NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

While consumers have often looked to on-the-go breakfast options, breakfast at home has been making a comeback during COVID-19. But it’s not just cereal and pancakes that are now in demand. Similar to the trend of surging meal kit sales, consumers have been flocking to smoothie subscription boxes. Consumer spending data reveals how sales for smoothie kits have skyrocketed throughout the pandemic, as well as which smoothie box companies are leading the pack in terms of market share growth and customer retention.

Smoothie box category saw robust growth in 2020

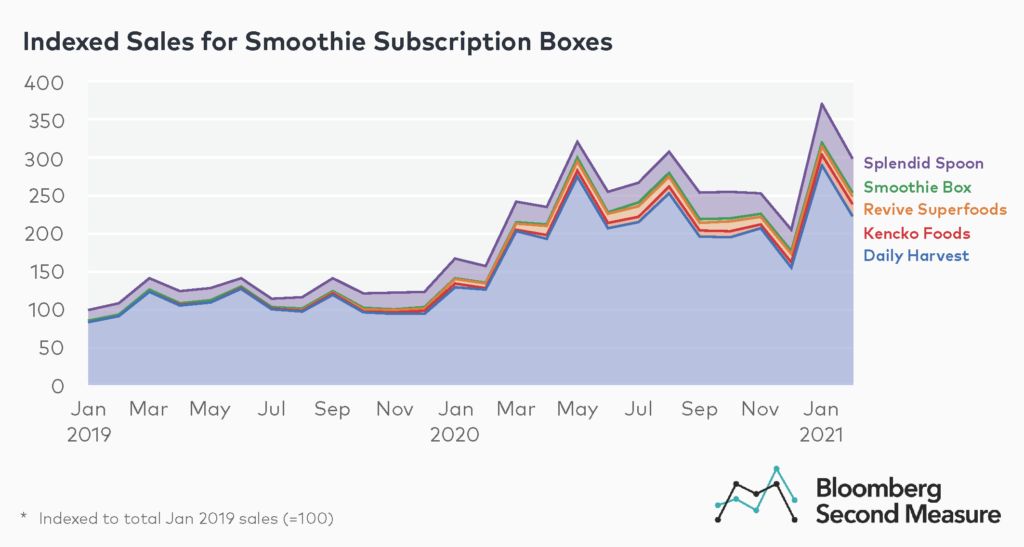

Since January 2019, the market size for smoothie subscription boxes has tripled. Sales accelerated the most in the early months of the pandemic, and monthly year-over-year sales growth in 2020 averaged 97 percent. Smoothie box companies also experienced noticeable sales spikes in January of each year. Month-over-month sales from December 2019 to January 2020 grew 37 percent, while sales from December 2020 to January 2021 grew 80 percent.

Among a chosen competitive set of five smoothie subscription companies, Daily Harvest leads the pack with 75 percent of sales as of February 2021, while Splendid Spoon was a distant second with 15 percent share of sales. Smoothie boxes have the benefit of being frozen or shelf-stable, giving consumers a dose of healthy fruits and vegetables without the need to go to the grocery store for fresh ingredients. Smoothie Box, Daily Harvest, and Revive Superfoods offer pre-portioned frozen cups, which need to be prepared by the end user, while Kencko smoothies come in powdered form. Splendid Spoon has pre-bottled smoothies, making it the only competitor in the set that requires no prep work.

