NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

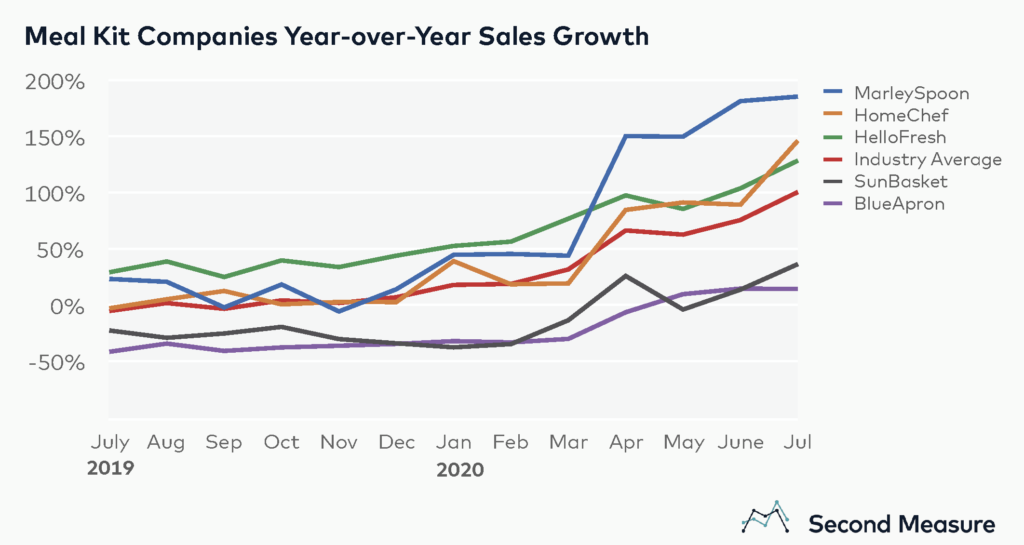

The struggling meal kit industry has flourished in the COVID-19 era. Whereas industry sales had previously fallen 5 percent in July 2019, the industry has gained tailwinds a year later, growing an average of 101 percent in July 2020.

As shelter-in-place orders left many Americans with extra time for home cooking, a closer look at meal kit companies operating in the U.S. reveals that not all companies benefited from the lockdown demand surge. Marley Spoon was a clear victor, with sustained year-over-year growth over 150 percent every month since April—more than any other competitor.

Industry leader HelloFresh Group, whose subsidiaries include HelloFresh, Green Chef, EveryPlate, and Chef’s Plate, showed lockdown gains of 129 percent in July. Home Chef, the company’s closest competitors by national market share, also demonstrated strong growth trends in recent months. The company observed a 147 percent increase year-over-year in July, up from 90 percent growth in June.

