NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

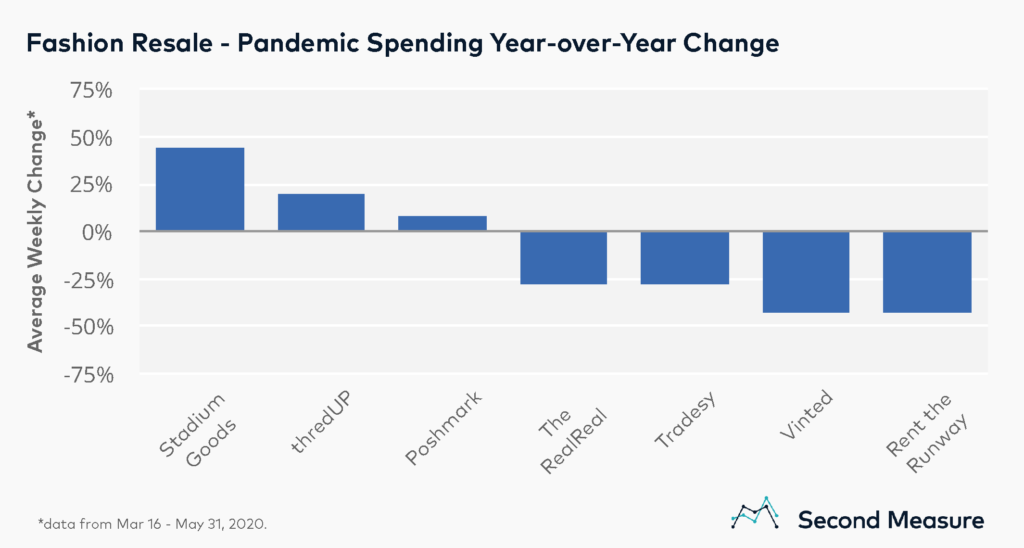

As many Americans have spent weeks at home during the COVID-19 pandemic, apparel retail has been among the hardest hit industries, while ecommerce has been thriving. Where does this leave online sellers of secondhand fashion? Like the merchandise on their sites, the answer is a mixed bag. In recent months, year-over-year sales were down more often than not among fashion resale platforms, but some have seen spending increase.

Stadium Goods, which caters to the pre-owned athletic sneaker market and also sells apparel, has seen the most growth during the pandemic, with average weekly sales from Mar 16 through May 31 growing over 40 percent year-over-year. The marketplace also supports consignment, with product lines ranging from vintage Air Jordans to the latest Yeezys, varying in price from just over $100 to several thousands of dollars for rare pairs, like the Back-to-the-Future-inspired “Marty McFly.”

ThredUP and Poshmark, two resale sites geared primarily toward women’s fashion, have also seen sales increase 20 percent and 8 percent, respectively. In uncertain economic times, these secondhand fashion marketplaces help provide both secondary income for sellers and affordable apparel for savvy shoppers.

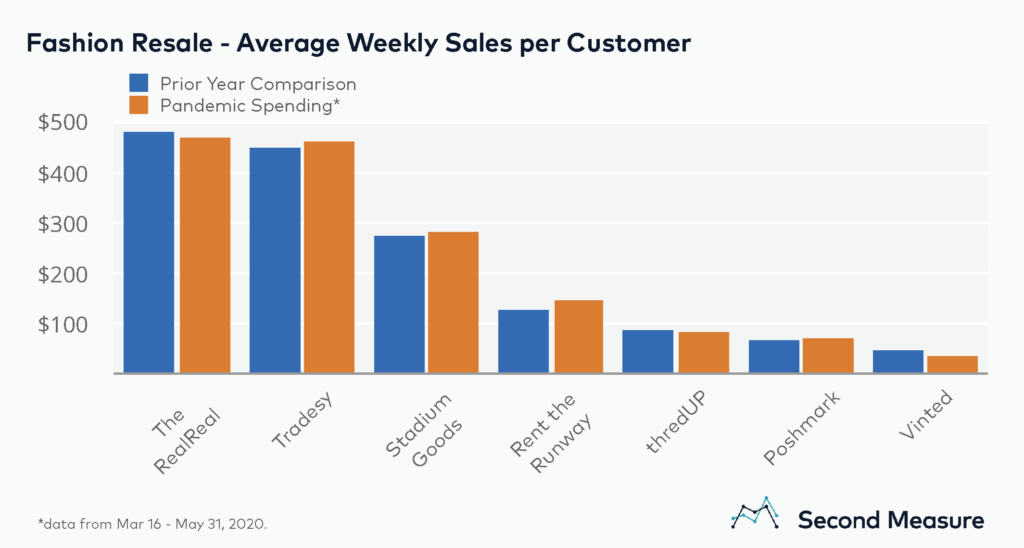

Little movement in average spending among online luxury consignors

Overall, pandemic customers are spending similarly to the comparable weeks in 2019, with average weekly sales per customer changing between -5 percent and +15 percent year-over-year on most resale platforms. The exception being Vinted, where sales per customer have fallen to under $35, a 25 percent decrease over the same weeks in 2019. Already the secondhand site with the lowest weekly sales per customer before COVID-19, the Vinted marketplace is host to deep discounts on both designer labels and fast-fashion brands.

Meanwhile, retailers that cater to luxury fashion, like the RealReal and Tradesy, continue to attract big spenders, with the average shopper spending $450 or more both this year and last. These folks who have been all dressed up with no place to go in recent months may finally be getting to show off their latest purchases, since most states are well underway with phased reopenings.