NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Gobble was started in 2011 as a marketplace for home-cooked food. By 2014, they had become a pre-cooked meal subscription service as part of YC.

Neither model really took off, so in September they pivoted again – this time to meal kits. Here’s what happened:

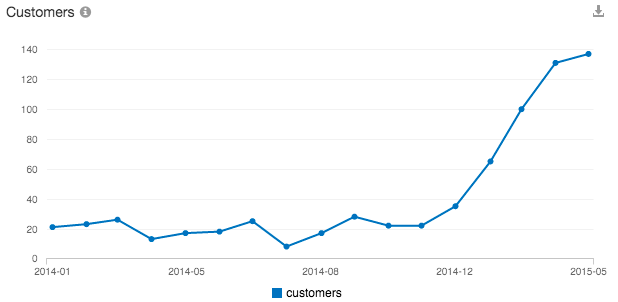

Gobble hasn’t revealed their monthly numbers, but we believe this represents just over 3% of their true revenue and customer base.

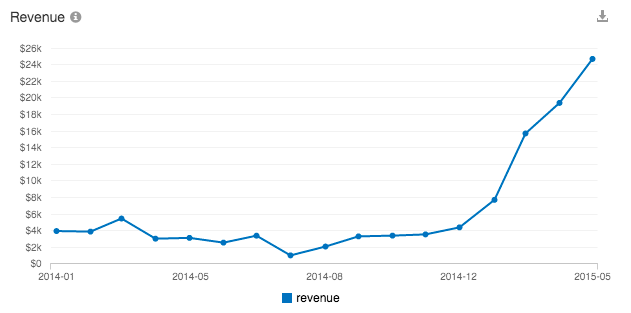

We estimate Gobble earned $750k from 4200 customers in May

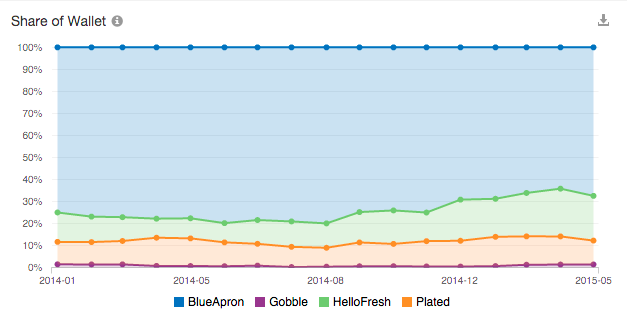

Even though Gobble is a small (but fast-growing) fish in the meal-kit sea:

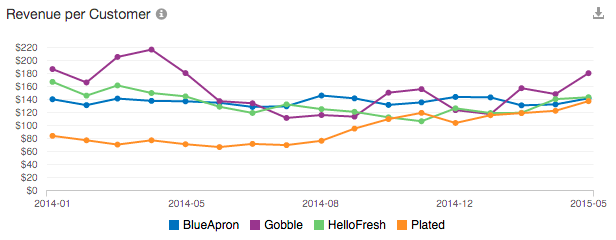

Gobble customers monetize better than Blue Apron, HelloFresh, or Plated:

*On May 22, Gobble reported their average member spends $242 each month. The key word is “member”, meaning retained customer. We confirmed this in our data: customers who joined prior to April and were still active in May spent an average of $240 in April, while the rest (new and/or churned customers) spent an average of $97.

Which begs the question: when are they raising their next round?

All data pulled directly from Second Measure. Request access to explore Gobble, Blue Apron, and hundreds of other public and private companies.