Known for vintage and personalized merchandise, online marketplace Etsy (NASDAQ: ETSY) has become a hot destination for holiday shopping in recent years. Despite increased transaction fees for Etsy sellers as well as consumers’ concerns about inflation, consumer transaction data reveals that Etsy.com’s U.S. sales in November and December of 2022 were relatively consistent compared to the previous year. At the same time, Etsy Inc’s recently acquired resale marketplace brands saw higher transaction values and average transactions per customer in the U.S. than the flagship Etsy.com brand during the holiday quarter in 2022.

Etsy holiday sales trends in 2022 closely mirrored the same period in 2021

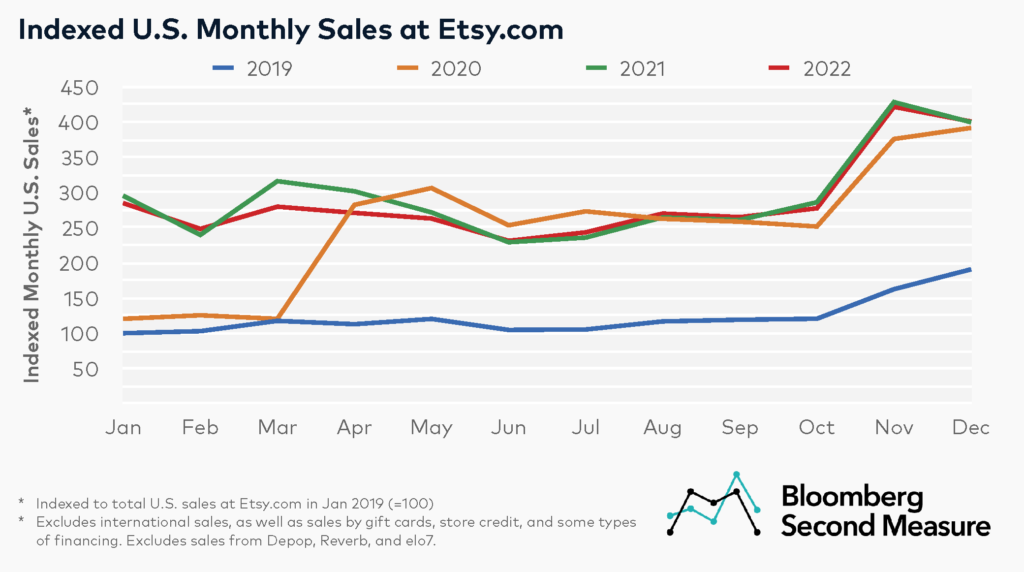

Bloomberg Second Measure data reveals that Etsy.com, an online marketplace that connects independent sellers and buyers, experienced rapid growth during the pandemic—including a 135 percent jump in U.S. sales between March and April of 2020, as consumers sought alternative resources for face masks—and its sales have remained elevated since.

Looking at annual spending patterns, Etsy.com sees its highest U.S. sales during the holiday season in November and December. Our data shows that combined U.S. sales in November and December of 2022 were around the same level as the holiday period in 2021. However, Etsy’s holiday sales in 2022 grew 7 percent compared to the holiday season in 2020 and 133 percent compared to 2019. Notably, Bloomberg Second Measure data excludes international sales, as well as sales by gift cards, store credit, and some types of financing.

On average, U.S. consumers are spending more per visit on Etsy Inc’s subsidiary resale marketplaces than on Etsy.com

Some consumers also reportedly turned to resale marketplaces for holiday gifts in 2022. Over the past few years, Etsy has been expanding into resale through its acquisitions of various secondhand marketplaces. In 2019, Etsy acquired the musical instrument resale platform Reverb. In 2021, Etsy also acquired UK-based resale site Depop and Brazilian resale marketplace elo7.

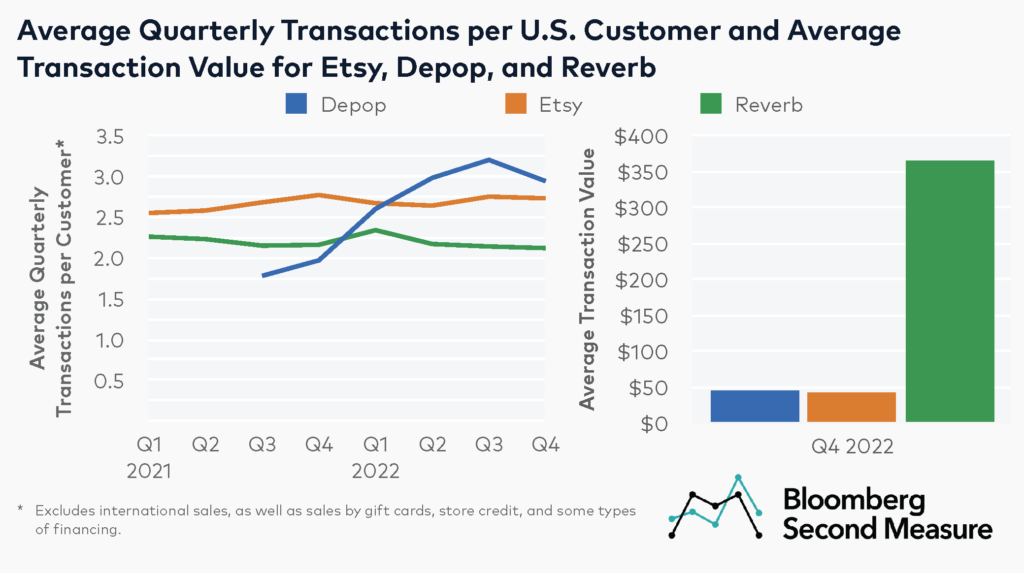

Looking specifically at the 2022 holiday quarter, Depop—which primarily sells secondhand apparel, accessories, and home goods—had the highest purchasing frequency among Etsy Inc’s brands with U.S. operations. Reverb, on the other hand, had the highest average transaction value. In Q4 2022, U.S. customers at Depop made an average of 2.9 transactions and had an average transaction value of $44. At Etsy.com, the average transactions per U.S. customer was 2.7, with an average per-order value of $42. Reverb had the lowest transactions per customer in Q4 2022, with 2.1 transactions, but also had an average transaction value of $365.

Average quarterly transactions per customer at Depop—which is known for its popularity with Gen Z consumers—has generally grown since its acquisition by Etsy Inc. In Q4 2022, Depop’s average quarterly transactions per U.S. customer grew 49 percent year-over-year. By contrast, average quarterly transactions per U.S. customer were relatively consistent at Reverb and Etsy.com during the same time frame.

Even outside of the holiday season, resale is continuing to gain traction as consumers combat rising prices, seek limited edition items that are no longer available from original retailers, and prefer to buy used rather than new items due to concerns about sustainability.

Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest post in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.