NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Among the many supply chain challenges of the pandemic, one such commodity experiencing a shortage is boba—the tapioca pearls that are the main ingredient in bubble tea. A closer look at consumer transaction data for large national chain Kung Fu Tea reflects that demand for bubble tea has been rising during the pandemic, but so far does not indicate that the boba shortage is affecting the company’s sales or customer counts, likely due to the company having warehouses on both the East Coast and West Coast.

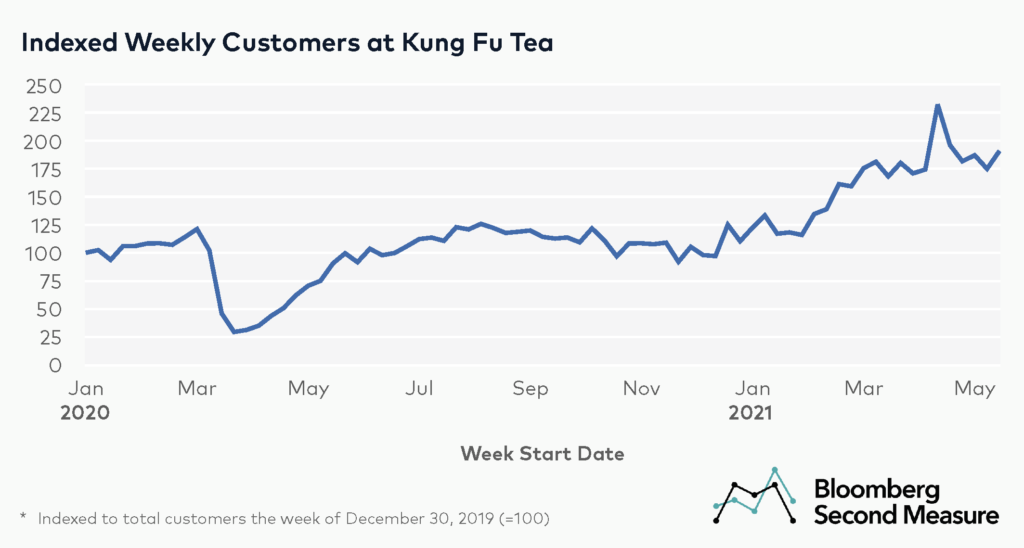

Kung Fu Tea weekly customers have doubled since last year

The number of customers at Kung Fu Tea has been on the rise in 2021. Between the first week of January 2021 and the first week of June 2021, the number of customers increased 52 percent. Compared to the first week of June 2020, the number of customers at Kung Fu Tea the first week of June 2021 has more than doubled.

Kung Fu Tea saw its biggest spike in customers the week of April 26, 2021, with a 33 percent week-over-week increase in customers. This is likely a result of the company’s National Bubble Tea Day promotion, which gave app users who bought a drink on April 30 a $4 coupon to use the following week. Customers can purchase Kung Fu Tea at one of its brick-and-mortar stores, through the Kung Fu Tea app, or through several meal delivery apps. However, sales from meal delivery services are not included in the figure above.