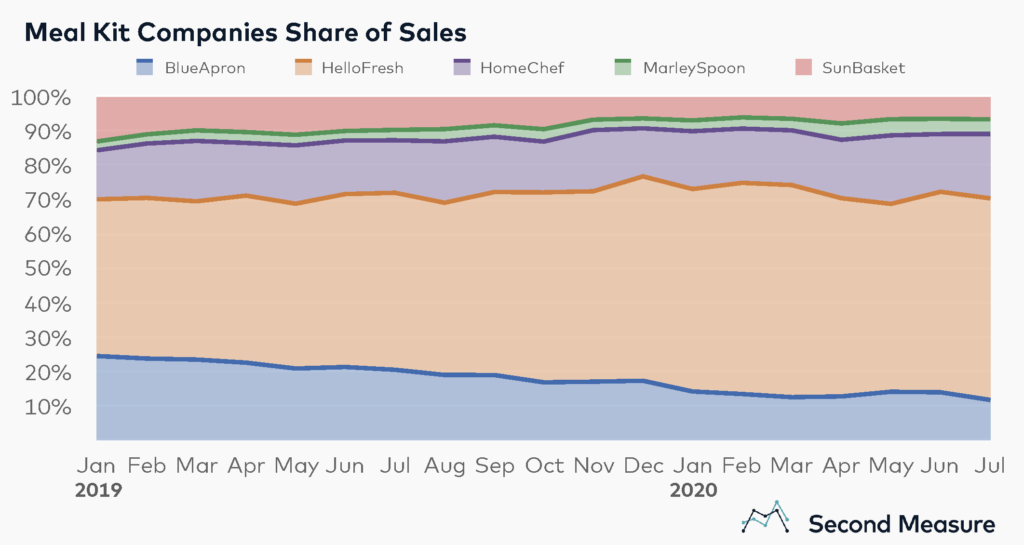

HelloFresh continues gobbling up market share

Over the past three years, Blue Apron has suffered the brunt of HelloFresh’s growing market share. The company’s market share fell from 20 percent in July 2019 to 19 percent in July 2020.

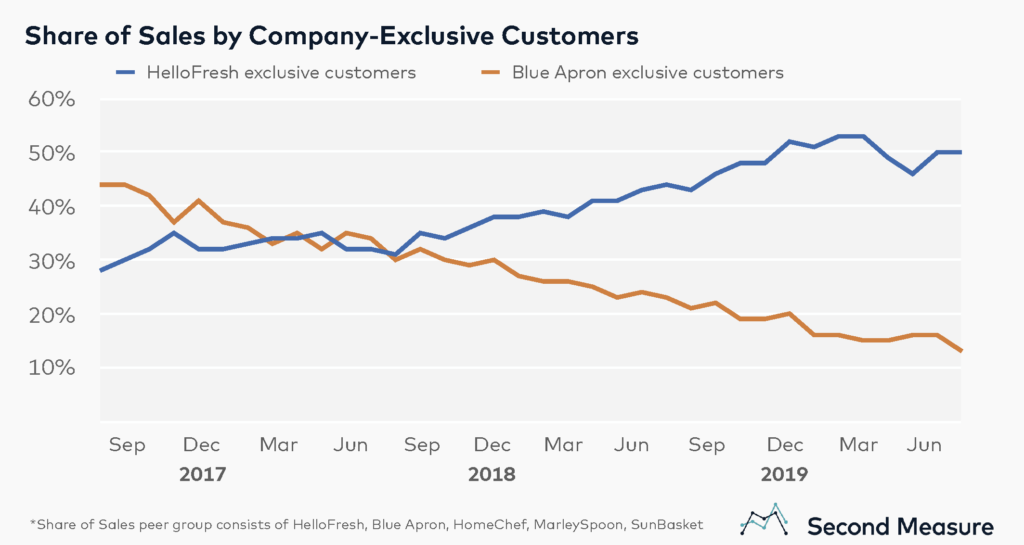

One possible reason for Blue Apron’s market share losses could be the steady decline of customer loyalty, as consumers shop around for the best possible deal between competitors. A closer look at the spending behavior of Blue Apron and HelloFresh customers in July revealed that only 18 percent of these customers shopped exclusively at Blue Apron, while 81 percent of them shopped exclusively at HelloFresh. Additionally, share of sales of Blue Apron-exclusive customers has decreased steadily over the past three years while the opposite appears to be true for HelloFresh.

In July, Blue Apron-exclusive customers held a 13 percent share of sales, while HelloFresh-exclusive customers held more than 50 percent. In contrast, the companies’ exclusive customers share of sales were toe-to-toe two years ago. In 2018, the share of sales held by both companies’ exclusive customers were slightly over 30 percent.

New market entrants in the ready-to-eat space

In recent years, the industry has expanded to include ready-to-eat meals and smoothie kits that require little to no preparation. Within the smoothie kit market, our data indicates that share of sales between market incumbent Daily Harvest and newcomer Revive Superfoods leans heavily in favor of Daily Harvest, with the company capturing 94 percent of the smoothie kit market.

However, Revive Superfoods’s market share has grown significantly, from 0.5 percent in July 2019 to 6 percent in July 2020. Consumer interest in both companies has skyrocketed since the start of the pandemic, with Daily Harvest observing a 52 percent increase in quarterly sales in the second quarter of 2020 while quarterly sales for new market entrant Revive Superfoods grew 76 percent that same period.