NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Shelter-in-place orders aimed at controlling the COVID-19 pandemic pushed large segments of the U.S. workforce to work from home starting in March. A SurveyMonkey Audience study of 2,759 adults reveals over 40 percent of U.S. workers report working from home as of April 4. In order to do so, many have been purchasing office supplies, contributing to a dramatic rise in year-over-year sales at major office supply retailers.

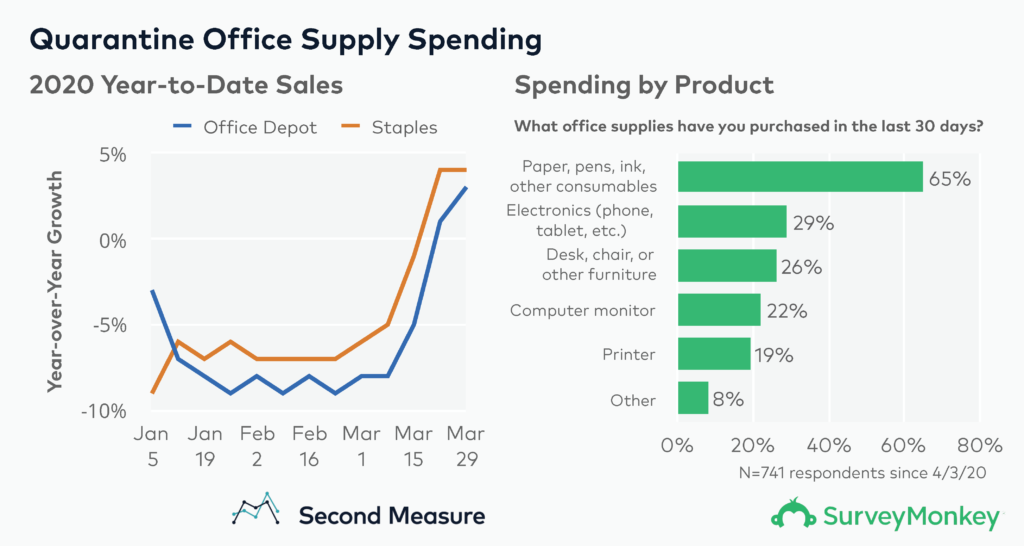

In January and February, year-to-date sales at Office Depot and Staples were down year-over-year, hovering between -3 percent and -9 percent. Growth began to climb in March, rising over 10 percentage points at each company throughout the month. This shift to positive growth leaves Office Depot up 3 percent and Staples up 4 percent year-over-year as of March 29.

When at-home workers were asked about their recent spending, 65 percent reported purchasing consumables—like pens and paper—while 29 percent reported buying a new electronic device, and 26 percent said they purchased office furniture.