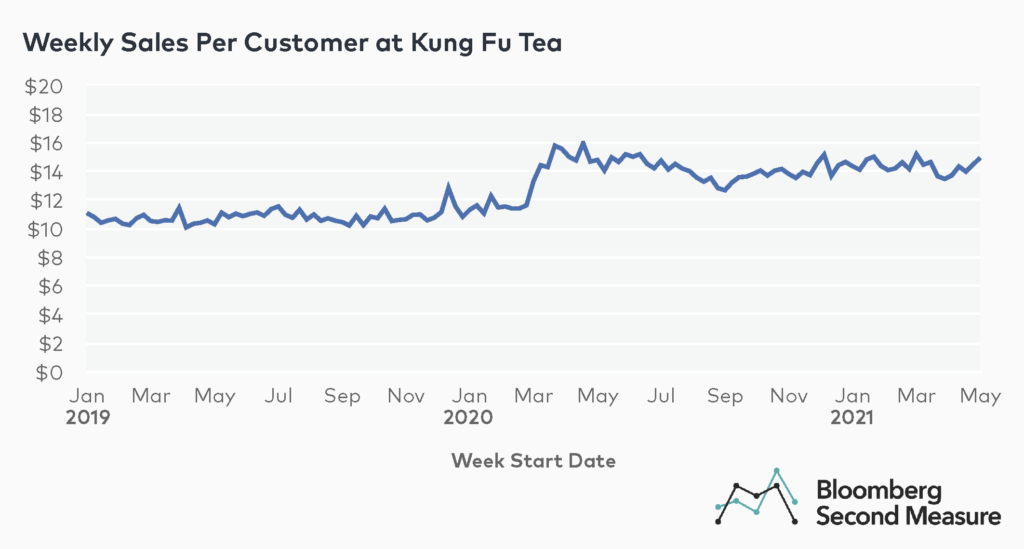

Sales per customer also increased during the pandemic

The average weekly sales per customer at Kung Fu Tea in 2019 was $11, compared to $14 in 2020 and year-to-date as of May 2021. Weekly sales per customer experienced a significant jump in spring 2020, with a 39 percent increase between the first full week of March and the first full week of April.

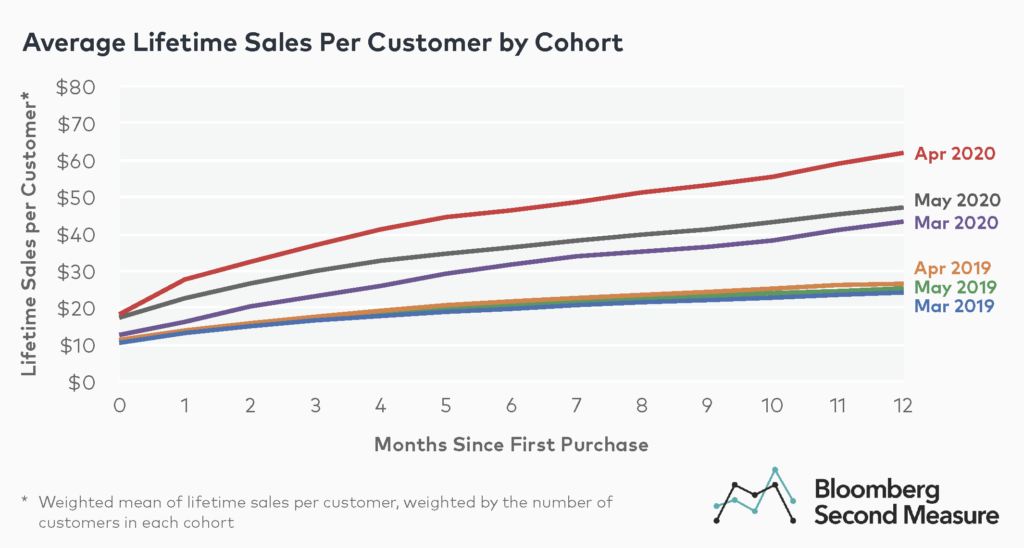

Similarly, lifetime sales per customer for the cohort that made its first Kung Fu Tea purchase in April 2020 far outweigh cohorts prior to the pandemic. After twelve months, the average lifetime sales per customer for the April 2020 cohort was $62, compared to $27 for the cohort that made their first purchase in April 2019. Average lifetime sales from other early pandemic-era cohorts, such as those starting in March 2020 and May 2020, were also elevated compared to the year before.

Ingredient shortages may continue throughout the summer

The boba shortage is expected to worsen throughout the summer. Some quick-service restaurants are adding bubble drinks using ingredients other than boba, inspired by the bubble tea hype. Starbucks has also been experiencing shortages for key ingredients in its beverages, as well as cups and lids. If supply issues continue as businesses reopen and consumer demand for cold beverages rises, some customers may ultimately leave feeling thirsty.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.