NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

After trying to disrupt the cinema market for more than six years, MoviePass finally has a hit on its hands. Since dropping its price late last summer, signups have grown more than one-hundred-fold over MoviePass’s July customer base. Today, the company lowered its price again, offering subscribers a movie a day for just $6.95 a month. If this deal sounds too good to be true, it’s because it might be. Without a doubt, MoviePass subscribers are driving higher sales at theaters, but it’s less clear whether MoviePass will be able to survive in the industry it has reshaped.

In August, MoviePass started offering unlimited movies for $9.95 per month—a plan that had previously cost $50—leaving many to wonder how MoviePass could possibly turn a profit while paying full price for its users’ tickets. In response, CEO Mitch Lowe has promised that, while MoviePass users will frequent theaters heavily at first, they’ll scale back once the novelty wears off and settle into a regimen that benefits theaters by increasing ticket revenue and boosting concession sales. Our spend analysis aligns with his predictions, though it may not be enough to sustain his company.

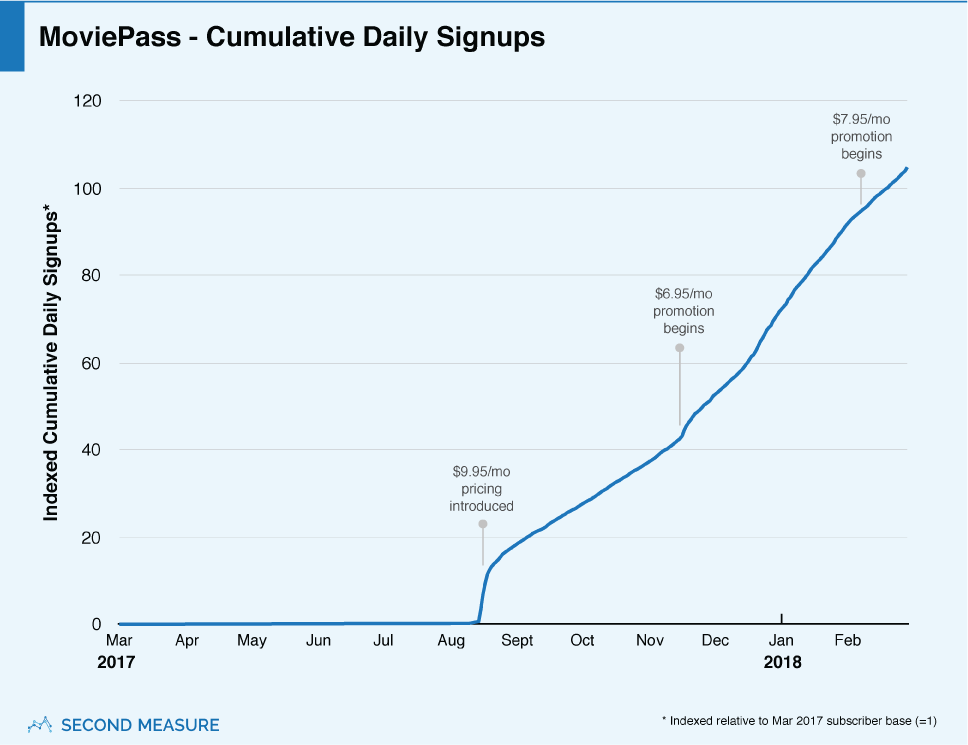

With each price cut, MoviePass memberships climb

When prices were lowered in August, MoviePass’s subscriber base grew more than sixteen-fold in one month. The promotion was so popular that MoviePass could not keep up with the demand for membership cards. In November, MoviePass lowered prices again, this time advertising memberships for just $6.95 per month when users pay up front for an entire year. Among all MoviePass customers that month, 14 percent opted for a full-year deal, with roughly a quarter of those annual subscribers purchasing more than one membership.

The resulting windfall helped prop up a business model that hemorrhages cash. Total November sales were more than five times as great as October sales, with 55 percent of that spending coming from customers paying $89.95 for a full year of membership. A similar deal began last month, this time offering new subscribers a year of MoviePass for $115.35 up front. But MoviePass is playing a dangerous game. The lower its prices fall, the more money it stands to lose every time it buys a full-price ticket for one of its 2 million users.

