NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

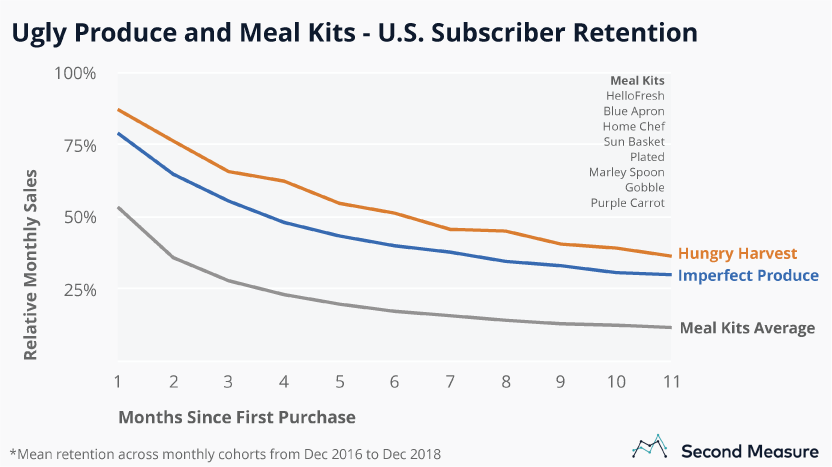

Those misshapen vegetables cropping up in your grocery store didn’t sneak past inspection. They’re part of the ugly produce movement, a recent effort to rebrand the irregular fruits and veggies that can become waste. The trend is also gaining popularity via subscription, with delivery boxes Imperfect Produce and Hungry Harvest offering bargain produce by mail—and seeing impressive subscriber retention. Over 30 percent of ugly produce customers are still subscribers at the end of their first year, dwarfing the average retention for another trendy food delivery: meal kits.

Imperfect Produce and Hungry Harvest keep subscribers coming back nearly three times as well as meal kit companies, which are, on average, all seeing just 12 percent of their U.S. subscribers return after one year. Once an investor darling, meal kits are facing a decline. Blue Apron’s stock has fallen below $1 and its December 2018 monthly sales were down 30 percent year over year—sinking below 2015 levels.

For meal kits, efforts to reach high-value customers with premium designations—like organic or locally sourced—conflict ethically with the excessive packaging and waste that comes with single-portioned ingredients. Ugly produce provides a new option for home chefs looking for more environmentally friendly ways to have food delivered. As with meal kits, ugly produce subscribers can sign up for weekly delivers and customize their selections and delivery schedule, with restrictions that vary by company.