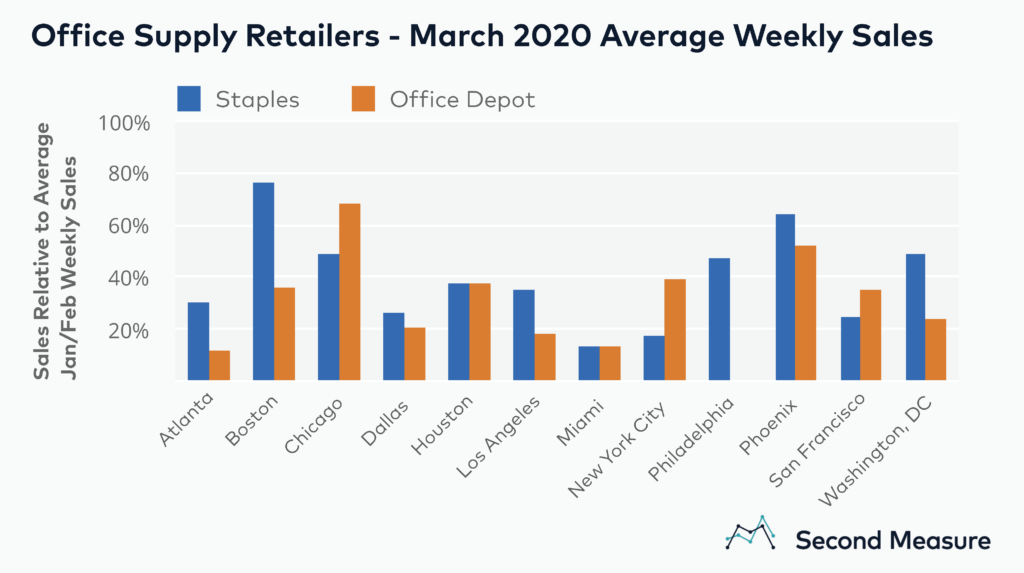

Average weekly sales are up across major U.S. metros

In the most populous U.S. cities—some of the first places to enact quarantine measures—weekly spending at office supply retailers in March 2020 was up across the board, relative to the previous two months. City dwellers spent 32 percent more, on average, at Staples, with March weekly spending in Chicago and Phoenix increasing most—over 50 percent compared to weekly spending in January and February. Office Depot saw the biggest change in spending behaviors in Boston, where weekly average sales increased 76 percent.

During the coronavirus pandemic, increased sales at office supply retailers in major cities have been, in part, a function of larger transaction values. Purchase totals in the largest U.S. cities increased 29 percent at Staples and 25 percent at Office Depot over the same period, up to $63 and $69, respectively. Among surveyed Americans who recently bought office supplies, 29 percent report an electronics purchase. These big-ticket items may be one factor contributing to rising average transaction values.

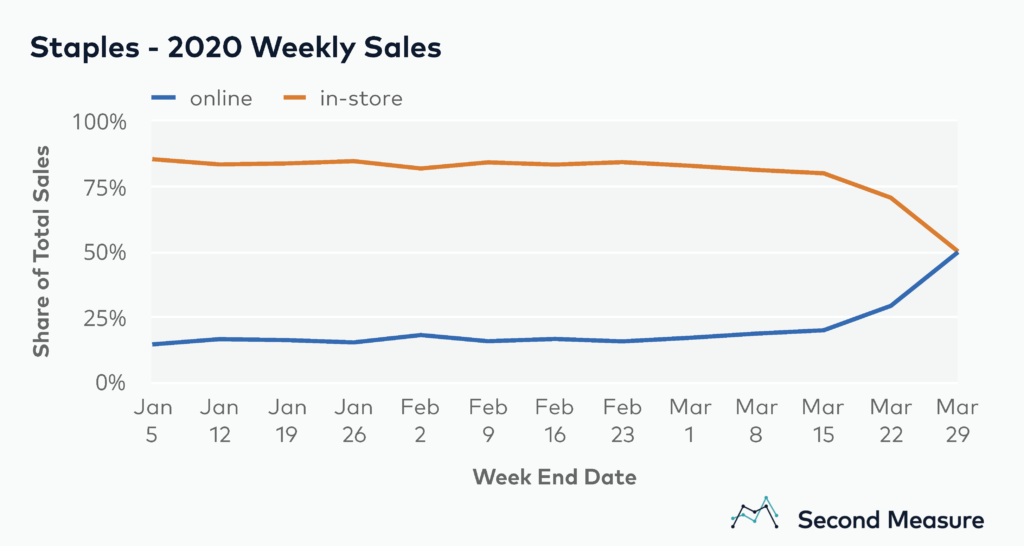

At Staples, a rising share of purchases are being made online

At Staples, where in-store and online purchases can be analyzed separately, the coronavirus’s impact on spending behaviors is clearly visible. Overall, a larger share of weekly sales are coming from online orders (versus prior weeks), up to 50 percent as of March 29. Previously in 2020, online sales typically accounted for between 15 and 20 percent of total sales.

Data collected by SurveyMonkey through early April shows that, among work-from-home employees, nearly three-quarters report purchasing office supplies online—rather than in-store—at a variety of major retailers. These findings suggest that Staples’ share of nationwide sales coming from online orders may continue to rise.

To learn more about how transaction data can help disentangle coronavirus market fluctuation from business impact, request a demo today.