NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Summer vacation is around the corner, and consumer demand for travel has picked up again. Chip shortages have driven up the price of new and used cars, while gas prices have reached historic levels and contributed to soaring airfares. The rental car and car sharing industry has also typically seen higher sales in the summer months, and the shortages that plagued last year’s summer travel are expected to continue this year. As we enter the new summer season, consumer transaction data shows that among major car rental and car sharing services, Turo—which filed for an IPO earlier this year—has seen the most growth in sales and customer counts over the past three years.

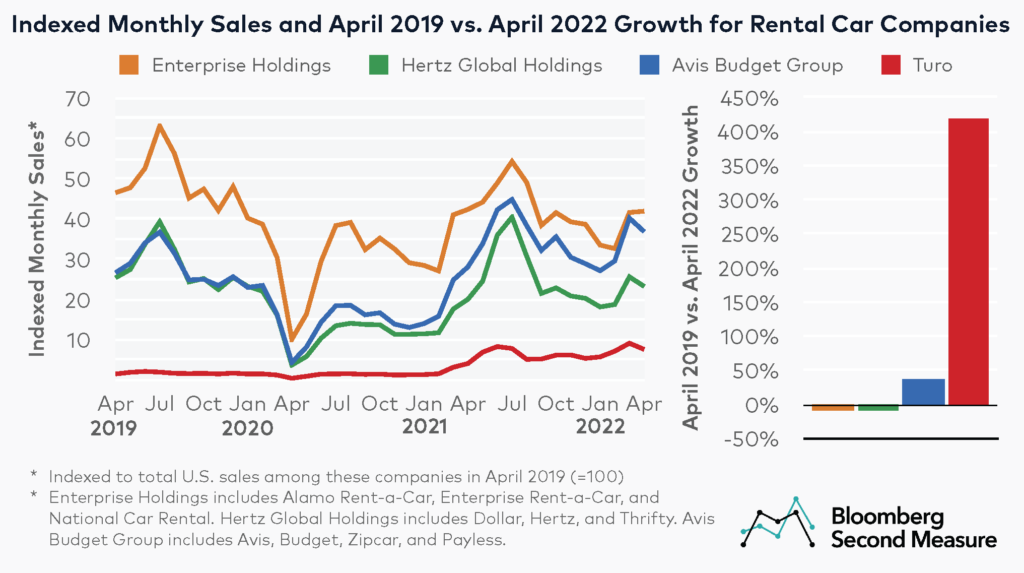

Turo has experienced the most sales growth during the pandemic

Among the car sharing and car rental companies in our analysis—Turo, Enterprise Holdings, Hertz Global Holdings (NASDAQ: HTZ), and Avis Budget Group (NASDAQ: CAR)—Turo experienced the most U.S. sales growth compared to pre-pandemic levels. In April 2022, Turo’s U.S. sales were 419 percent higher than the same month in 2019. One potential factor in Turo’s strong growth compared to competitors is that it is a smaller company and less established than the other major car rental services. The only other company in our analysis to experience sales growth in this time frame was Avis Budget Group—composed of Avis, Budget, Zipcar, and Payless—which saw a sales increase of 38 percent for its U.S. market.

By contrast, both Enterprise Holdings—which includes Alamo Rent-a-Car, Enterprise Rent-a-Car, and National Car Rental—and Hertz Global Holdings—composed of Dollar, Hertz, and Thrifty—had lower sales in the U.S. in April 2022 than they did three years ago, with declines of 10 percent and 9 percent, respectively.

While Enterprise Holdings sales remained relatively consistent year-over-year, the other three companies experienced sales growth between April 2021 and April 2022. Turo’s sales increased 86 percent year-over-year in April 2022, while Avis Budget Group’s sales grew 31 percent and Hertz Global Holdings’ sales increased 16 percent.

Enterprise Holdings remains the largest company in our analysis, accounting for 38 percent of sales among these companies in April 2022. Getaround, another car-sharing service, accounted for less than half of a percent of sales in April 2022 and was therefore excluded from the charts above. Both Getaround and Turo are peer-to-peer car-sharing marketplaces that connect car owners with renters, rather than provide corporate-owned cars for rent.