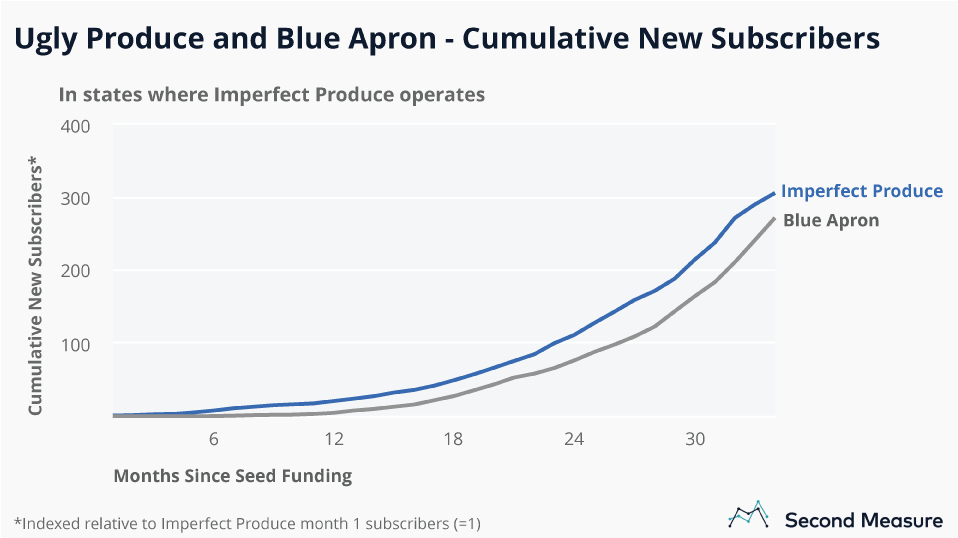

Imperfect Produce’s early growth outpaced Blue Apron

Ugly produce boxes are bringing back a larger proportion of their customers than meal kits each month, but currently deliver to a limited footprint. Nearly three years after its seed funding, Imperfect Produce operates in about a dozen metro areas. After receiving its first funding in late 2014, Hungry Harvest currently delivers to select regions in eight states. In contrast, Blue Apron—the first meal kit company to dominate the U.S. market—boasted a delivery area that included 85 percent of the U.S. in April 2014, less than two year after its seed funding.

But, in those 10 states where it operates, Imperfect Produce is growing more rapidly than Blue Apron did as a startup. Since its seed funding, Imperfect Produce had acquired 12 percent more subscribers than Blue Apron attracted in the same markets during the comparable historical period.

Hungry Harvest, however, hasn’t caught on as quickly. As of December 2018, its active customer base is just one-seventh the size of Imperfect Produce’s. Though they offer competing services, Imperfect Produce and Hungry Harvest have little crossover in their delivery territories, with some overlap in the Mid-Atlantic.

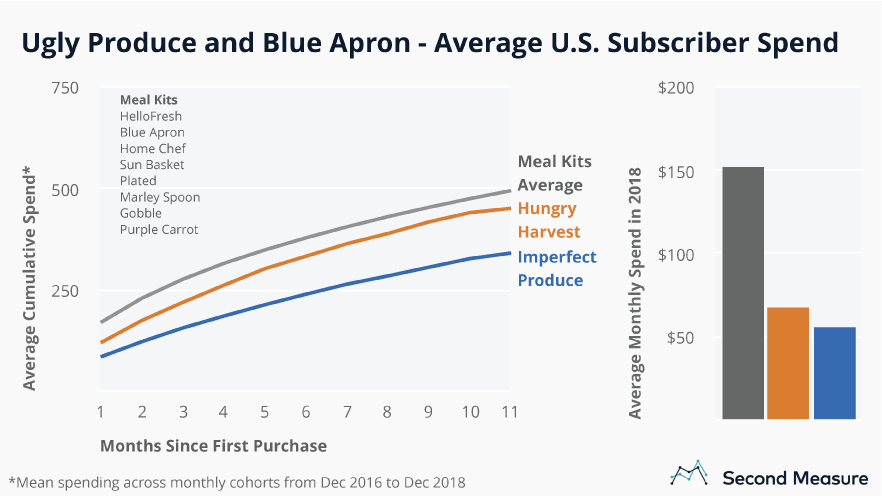

Ugly produce closing customer gap but can’t compete on basket size

Nationwide, the customer differential between Imperfect Produce and top meal kit companies is shrinking. As of December 2018, HelloFresh—the largest meal kit company in the U.S. today—has roughly three times as many U.S. customers as Imperfect Produce. One year earlier, HelloFresh’s customer base was nearly eight times larger than that of Imperfect Produce.

The sales differential remains more substantial, as December monthly sales at HelloFresh were more than eight times greater than at Imperfect Produce. Even with strong customer acquisition and subscriber retention, ugly produce basket size may be an obstacle for closing that gap. In 2018, Imperfect Produce subscribers spent, on average, $56 each month, while the average meal kit subscriber’s monthly spending topped $150.

Ugly produce faces a lower spend ceiling than meal kits, which can rely on big-ticket items—like steaks and wine pairings—to increase sales. New meal kit customers spend, on average, $577 in their first year, compared against Imperfect Produce subscribers who spend just $340.

Ask us about access to the freshest data on ugly produce.

Oh, and we’re hiring.