NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

This post has been updated.

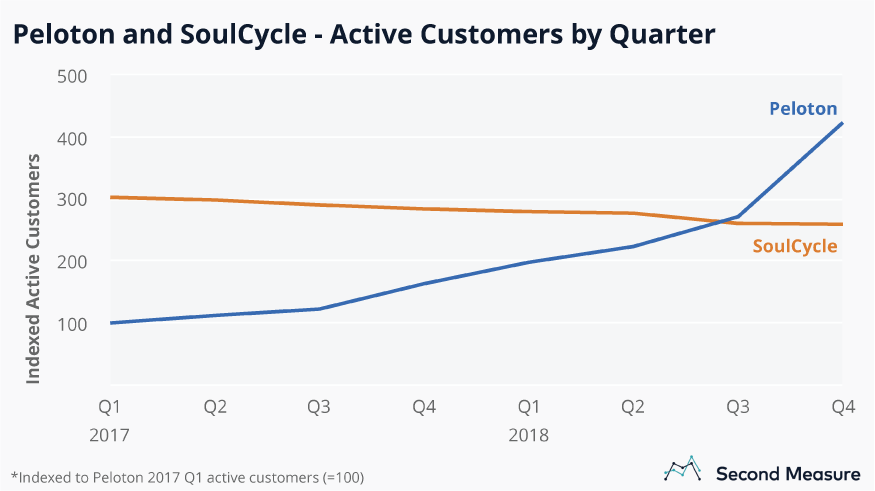

What has one wheel, doesn’t go anywhere, and is the foundation of a $4 billion dollar fitness brand? It’s a Peloton, the stationary bike that’s had a slew of elites in its saddle, from Hugh Jackman to Michelle Obama. The company’s sky-high valuation is about more than premium equipment. Peloton engages with customers long after their initial purchases via subscription content, which includes spin classes that stream live on the bike’s built-in monitor. Peloton subscriptions make it possible for at-home workouts to meet—and even exceed—the expectations of a boutique spin class experience. Riders seem to agree. In 2018, Peloton’s ridership eclipsed SoulCycle’s, and Peloton ended the year with 63 percent more quarterly customers than SoulCycle (up from 4 percent when this comparison was first run with data just through the third quarter).

Peloton subscriptions outnumber SoulCyclers

Peloton has been acquiring subscribers rapidly, while SoulCycle’s customer base has started to shrink. As of last quarter, Peloton has more than doubled its active memberships year-over-year. During the same period, SoulCycle lost 9 percent of its active customers. Peloton’s members are billed monthly for platform access, though new signups can pay up front for a full year. SoulCyclers’ transactions are less predictable—they pay per class and can purchase multi-class packages that can be redeemed over multiple months.

For this analysis, active customers are defined as anyone who made a purchase in a given quarter. To start riding, the buy-in at Peloton is much steeper than at SoulCycle. Purchasing a bike will easily set you back two grand, with delivery, gear, and warranties often pushing initial costs closer to $3,000. The Peloton Bike was a popular holiday gift in 2017 and 2018 and, both years, 42 percent of all outright bike purchases were ordered in the fourth quarter. The bikes have a 30-day refund window, although customers are still on the hook for the $250 shipping fee—each way. Just 2 percent of upfront bike purchases have been refunded.

Peloton cyclists keep their memberships longer than Equinox gym members

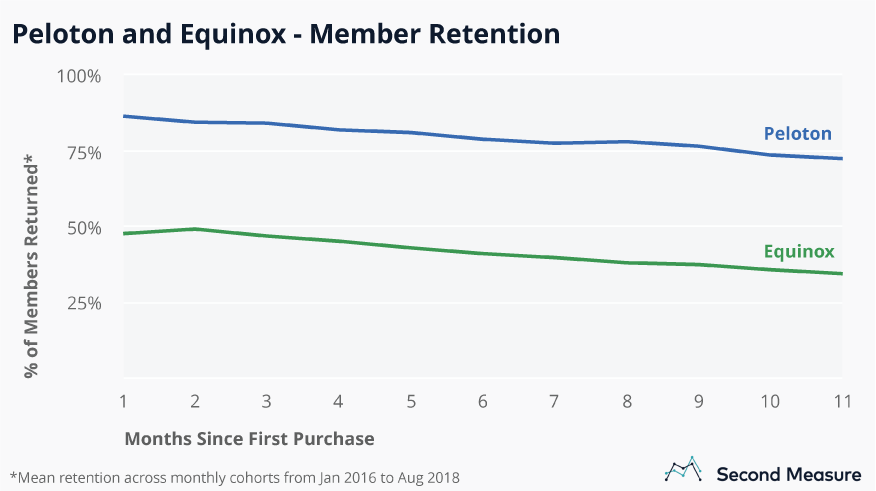

The Peloton brand is built around its streamable content, both live and pre-recorded classes that cost $39 per month to access. Until earlier this year, new Peloton subscriptions came with a one-year commitment, although the introduction of a “cancel anytime” policy does not appear to have negatively impacted Peloton’s retention rate. At the end of their first year, nearly three-quarters of monthly Peloton subscribers are still active—an impressive proportion for the fitness industry.

While 73 percent is quite a bit lower than the 96 percent retention rate reported by Peloton 18 months ago, our analysis captures only monthly subscribers—excluding Peloton members who paid up front for a full year of content. Either way, Peloton’s retention rate remains substantially higher than luxury gym Equinox, where only 35 percent of members return at the end of their first year.

