NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

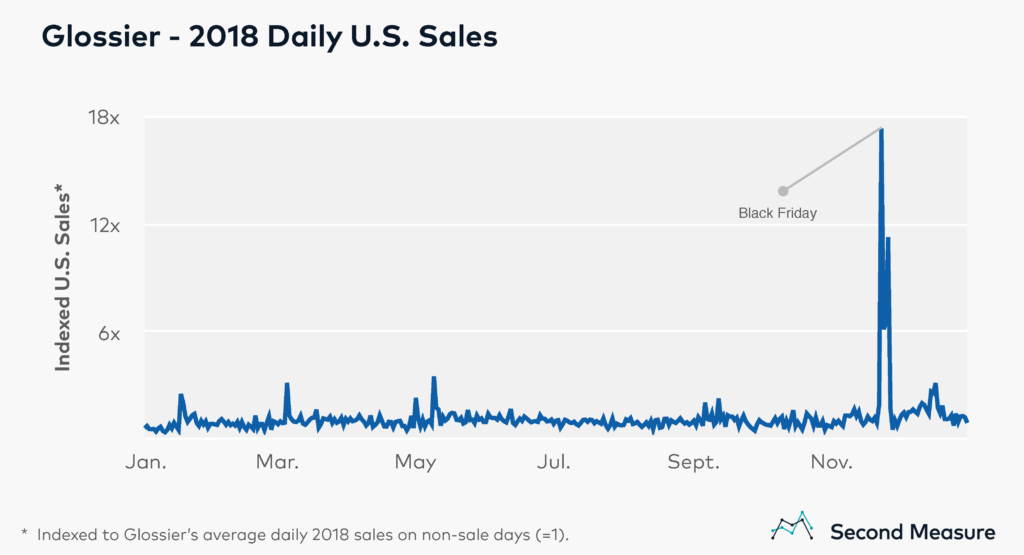

Glossier, the online cosmetics sensation valued at more than $1 billion, famously holds just one sitewide sale a year—20 percent off from Black Friday through Cyber Monday. It’s a strategy that produced monumental sales last year and attracted more returning customers than new ones.

Last year, all four days of the shopping event yielded sales at least six times Glossier’s 2018 average daily sales for the rest of the year. And Black Friday saw sales more than 17 times the daily average.

Unlike most major beauty brands, Glossier only sells its products on its own website and in a handful of branded stores. It has not announced whether it will hold a Black Friday sale again this year, though beauty publications are full of speculation.

Anecdotes about the success of last year’s event are plentiful. The company reported selling one of its most popular products, the Boy Brow eyebrow pomade, every four seconds during the weekend. It also said Black Friday sales doubled from 2017, a claim Second Measure data supports.

Sale customers buy more, spend the same

While the 20-percent discount allowed Glossier fans to get more for their money, their purchase totals remained steady. In 2018, the average transaction value was about $51, and, during each of the days of Thanksgiving weekend, customers’ average spending was within $3 of that.

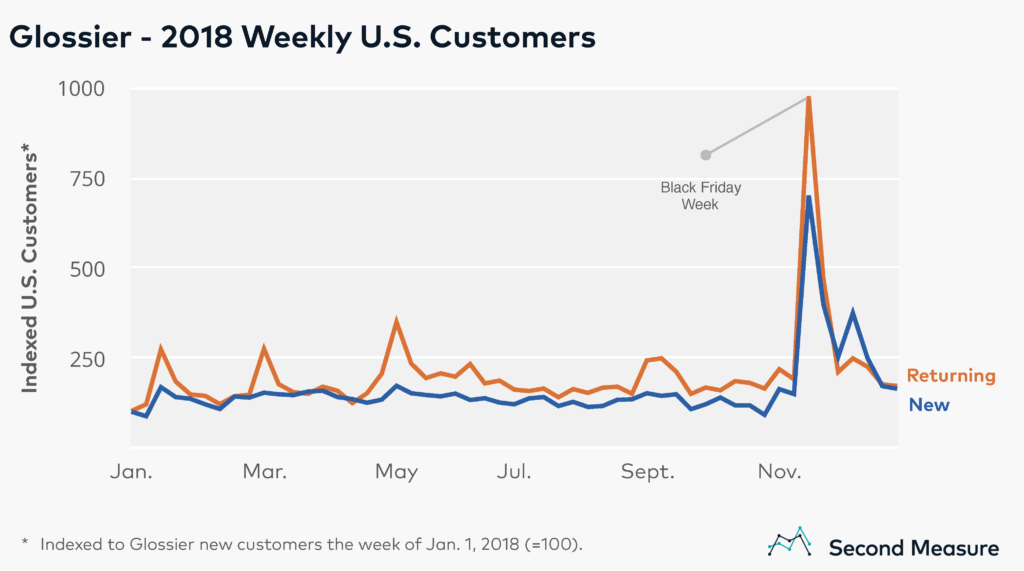

Returning customers outnumber first-timers

Much of Black Friday weekend’s record spending was done by repeat customers. About 59 percent of the sale shoppers had made a past Glossier purchase, a figure not far off the 2018 weekly average of 56 percent.

In fact, there were only five weeks in 2018 when Glossier had more first-time customers than returning ones, and three of them were the December weeks preceding Christmas. It’s a sign that Glossier is creating a year-round fan base that’s eager to turn out for the company’s only major sale.

Although they were outnumbered by returning customers, new shoppers did show up for the Glossier sale in droves. The discount attracted more first-time customers than any other week of the year—more than quadruple the weekly average.

November customers return at lower rates

For those who did get their first taste of Glossier during the Black Friday discount, paying regular prices the rest of the year has proven a little less attractive. November 2018 customers were less likely to return than the first-time shoppers from other months.