Daily Harvest lost market share to Revive Superfoods and Kencko Foods in 2020

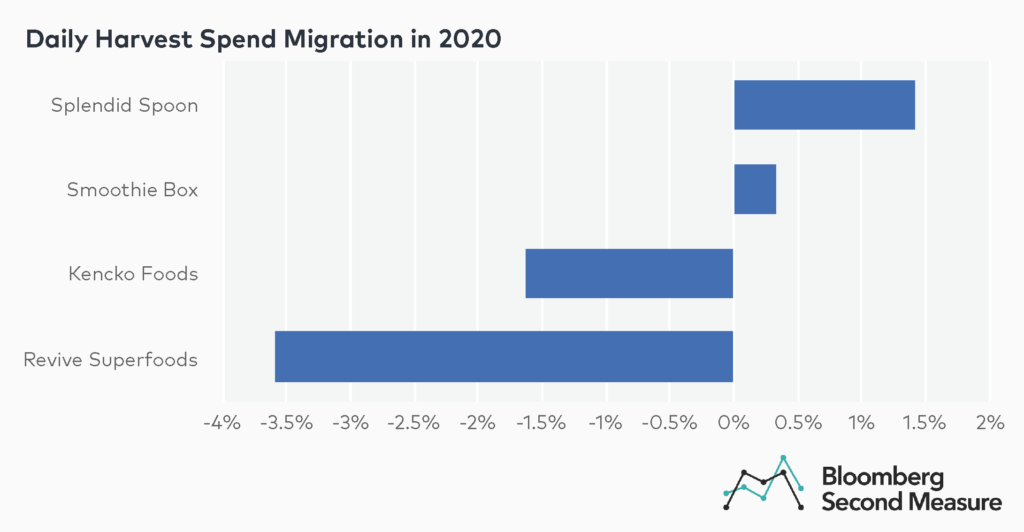

Despite its rising sales, Daily Harvest lost market share in 2020 to some of its newer competitors. In 2020, Daily’s Harvest’s company’s relative share growth—or growth rate of market share—was -4 percent.

A closer look at spend migration data found that Daily Harvest lost consumer spend to Kencko and Revive Superfoods in 2020. Notably, Revive Superfoods was originally founded in Canada, so its market share growth in 2020 could be partially attributed to its more recent entry to the U.S. market. Daily Harvest also captured some spend from Smoothie Box and Splendid Spoon in 2020, partially offsetting its losses.

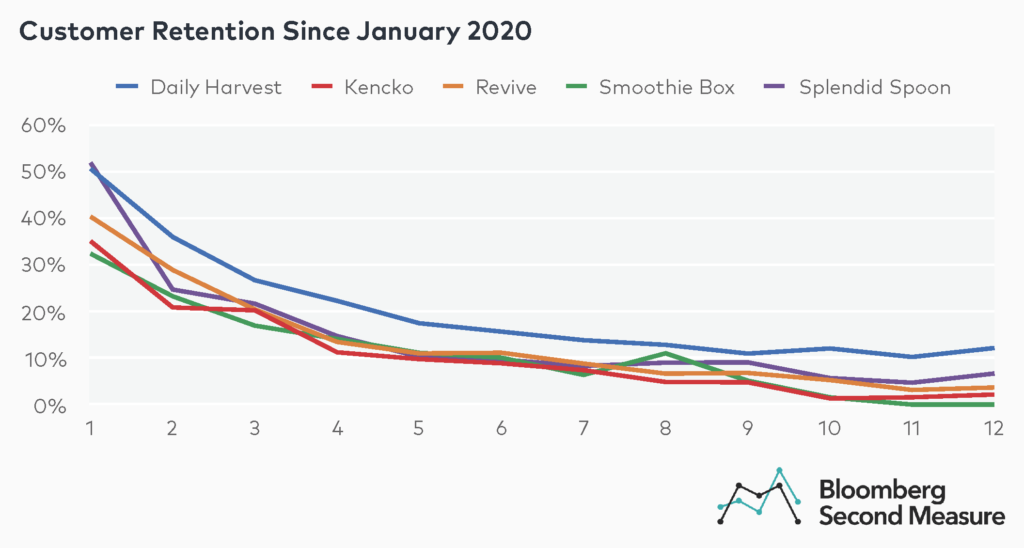

Daily Harvest has the highest customer retention rate

Looking at customer retention since January 2020, Daily Harvest had the highest customer retention among the competitive set for every month except the first after purchase. Roughly half of customers made a repeat purchase one month after initial purchase for Daily Harvest and Splendid Spoon, while Revive Superfoods had a customer retention rate of 40 percent after the first month. Twelve months after the first purchase, 12 percent of consumers made a repeat purchase at Daily Harvest, about twice that of its nearest competitor Splendid Spoon.

Interestingly, the companies with the highest customer retention also have the most diversified product offerings. Daily Harvest, Revive Superfoods, and Splendid Spoon offer not only smoothies, but also heatable meals, soups, and oat bowls. Daily Harvest also introduced a product line of dairy-free ice cream in May 2020, and recently launched a new plant-based milk alternative.

Some of the companies with more varied healthy food offerings also saw higher lifetime sales. After 12 months, Splendid Spoon had the highest lifetime sales per customer with $659, followed by Daily Harvest with $544. By contrast, lifetime sales per customer for Revive Superfoods, Smoothie Box, and Kencko were under $200 after 12 months.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.