NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Amazon’s first big move at Whole Foods was to lower prices on grocery staples, which risked a drop in revenue if shoppers chose to pocket the savings. Instead, the gamble paid off. Throughout the first week, customers still spent similarly high amounts, and the discounts increased new traffic.

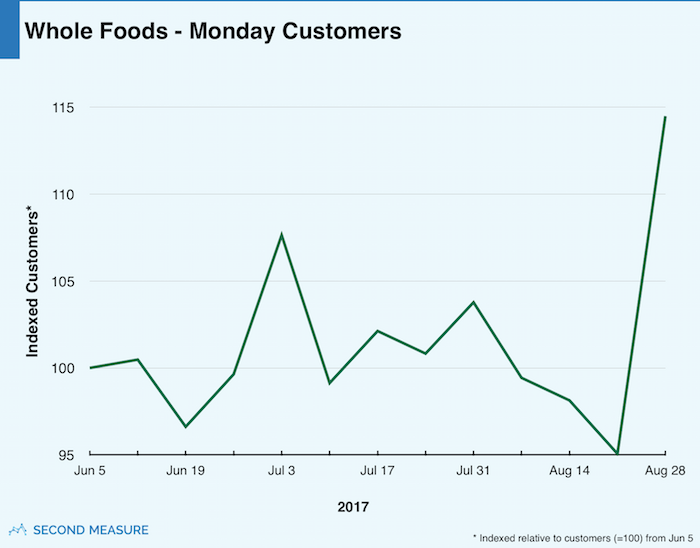

Transaction data shows that August 28 outpaced customer counts from the prior Monday by 20 percent. Sales were also 20 percent higher than the previous Monday.

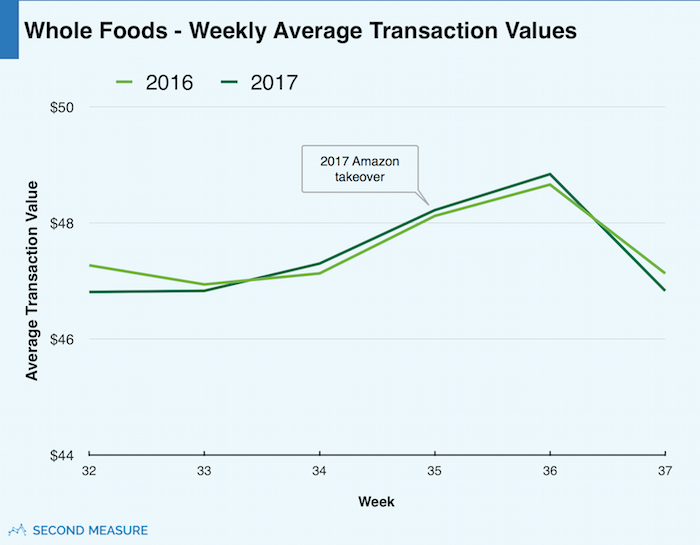

Despite lower prices, average weekly transaction amounts at Whole Foods were stable in the weeks before and after the Amazon takeover: between $46 and $49. Average purchase values in this time period also trend similarly to values from the corresponding weeks in 2016, a good sign for the high-end grocer. So how are transaction totals unaffected by bargain bananas? It stands to reason that shoppers are either buying mostly full-price items or simply buying more.

As one might expect, the discounts also brought new customers to Whole Foods. The week prices were cut, Whole Foods attracted 23 percent more new shoppers than in the previous week.

In fact, the week of August 28 drew more new customers than any prior week this year. There may be similar spikes in new customers as Amazon continues to make changes at Whole Foods in the coming months—like the planned in-store rewards program for Prime members.

Get in touch and request a demo to follow how future changes at Whole Foods will influence spending and traffic.