NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

When hair salons temporarily closed at the beginning of the pandemic, many consumers turned to DIY haircuts—with varying degrees of success. Hair salons gradually reopened as COVID-19 cases slowed and state and local authorities lifted their shelter-in-place orders, but sales at Regis Corporation (NYSE: RGS)—the parent company behind salon brands such as Supercuts, Cost Cutters, and SmartStyle—remain below pre-pandemic levels. Our analysis of consumer transaction data shows that sales recovery for Regis Corporation has varied by state, especially early in the pandemic. Similarly, sales for some brands under the Regis Corporation umbrella have been growing faster than others.

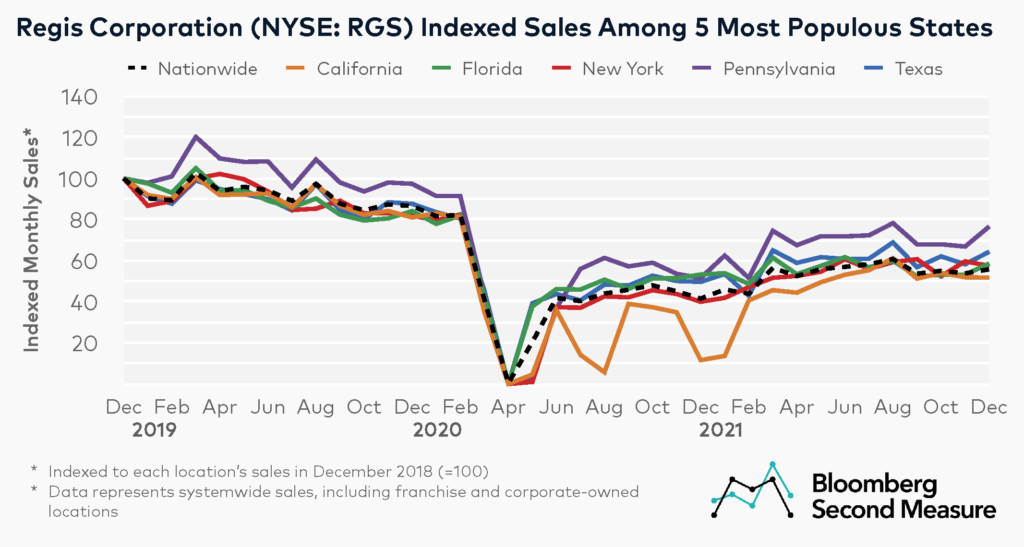

Regis Corporation sales growth in California has trailed nationwide growth during the pandemic

Hair salons, including those owned by Regis Corporation, were hit particularly hard at the beginning of the pandemic. As uncertainty around the COVID-19 pandemic grew and shelter-in-place orders began going into effect, most Regis Corporation locations temporarily closed in late March 2020. The company’s nationwide sales dropped 50 percent between February and March of 2020.

Regis Corporation sales began to recover in spring and summer of 2020, but timing and growth rates varied by state. Looking specifically at the five most populous states, Regis Corporation began to experience sales growth in Florida and Texas in May 2020 as hair salons were permitted to reopen, while sales in New York, California, and Pennsylvania began picking up again in June 2020. Some factors likely affecting Regis Corporation’s recovery during this time include reduced capacity limits for many salons, in addition to some consumers’ preferences for pivoting toward at-home hair care and grooming habits, or avoiding nonessential businesses.

Interestingly, Regis Corporation sales in California experienced a noticeable series of spikes and declines in the second half of 2020. In addition to evolving consumer preferences that may have influenced recovery for hair salons, California implemented additional regulations that affected business reopenings, including indoor hair salons, when COVID-19 cases surged in July and December of 2020.

Among the five most populous states, Pennsylvania’s sales have come closest to pre-pandemic levels. Regis Corporation’s Pennsylvania sales in December 2021 were 21 percent lower than in December 2019 and 23 percent lower than in December 2018.

As of the end of 2021, nationwide sales had not reached pre-pandemic levels for Regis Corporation. In December 2021, U.S. sales at Regis Corp were 34 percent higher than in December 2020, but 36 percent lower than in December 2019 and 44 percent lower than in December 2018.

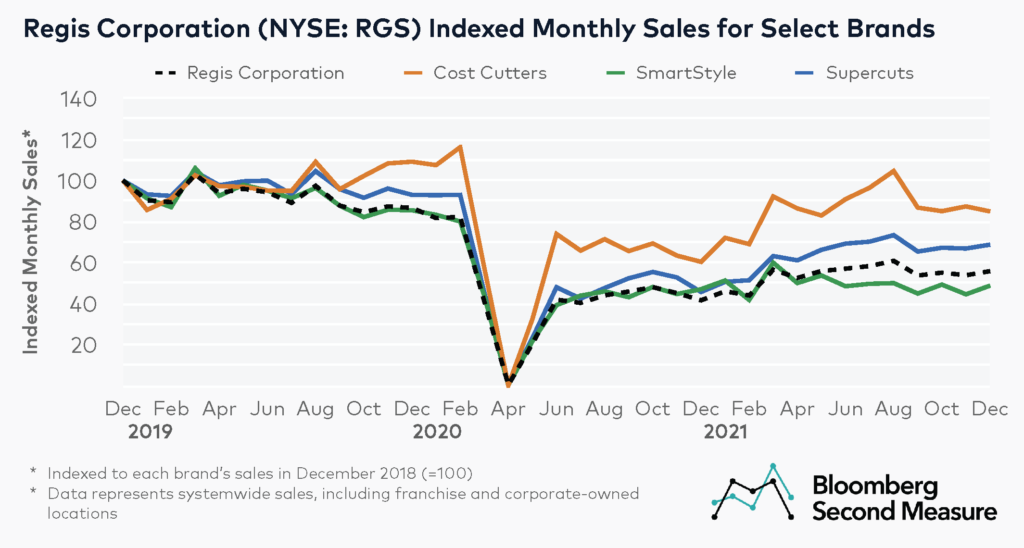

Sales at Cost Cutters and Supercuts have outperformed Regis Corp’s overall U.S. sales during the pandemic

Similar to how sales recovery has varied by state, some of Regis Corporation’s brands have seen faster recovery than others during the pandemic. Specifically, Cost Cutters and Supercuts have seen stronger sales growth both before and during the pandemic compared to Regis Corporation overall, while SmartStyle’s sales growth has been slower.

In December 2021, sales for Cost Cutters and Supercuts were 41 percent higher and 51 percent higher year-over-year, respectively. Among the three brands in our analysis, Cost Cutters sales have also been closest to pre-pandemic levels, as December 2021 sales were 22 percent lower than in December 2019 and 15 percent lower than in December 2018.

On the other hand, SmartStyle—which has salons located in Walmart Supercenters—had sales growth generally following overall Regis Corporation sales throughout 2019 and 2020, before diverging in 2021. In December 2021, SmartStyle sales were 43 percent lower than sales from the same month in 2019 and 51 percent lower than sales from the same month in 2018.

Regis Corporation’s business model is continuing to evolve in the COVID-19 era. The company has reportedly sold most of its corporate-owned salons to franchisees, in addition to closing underperforming locations.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.