NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

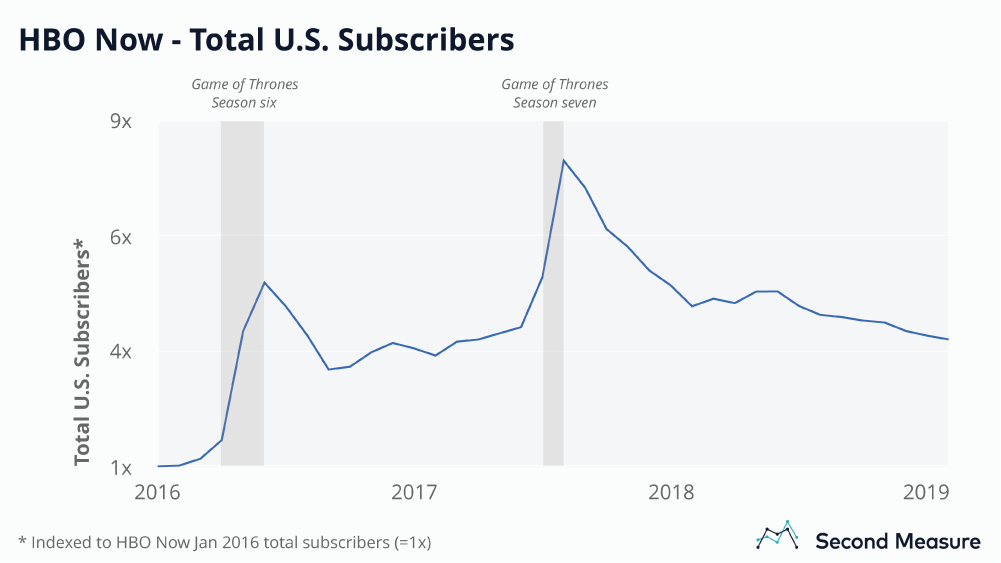

Game of Thrones returns for its final season this weekend, as will hordes of HBO Now subscribers who join the streaming service when the hit show premieres. But, as a previous analysis of HBO Now showed, roughly half of the subscriber growth from Game of Thrones season 6 vanished within three months of the finale. Our latest analysis, updated to include season 7 data, found a similar effect around the Game of Thrones premiere. Total HBO Now members jumped by 91 percent in the U.S. during season 7 but, after the finale, total subscribers fell into a decline for six consecutive months.

Season 7 aired in July 2017 and, at the time, HBO Now offered an introductory month free to new customers—meaning first-time signups became observable starting with their first monthly payment in August. HBO Now memberships offer access to HBO’s streaming-only package and do not include subscribers to HBO’s cable TV channel and its companion HBO Go service.

Like Game of Thrones premiere, Star Trek: Discovery drives signup surge

A single-show spike in subscribers isn’t common at other streaming services that create their own content. For example, the hit Netflix show Stranger Things didn’t lead to a noticeable increase in new memberships around either season’s release date. But our analysis did uncover one other show that comes close to Game of Thrones in its ability to drive signups.

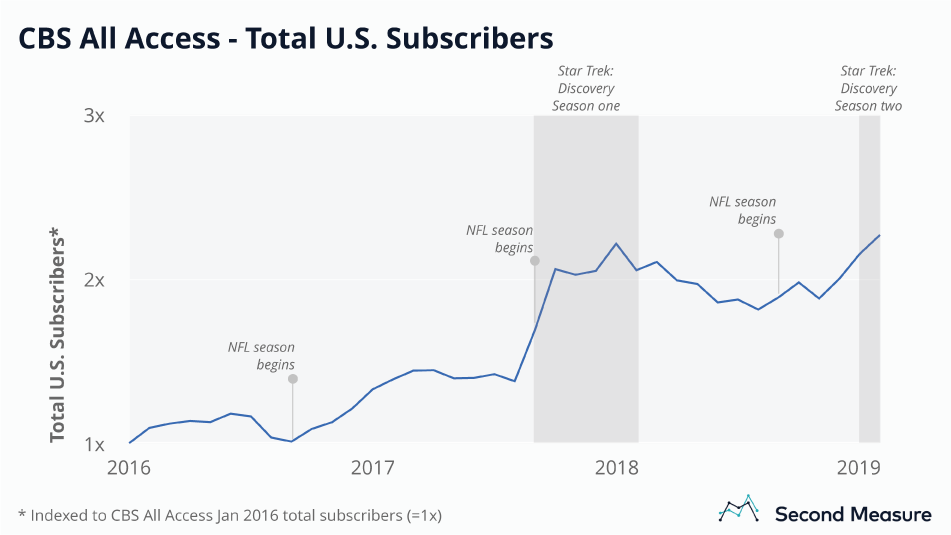

CBS All Access’ hit Star Trek: Discovery was first released in September 2017 and, during the first two months it aired, CBS All Access’s U.S. subscriber base increased by 50 percent. Unlike most other content on CBS All Access, Star Trek: Discovery is only available online and does not air on the CBS broadcast channel.

Although some of those September 2017 memberships may have come from NFL fans signing up at the start of the season, neither the previous nor following football seasons garnered comparable levels of interest from new subscribers. And the January 2019 release of Star Trek: Discovery season 2 helps confirm that Trekkies are behind the boost. Since the premiere, monthly new signups have been up by 82 percent over a typical month in the previous three years.