Over the last two years, on average, 6 percent of Glossier shoppers made another purchase six months after their first, but only 3 percent of the November 2018 new customers did. (Admittedly, few people buy makeup every month. Glossier’s customer retention numbers look much rosier when calculated on a quarterly basis.) Still, the Black Friday sale lures so many new customers, when even 3 percent return, it’s more new customers than Glossier retains in a typical month.

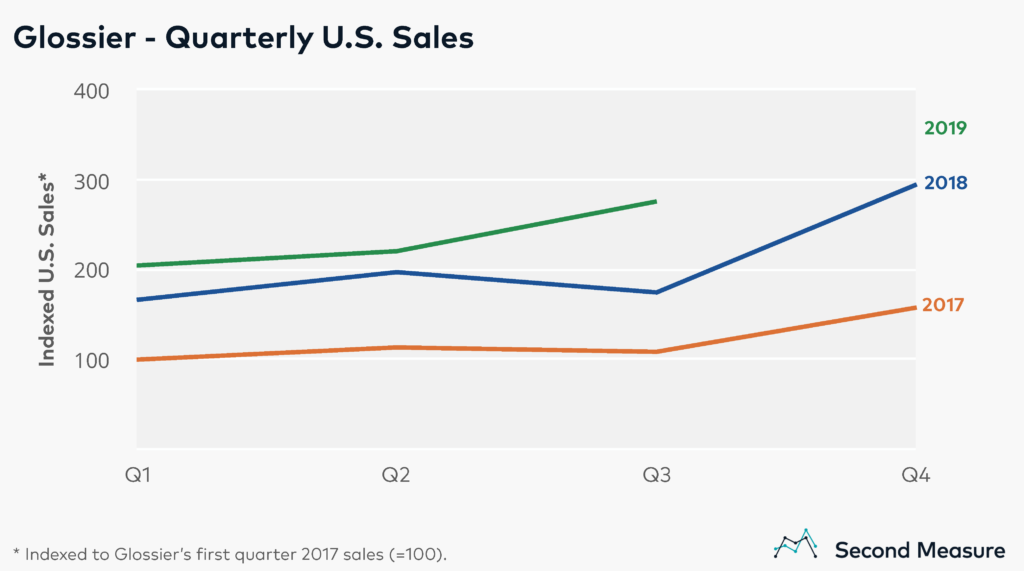

Year-over-year, Glossier shines

Black Friday isn’t the only growth story for Glossier. In the third quarter of 2019, its sales were up 58 percent year over year. Another huge Black Friday could put the company on track for another impressive fourth quarter.

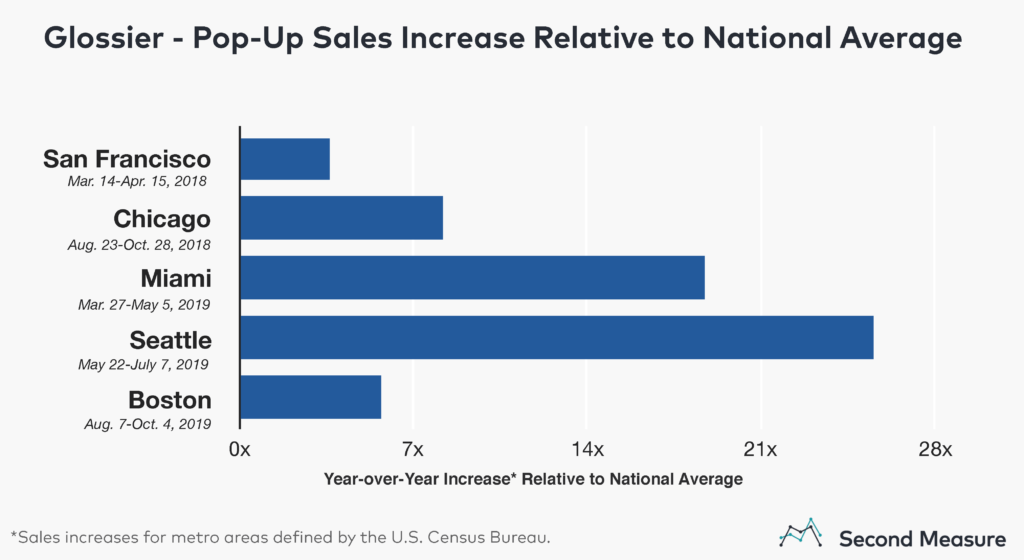

Local sales explode with pop-up stores

Unlike nearly all its competitors, Glossier sells in only two permanent brick-and-mortar locations: its own branded stores in New York and Los Angeles. But, the company also brings pop-up stores to major cities across America, giving local fans a chance to try and buy in person, if only for a few weeks.

The stores are getting a reputation for lines that stretch around the block and start well before doors open. And data shows those crowds are paying off. The year-over-year sales boosts Glossier gets while pop-ups are in town are consistently many times greater than its nationwide growth.

For example, a Boston pop-up store ran Aug. 7 to Oct. 4, 2019. It led to sales 366 percent above the Boston metro area’s sales over the same period in 2018. Nationally, sales during that time increased 64 percent year-over-year.

In the Miami and Seattle metro areas, most weeks of the pop-up store resulted in local sales (in-store and online) that surpassed their Black Friday week sales.

Despite its strong Black Friday and pop-up store performance, the company’s customer counts still lag far behind those of the beauty mega-retailers Glossier’s CEO says she has no plans to partner with. As of September 2019, less than 1 percent of U.S. consumers had ever made a purchase at Glossier. In contrast, nearly a quarter have shopped at Sephora, and 27 percent at Ulta.

Want to know whether Glossier shines again on Black Friday? Request a Second Measure demo >>

And, also, we’re hiring.