NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

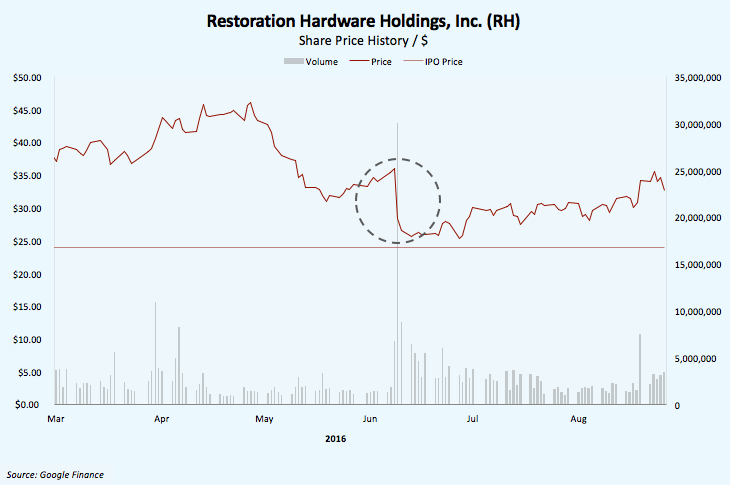

Restoration Hardware’s most recent earnings release in June triggered a sell-off that sent shares plunging 21.2%.

The sell-off was largely attributed to management’s weaker 2Q16 earnings per share (EPS) guidance between $0.28 to $0.33[1], a significant decrease from 2Q15’s EPS of $0.85.

Gary Friedman, CEO of Restoration Hardware, pointed to[2]:

- Weakened sales from a macro downturn in the luxury market

- Inventory issues with RH Modern

- Lengthening sales cycles and uncertainty from the introduction of the Grey Card

As Restoration Hardware works through this Grey Card uncertainty, analysts are concerned about the lack of visibility into fundamental trends from the Grey Card launch.

What is the RH Grey Card?

For a $100 annual fee, customers get 25% off any item at Restoration Hardware. The Grey Card launched in March 2016 and marks RH’s foray into a paid membership model. Prior to this, RH’s revenue was highly cyclical, driven by seasonal sale events. With a year-round 25% discount, Grey Card members’ spending may no longer be driven by seasonal sales.

To shed light on the Grey Card launch, we examine the following:

- How are Grey Card memberships growing?

- What impact does Grey Card have on spending behavior?

Growth of RH Grey Card

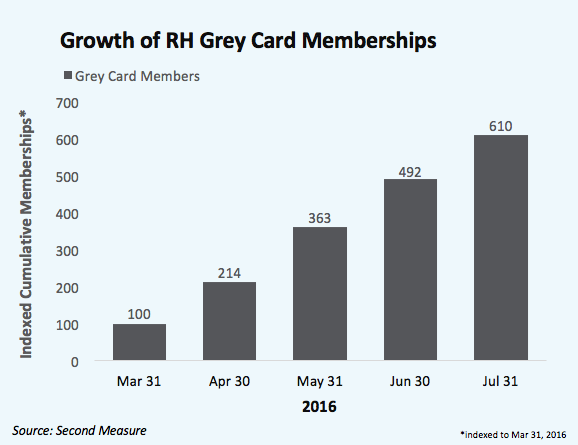

Grey Card memberships grew 2.8x in 2Q16. Given the 60,000 signups Friedman revealed on the 1Q16 earnings call[3], our observed growth suggests they’d amassed ~170,000 members by the end of Q2.

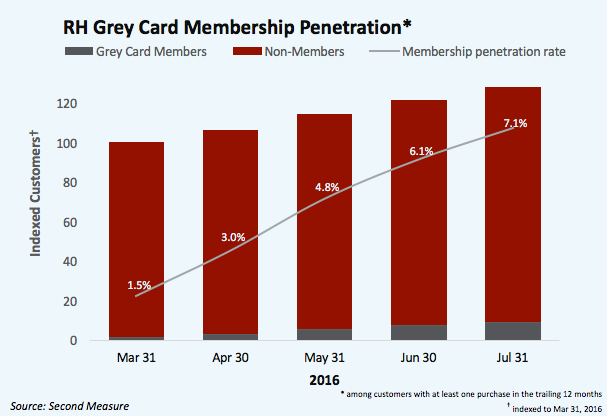

These memberships compose an increasing percentage of RH’s customers, reaching 7.1% at the end of the 2Q16.

Median Order Value

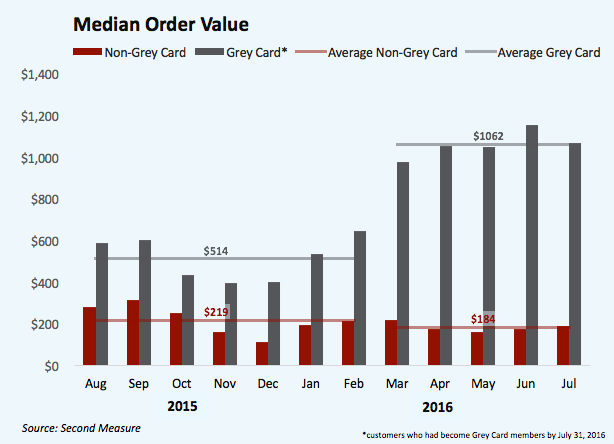

Friedman did not disclose the average order value of Grey Card members, but described it as “meaningfully higher.” After launch, Grey Card members’ spending doubled as compared with before, averaging $1062 on each purchase[4]. However, even before launch, those same customers were spending 135% more than their non-member counterparts, averaging $514 per purchase.

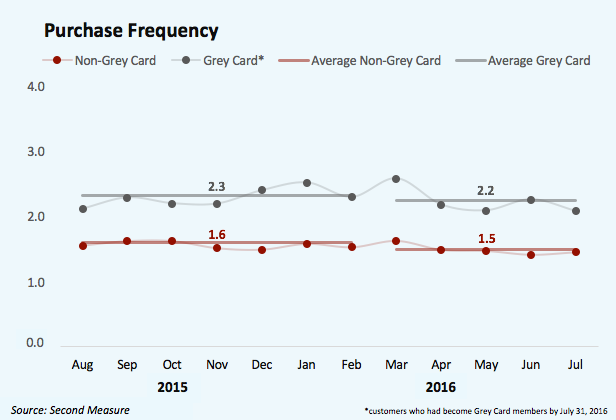

Purchase Frequency

Notably, despite higher median order values, the Grey Card has had little impact on purchase frequency.

The Bottom Line

The Grey Card has seen healthy adoption, growing to 7.1% of RH’s customer base[5] in just 5 months – and with members spending more than they had before. However, its impact on subsequent quarters remains to be seen. Will RH still see a holiday spike, or has the Grey Card simply redistributed these seasonal sales over the year?

To stay on top of developments with the RH Grey Card, request a demo.

- https://finance.yahoo.com/news/zacks-analyst-blog-highlights-restoration-133001488.html ↩︎

- http://www.chicagotribune.com/business/ct-restoration-hardware-problems-20160610-story.html ↩︎

- https://www.morningstar.com/news/market-watch/TDJNMW_20160610188/mw-update-restoration-hardware-results-prompt-concerns-the-wheels-may-be-falling-off.print.html ↩︎

- Excludes $99 Grey Card membership fee ↩︎

- Among customers with at least one purchase in the trailing 12 months ↩︎