NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Netflix is (and always has been) the industry titan when it comes to streaming video subscriptions. Not only does it have the most customers, but those customers largely keep coming back, month after month, and year after year. Yet, Netflix’s most recent earnings report suggests trouble could be brewing. And Disney’s new streaming service, set to launch in November, may put the company’s unparalleled customer-retention record to the test.

This summer, for the first time in nearly a decade, Netflix announced a drop in U.S. customers. (The company conceded that recent price hikes may have played a role.) Still, when it comes to retaining users, no competing service comes close to Netflix.

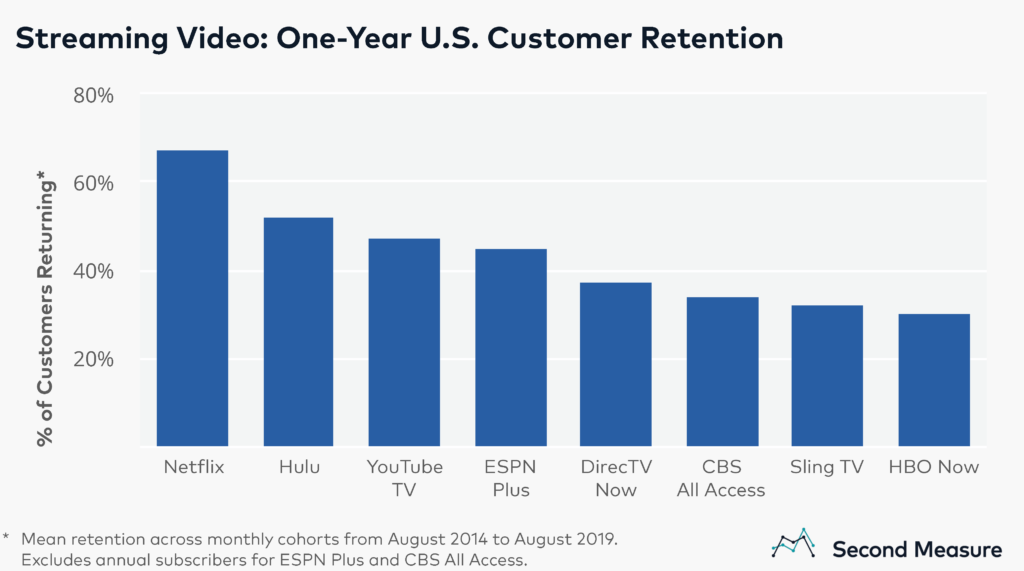

On average, two-thirds of the company’s monthly-paying customers are still subscribed 12 months after first signing up. At Hulu, the service with the second-best retention, 53 percent of customers remain 12 months after joining. (This analysis excludes customers who bundle streaming video with other services, such as cable packages or Spotify Premium. It also excludes customers who pay annually.)

HBO Now is the service with the lowest retention. Less than one-third of subscribers are still paying 12 months later. And, as our previous research has shown, much of the volatility can be traced back to “Game of Thrones” fans joining the service just long enough to watch each blockbuster season.

HBO’s new parent company, AT&T, announced it will launch a new streaming service, HBO Max, in the spring of 2020. And it will offer exclusive access to the beloved sitcom “Friends”—presently one of Netflix’s most-streamed shows. Netflix is also losing another top-watched series, “The Office,” to NBC Universal and its planned 2020 streaming service. And Apple will launch its own streaming video platform in November, complete with some very expensive original content and star power.

Long term, Netflix trounces competition

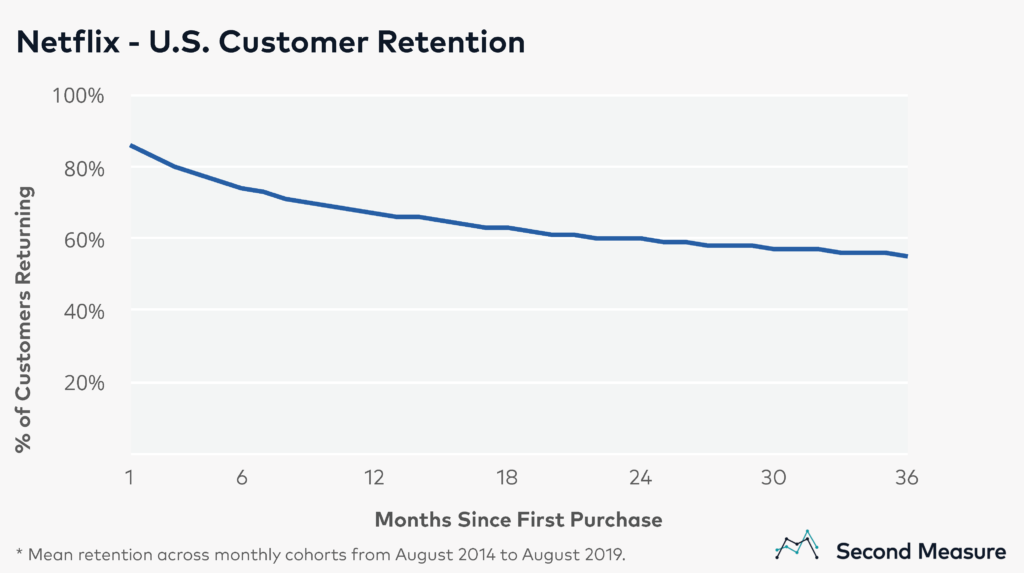

All the new streaming upstarts seem daunting, but history shows that—so far—Netflix has had staying power. Two and even three years out, Netflix customers are sticking around at rates higher than any competitor can boast after just one year. An average of 60 percent still pay for the service two years after joining, and 55 percent do after three. These trends have largely held up through Netflix price hikes and tempting competitor promotions, like Hulu’s wildly popular 2018 Cyber Monday deal, offering the service for 99 cents a month.

That’s not to say Netflix has never experienced bumps in the road. It lost 800,000 subscribers in 2011 when it raised prices and split its services into separate accounts for DVD and digital content (a move it later reversed). And other price increases have led some customers to say goodbye. But, on average, none of this has moved its long-term retention rates more than a few percentage points over the last five years.

However, Netflix will soon face some heavy-weight (and lower-priced) streaming competition that will feature some of the very shows it used to carry. Time will tell whether it’s enough to lure away customers who have long been loyal Netflixters.