What keeps riders spinning their wheels? Peloton superfans are often ardent followers of a favorite trainer, some of whom have celebrity status in the fitness world. Building instructors into its brand is no accident, evidenced by Peloton’s latest round of funding that will be used, in part, to expand its content offerings. New content hinges on star-caliber instructors, who are reportedly poached from competing fitness brands and generously compensated. To get ahead of the curve, SoulCycle and Equinox recently opened a talent management agency for finding and fostering top talent.

Some riders are leaving SoulCycle for Peloton

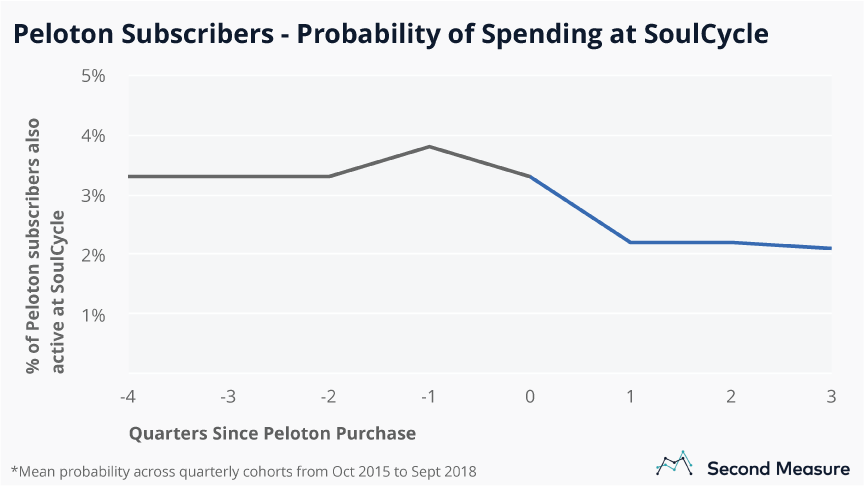

Though SoulCycle and Peloton compete for talent, their customer overlap is relatively small—in 2018, only 5 percent of SoulCyclers also spent money at Peloton. Among cyclists who have used both, the data suggests Peloton’s popularity is rising faster.

Cyclists are less likely to spend at SoulCycle after buying a Peloton. In the quarter prior to purchasing a bike, nearly 4 percent of soon-to-be Peloton customers were active SoulCyclers. But, one year later, riders were 44 percent less likely to still be spending at SoulCycle.

Furthermore, joining SoulCycle increases the chance that a customer will eventually own a Peloton. In fact, in the first quarter that a cyclist tries SoulCycle, their odds of spending money at Peloton double and continue to rise thereafter.

These trends fit Peloton’s brand narrative of a disruption technology on a mission to bring a boutique caliber fitness experience to the home gym. In a recent interview, CEO John Foley expressed his belief that in-person spin classes will go the way of arcades—people will gladly leave them behind for a better experience at home.

Bringing boutique fitness to the masses

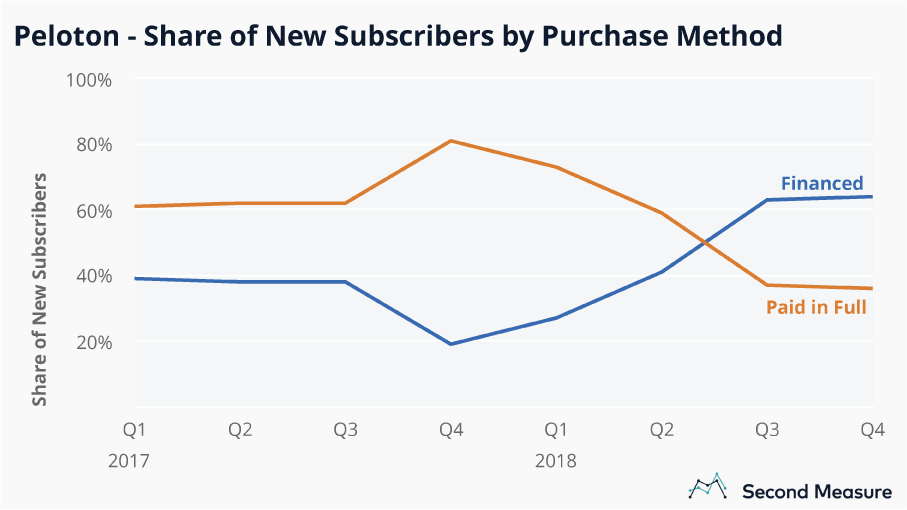

Peloton plans to do more than cater to the luxury fitness niche. Its newest customers are showing a preference for financing their bike, rather than shelling out the initial $2,000 up front. The shift suggests Peloton may be attracting more subscribers who don’t have large amounts of disposable income on hand. For this analysis, purchase method—financed versus paid in full—was determined by the first transaction amount.

In 2017, there was clear seasonality in the ratio of financers to purchasers, with more new riders paying up front for the bike around the holidays. But, as of June 2018, new customers were more likely to be financing—rather than purchasing—their bikes for the first time ever. That trend continued throughout the year, with 64 percent of fourth quarter equipment orders being financed.

Now, Peloton is encouraging cyclists to take its classes even without purchasing the bike. In June, Peloton’s iOS app received a makeover, and its classes are being marketed independently from the bikes. App users pay $19.49 per month—roughly half the monthly fee paid for content streamed directly to the bike. Purchases made through the iTunes store are excluded from this analysis, so it’s unclear what share of Peloton’s active customers are app-only subscribers. The app offers new class varieties, like cardio and strength training.

Peloton is also broadening its equipment offerings. It released a treadmill late last year and, of all full-priced equipment orders in November and December, 14 percent of purchases were for the Peloton Tread.

For the freshest data on Peloton’s treadmill sales, get in touch about starting a demo.

Oh, and we’re hiring.