NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Guest author John Shostrand contributed to this report.

The popular clothing-subscription company Stitch Fix filed for its much-anticipated IPO last week, and investors can’t wait to see what it will become. One thing it probably won’t be, though, is another Blue Apron.

Blue Apron debuted on Wall Street in June as one of the worst-performing IPOs of the year. Its stock has lost nearly half its opening value. And while Blue Apron and Stitch Fix do share some similarities, by many measures, Stitch Fix is set up for success where Blue Apron struggles.

The two companies started 18 months apart and began seeing rapid growth in 2014. Both now have annual revenue near $1 billion. But when it comes to customers, Blue Apron and Stitch Fix look very different.

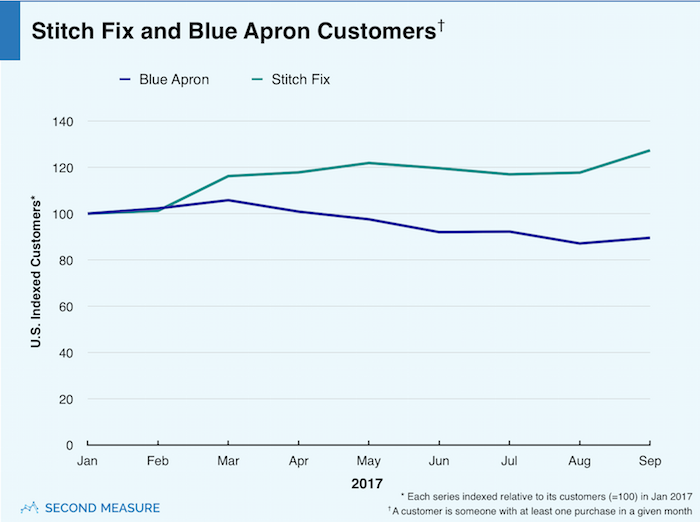

Customer Growth

Stitch Fix’s customer count has grown 27 percent since January and reached an all-time high in September. (For our purposes, a customer is defined as a person with at least one purchase in the specified month.) Blue Apron’s September customer count was down 10 percent compared to where it was in January.

Blue Apron has experienced several widely reported troubles, from inefficiency at its fulfillment plant to struggles hiring and training new employees. These issues prompted Blue Apron to scale back its marketing efforts this year, further stalling growth. And, last week, we learned 5,400 Blue Apron staff members got the ax.

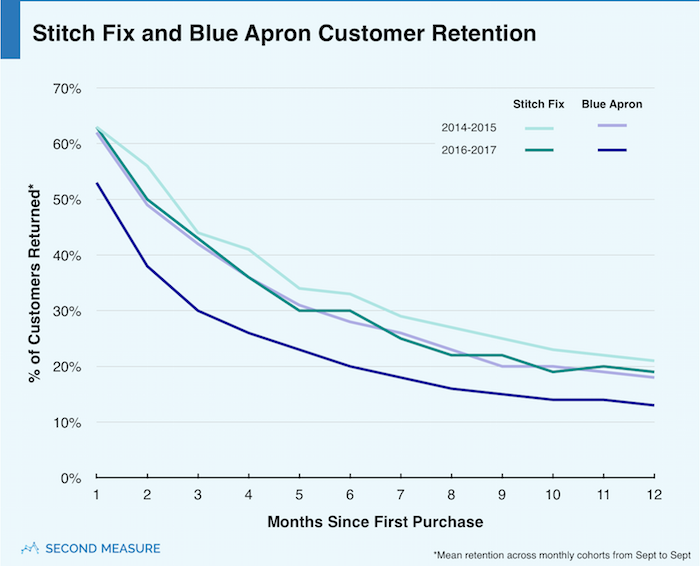

Customer Retention

Stitch Fix is also doing a better job retaining the customers it has. The company’s six-month retention is 30 percent. That is, 30 percent of Stitch Fix’s customers bought something six months after their initial purchase. Blue Apron’s six-month retention is just 20 percent.

Perhaps more interesting—Stitch Fix is able to retain new customers nearly as well as it did a few years ago. This is unusual. Most companies find that the customers they acquire early on are the most loyal, but Stitch Fix’s six-month retention has dropped just 3 points over the past two years (from 33 percent). In contrast, Blue Apron’s has dropped 8 points—from 28 percent to 20 percent.

In the chart below, the darker lines show average monthly cohort retention for both companies over the past year, while the lighter lines show what it was two years ago.

Update: The team at Goodwater Capital used our data for an interesting analysis of their own in November 2017. They found Stitch Fix retention also stands out against other brands like Trunk Club and Gilt Groupe.

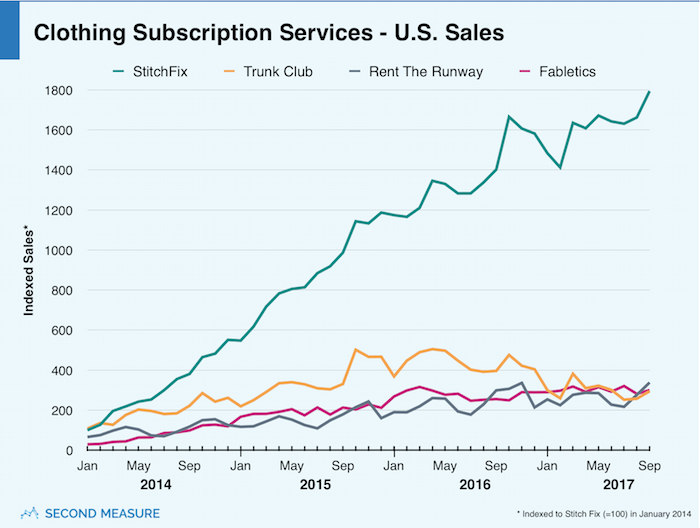

Stitch Fix Vs. Other Clothing Subscriptions

Blue Apron aside, how does Stitch Fix stack up against subscription services in its own industry? In a word: domination.

Trunk Club, the closest competitor in the space, was acquired by Nordstrom in 2014 for $350 million. Its customers spend more per purchase than those of Stitch Fix, but Stitch Fix’s customer base is about 16 times as large. Nordstrom took a $197 million write-down in 2016, two years after the acquisition.

Fabletics, which supplies trendy athletic apparel, and Rent the Runway, which allows customers to rent designer clothing, complement rather than directly compete with Stitch Fix. These services cater to specific needs, which will limit growth, and Stitch Fix has far outpaced them in sales since 2014.

In terms of growth, Stitch Fix is truly in a class of its own. From January 2014 to September 2017, its sales grew 17.9x. Fabletics, despite being one-sixth the size of Stitch Fix, saw sales growth of “just” 10.3x.

There are many other clothing subscription services on the market, including Bombfell and FiveFour for men; Gwynnie Bee, Le Tote, and Wantable for women; and Frank and Oak for both. But none have sales totals as high as the four key players mentioned above.

The One To Watch: Amazon Prime Wardrobe

Of course, almost no e-commerce discussion can be complete without mention of Amazon, and sure enough, Amazon Prime Wardrobe is in beta now. This service allows customers to try on and return as many clothes as they like. But unlike Stitch Fix, which has stylists curate outfits, Amazon customers choose the clothes themselves. This is generally how shopping for clothes on Amazon always worked, except that Prime Wardrobe shoppers have seven days to return clothes they don’t want, and they will only only be charged for the clothes they keep. Of course, like Stitch Fix, there’s deeper discounts only for those who keep the most clothes.

Want to keep tracking Stitch Fix and see if it lives up to expectations? Request a demo today >>