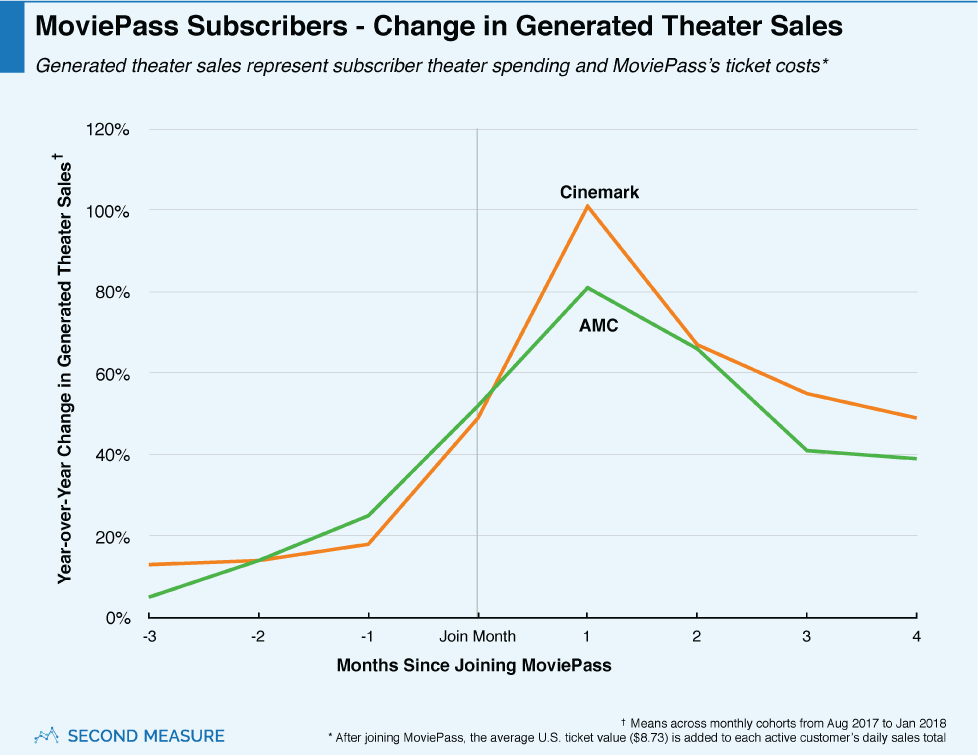

After joining MoviePass, members dramatically increase theater sales

As it starts to negotiate for lower ticket prices with some smaller chains, MoviePass must persuade potential partners it can create enough spend to keep everyone happy. Until that happens, theaters are enjoying major cashflow from two sources: full-price ticket sales paid for by MoviePass and subscriber spending on theater extras, like popcorn or a companion’s ticket.

Just how much value does MoviePass have for theaters? By adding the nation’s average ticket price to subscribers’ theater spending, we estimated the theater sales MoviePass members generate. Comparing those sales to how subscribers spent before joining MoviePass supports Lowe’s claim that theaters are making substantially more money from these moviegoers than they used to. In their first month of membership, MoviePass subscribers brought in 81 percent more sales to AMC than one year prior, and 101 percent more sales to Cinemark.

And this change represents a floor, not a ceiling, for sales growth. Total sales after joining MoviePass could be even higher, since admission prices of MoviePass members who smuggle in snacks or pay cash for their popcorn are not added in. As Lowe predicted, the spike in sales levels off over time. But after four months, these moviegoers are still bringing in more money for theaters than they did before joining MoviePass.

Short on funds and allies, MoviePass pegged as a flop by theaters

Despite the sales uptick from new MoviePass members, major theater chains have been largely hostile toward the service. MoviePass champions the idea of profit-sharing, claiming it can increase profits across the industry—and is entitled to a cut. Theaters largely aren’t buying it, refusing to work with MoviePass and presumably hoping the company will run out of cash.

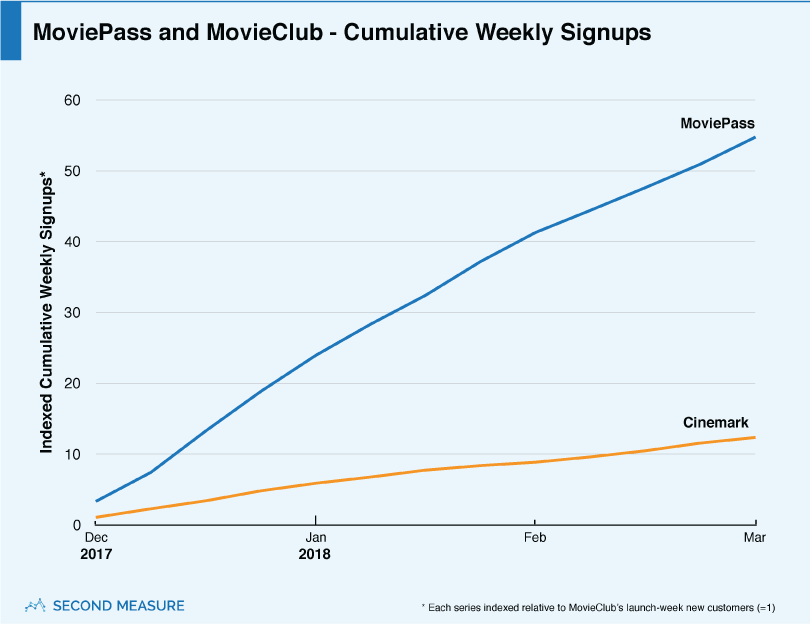

Cinemark has responded with MovieClub, a competing service. MovieClub’s $8.99 monthly fee includes just one free ticket per month (that can be rolled over if not used), as well as discounts on companion tickets and concessions. The deal may not sound as enticing as unlimited movies, but MovieClub’s rapid success has surprised Cinemark’s own CEO. Since its launch, MovieClub has enrolled one-fifth as many new users as MoviePass has gained over the same period. While it isn’t expected to overtake MoviePass anytime soon, MovieClub’s rise could chip away at the subscriber growth MoviePass depends on.

As ticket subscriptions grow in popularity, MoviePass may have to fend off competition from other theater chains as well. Though none are likely to undercut MoviePass on price, theater-operated subscriptions could be an attractive option for those concerned that MoviePass won’t be around much longer. And, like MovieClub, other theater-based programs can offer compatibility with premium screenings (like 3D and IMAX), as well as advanced ticketing and seating reservation—services MoviePass does not support.

Despite its pleas for industry collaboration, MoviePass has launched offensives of its own. In late January, MoviePass pulled out of several AMC theaters in major U.S. cities, issuing a not-so-veiled threat while simultaneously cutting itself a break by exiting some of the most expensive ticket markets in the nation. Then, earlier this month, MoviePass blocked some users from purchasing tickets to the new release, Red Sparrow. Members felt betrayed by the news, but if MoviePass doesn’t leverage its subscriber base to develop more industry partnerships, there may not be a service to subscribe to much longer.

Will MoviePass’s impact on spending trends outlast the company? Start a demo today to find out.

Oh, and we’re hiring.