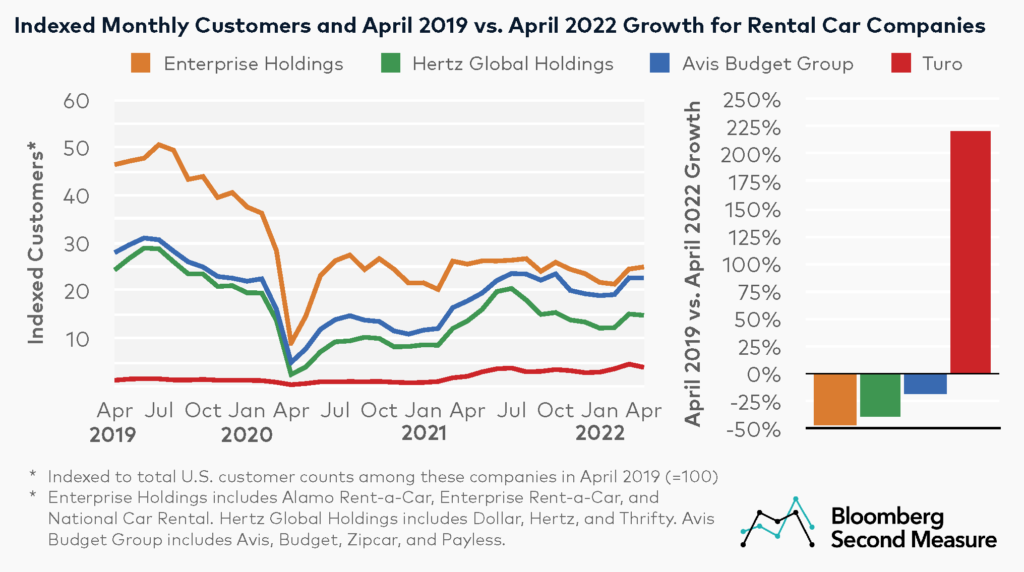

Only Turo experienced a rise in customer counts compared to pre-pandemic levels

All companies in our analysis saw a significant decline in U.S. customers between February and April of 2020, coinciding with shelter-in-place orders, but rental car customers slowly began to return over that summer.

However, customer counts at most of these car rental companies have not recovered to pre-pandemic levels. In April 2022, customer counts at Enterprise Holdings, Hertz Global Holdings, and Avis Budget Group were lower than in April 2019, with respective declines of 46 percent, 39 percent, and 19 percent. Conversely, Turo experienced strong customer growth during this time period, with customer counts growing 221 percent over the same three years.

On a year-over-year basis, three of the four car sharing and rental services experienced customer growth. Turo’s customer counts grew 92 percent between April 2021 and April 2022, while Avis Budget Group’s grew 27 percent and Hertz Global Holdings’ grew 9 percent. Customer counts at Enterprise Holdings declined 2 percent year-over-year.

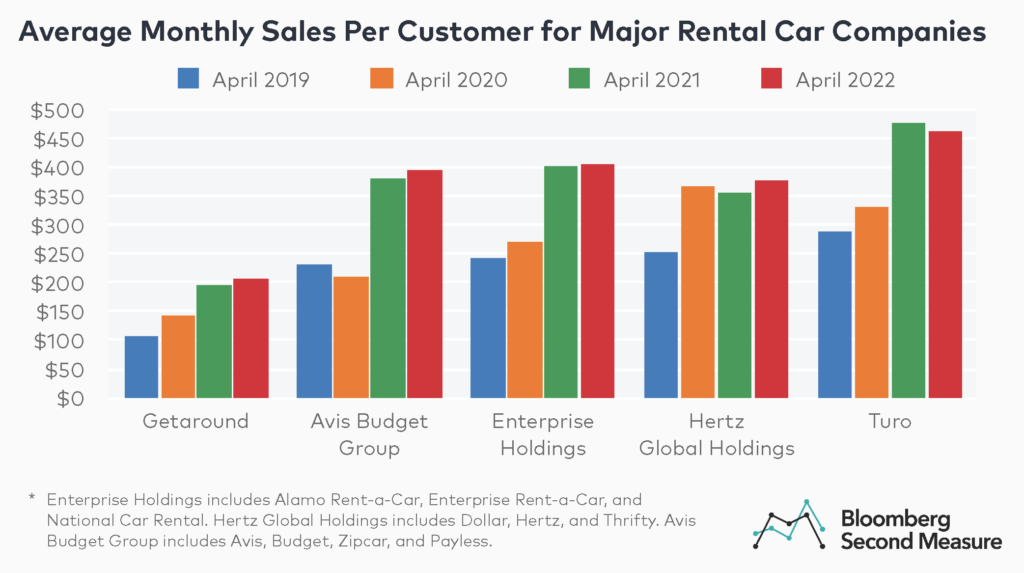

Sales per customer have generally increased at major rental car companies

A closer look at the car sharing industry trends suggests that customers have been spending more on auto rentals during the pandemic. Between April 2019 and April 2022, the average sales per customer increased 90 percent for Getaround, 71 percent for Avis Budget Group, 67 percent for Enterprise Holdings, 62 percent for Turo, and 50 percent for Hertz Global Holdings.

Among the companies in our analysis, only Turo experienced a year-over-year decline—of 3 percent—in sales per customer in April 2022. Average sales per customer grew the most year-over-year at Hertz Global Holdings, with a 7 percent increase.

In addition, consumers are spending the most at Turo. In April 2022, the average monthly sales per customer was $464. Enterprise Holdings came in second with $406, followed by Avis Budget Group with $394. Hertz Global Holdings customers spent an average of $379 with the company, while customers at Getaround spent $206 on average.

Another notable trend is that both peer-to-peer car sharing services in our analysis—Turo and Getaround—are preparing to join some of their more established car rental competitors in the public markets. Turo will be traded on the NYSE under the ticker symbol TURO after its IPO. Getaround also recently announced that it will be going public via a SPAC merger.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.