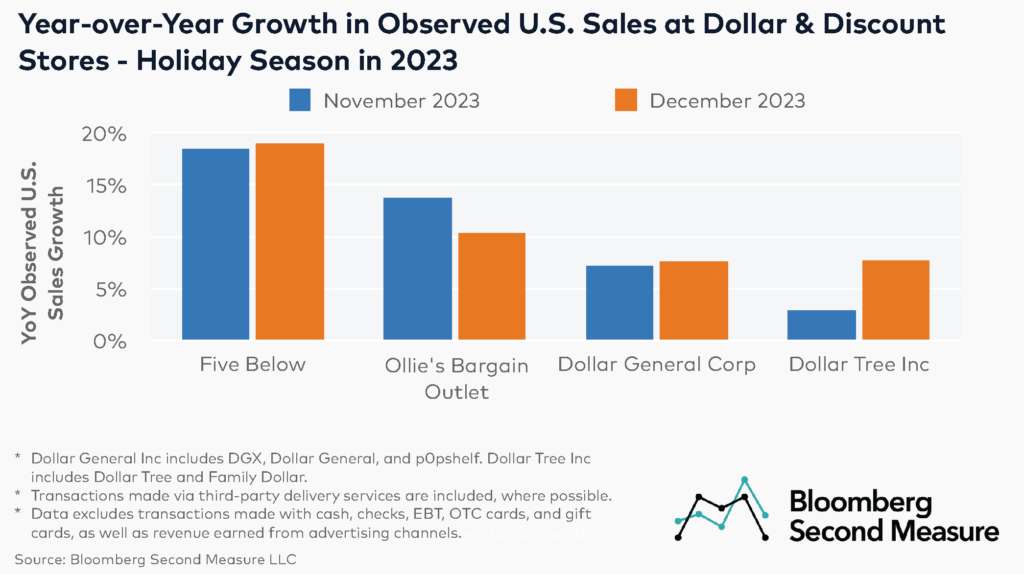

Consumer transaction data analytics show that during the 2023 holiday season, observed U.S sales at all dollar and discount stores in our analysis grew year-over-year, with Five Below and Ollie’s Bargain Outlet experiencing double-digit growth. Five Below’s observed sales were up 18 percent year-over-year in November 2023 and 19 percent in December 2023. Meanwhile, Ollie’s observed sales grew 14 percent in November 2023 and 10 percent in December 2023, compared to the same months in 2022.

Dollar General Corp’s and Dollar Tree Inc’s observed U.S. sales increased at a single-digit rate over the same period. Dollar General Corp’s observed U.S. sales grew 7 percent year-over-year in November 2023 and 8 percent in December 2023. Dollar Tree Inc’s observed U.S. sales increased 3 percent year-over-year in November 2023 and 8 percent in December 2023.

Five Below’s observed sales coming from both new and returning observed customers grew double digits year-over-year during the 2023 holiday season

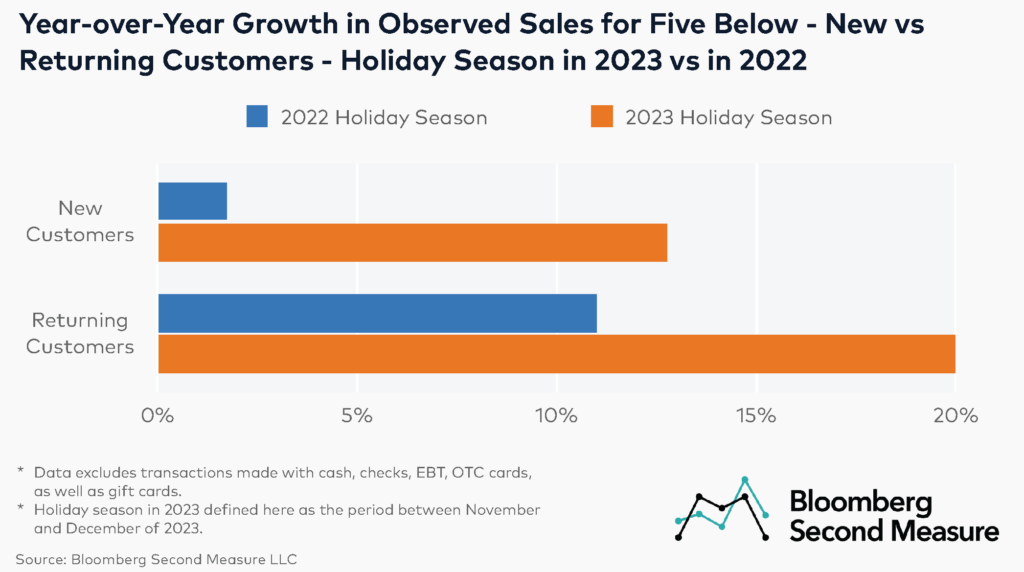

A closer look at Five Below shows that during the 2023 holiday season, observed sales originating from returning customers grew 20 percent year-over-year, while observed sales from new customers were up 13 percent during the same period.

By comparison, during the holiday season in 2022, Five Below’s observed sales coming from returning customers also grew at a double-digit rate and were up 11 percent year-over-year, while observed sales from new customers remained relatively unchanged year-over-year.

A possible factor contributing to Five Below’s observed sales growth during the analyzed period is the company’s physical store expansion. During its FY23 Q3 earnings call, Five Below announced that in Q3 2023, the company opened a record 74 new stores and was on track to open 200 stores by year-end. Another possible factor contributing to Five Below’s growth is the ongoing expansion of Five Beyond, the company’s higher-priced store concept.

Dollar and discount stores sought growth in 2023 by expanding their physical footprints

Five Below is not the only retailer that had plans to add new locations in 2023. Dollar General aimed to add 990 new stores in 2023, despite dialing back the expansion of p0pshelf, its pricier brand. Dollar Tree planned to open between 600 and 650 stores in 2023, while closing underperforming stores operating under its Family Dollar brand. Ollie’s Bargain Outlet also sought to expand its physical store network, with the goal of opening 45 new stores by the end of 2023.

Interested in holiday season retail company trends? Watch this webinar to see how you can use ALTD <GO>, the new Bloomberg Terminal® function that features Bloomberg Second Measure data analytics, to get an early read on company performance around key retail events such as the holiday season.

Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest post in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

The data included in these materials are for illustrative purposes only. The Bloomberg Second Measure services are made available by Bloomberg Second Measure LLC (“BBSM”). BBSM’s parent company, Bloomberg L.P. (“BLP”), provides BBSM with global marketing and operational support. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BBSM, BLP or their affiliates, or as investment advice or recommendations by BBSM, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. BLOOMBERG, BLOOMBERG SECOND MEASURE, BLOOMBERG TERMINAL, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG TRADEBOOK, BLOOMBERG BONDTRADER, BLOOMBERG TELEVISION, BLOOMBERG RADIO, BLOOMBERG.COM and BLOOMBERG ANYWHERE are trademarks and service marks of Bloomberg Finance L.P., a Delaware limited partnership, or its subsidiaries. Absence of any trademark or service mark from this list does not waive Bloomberg Finance L.P.’s or its affiliates’ intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.