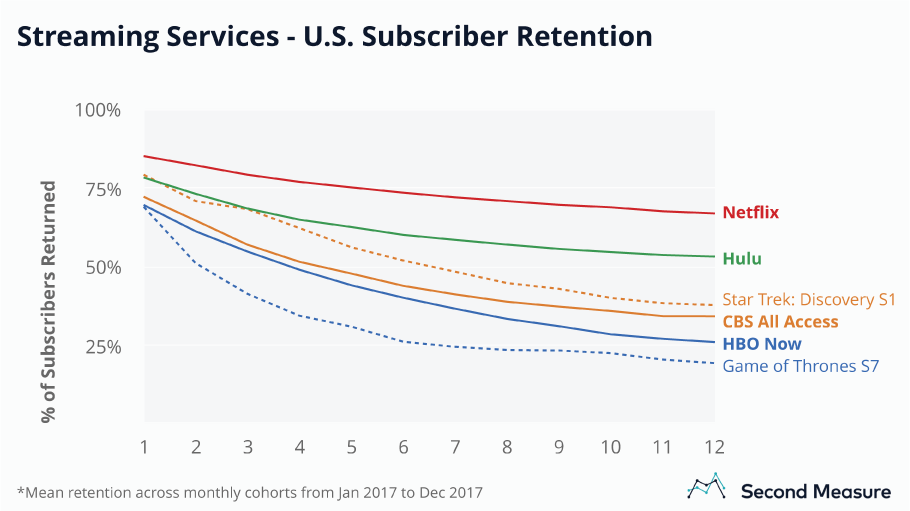

Trekkies are more loyal than Game of Thrones viewers, but neither match Netflix’s base

CBS All Access recently announced new Star Trek content in production: a rebooted Captain Picard with Patrick Stewart reprising his iconic role. The streaming service is banking on the continued loyalty of its Star Trek audience, and rightly so. Analysis of subscribers who joined during the signup spike in September and October 2017 shows that they were, on average, slightly more likely to stick with CBS All Access than subscribers who joined in other months of 2017. Fifty-two percent of season 1 subscribers still held memberships six months later, compared against 44 percent of subscribers from other months in 2017. CBS All Access also offers an annual membership, which was excluded from this analysis.

Game of Thrones fans, however, were less loyal to HBO Now than the average subscriber. Just 26 percent of viewers who made their first payment to HBO Now during Game of Thrones season 7 were still subscribers six months later, while that number was 40 percent among HBO Now signups from other months that year. Price may be one reason viewers drop HBO Now fastest. CBS All Access offers a monthly subscription with limited commercials for just $5.99 per month, while monthly access to HBO Now costs $14.99.

Neither service comes close to retaining subscribers as well as the industry leaders Netflix and Hulu. Hulu’s average six-month subscriber retention is a respectable 60 percent, while 74 percent of Netflix signups still held memberships six months later, on average. Subscriber retention at Hulu excludes Hulu Live TV accounts and Hulu subscriptions bundled with Spotify. All analyzed streaming services accept payment through multiple mediums, some of which are not captured, such as the iTunes store or Roku.

Netflix and Hulu are less dependent on hit shows to drive new signups thanks to their massive content libraries and large customer bases. HBO Now’s monthly subscriber base is currently less than 1 percent of the size of Netflix’s. And 43 percent of Americans have ever paid for Netflix, compared against less than 1 percent who have ever subscribed to HBO Now. As of February 2019, Hulu has just over a third as many members as Netflix.

Netflix dominates among single-service subscribers, but Hulu is gaining

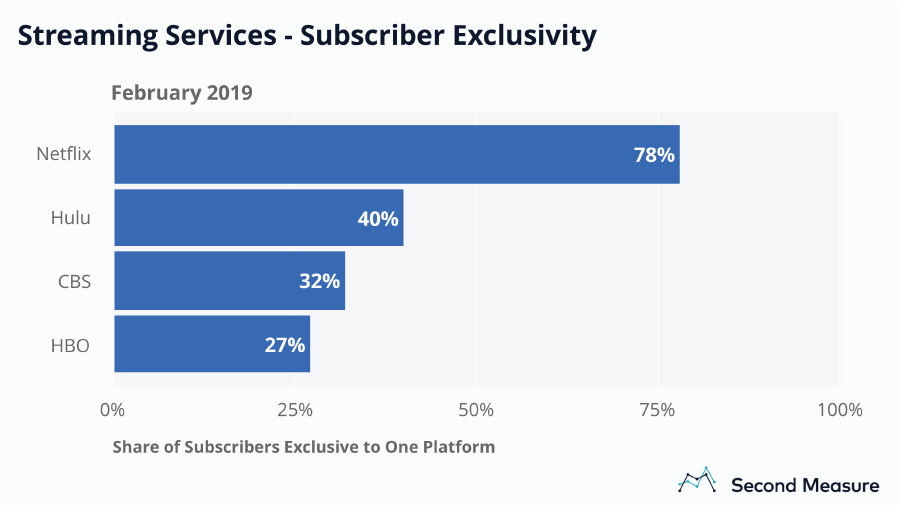

Netflix subscribers are the most likely to keep their memberships, and they’re also the most likely to be satisfied with a single streaming service. As of February 2019, 78 percent of all Netflix members were not subscribed to any of its content-creating competitors: Hulu, HBO Now, or CBS All Access. (Our analysis does not break out Amazon Prime Video, since it’s bundled with the Prime subscription.) However, at competing services, the majority of subscribers were not exclusive to a single service.

Loyalty to a single service is expected to decline as demand for streaming content continues to rise, but Hulu was the only service to improve year-over-year in exclusivity. In February 2019, 40 percent of its subscribers did not have an active membership with a competitor, up 2 percentage points from last year. Hulu’s 2018 Black Friday deal, which offered new memberships for just $1 per month, drew more than triple the average amount of new subscribers for all other months in 2018—56 percent of whom were not streaming anyplace else either.

How will the Netflix and Hulu price war impact subscriber trends? Be the first to know by getting in touch about starting a demo.

Oh, and we’re hiring.