NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

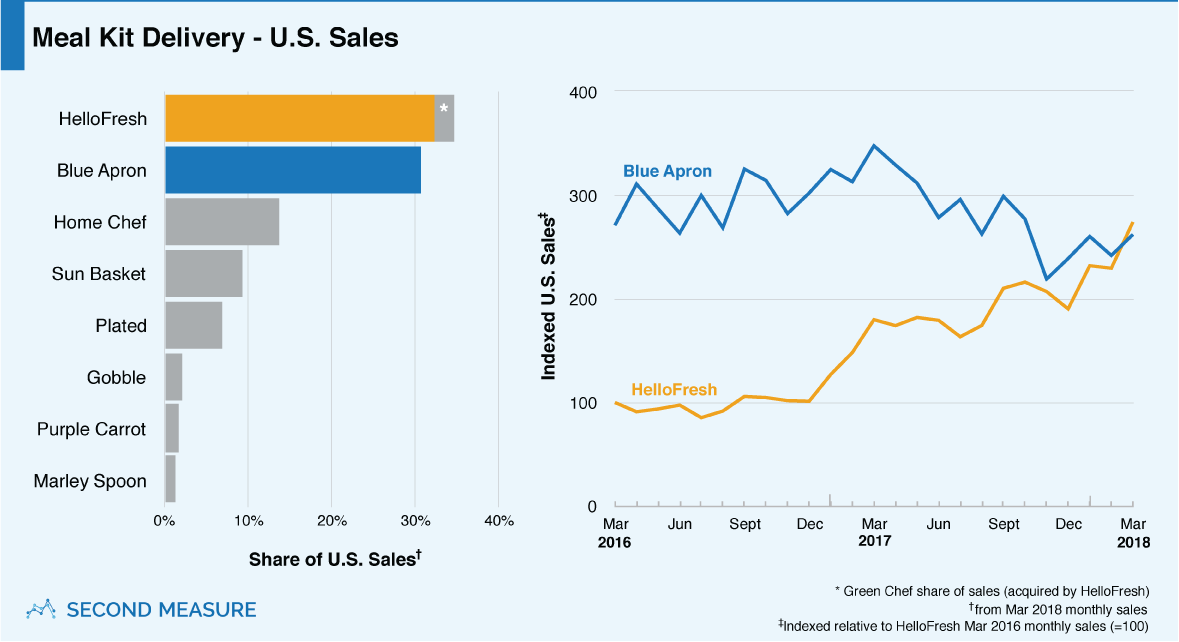

HelloFresh recently acquired Green Chef to create the largest meal kit delivery company in the U.S. According to the latest consumer data, HelloFresh earned the title in March, even without the added sales from Green Chef. For the first time, HelloFresh beat out Blue Apron, bringing in 4 percent more monthly spending.

Each of the nine competitors in our analysis claimed at least 1 percent share of March sales, although companies that deliver more than just meal kits, like Amazon and Peapod, are not included. Together, HelloFresh and Green Chef represent 35 percent of spending among major competitors. Blue Apron now claims just 31 percent—down nine percentage points from six months ago. This latest industry shake-up is on target with our fall projections that show HelloFresh’s quarterly sales surpassing Blue Apron’s in the second quarter of this year.

More home cooks are choosing HelloFresh

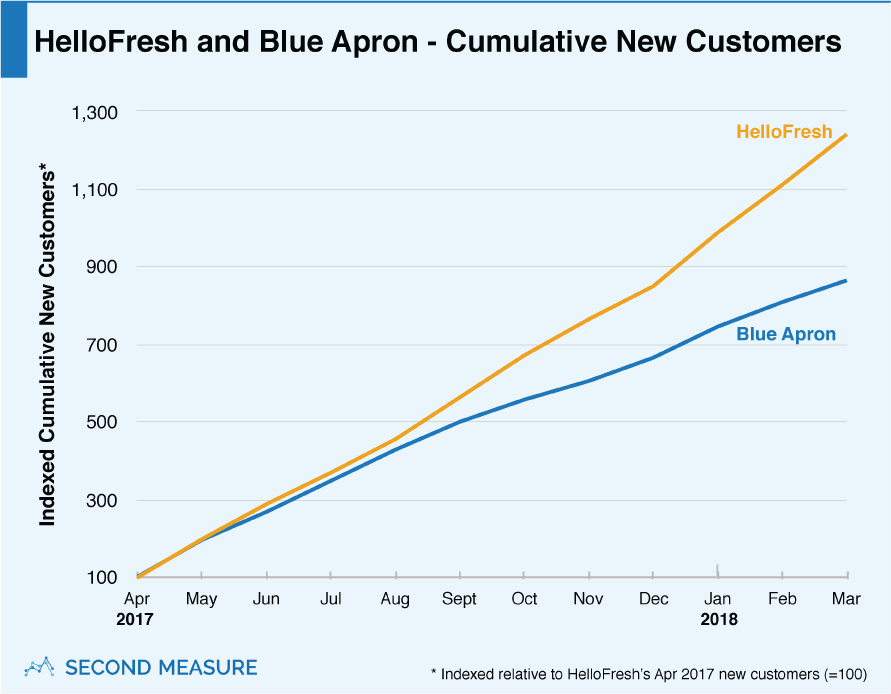

Profitability in the U.S. is not far off for HelloFresh, according to the company’s year-end report, due in part to a massive expansion of its customer base. In March, HelloFresh saw a 44 percent year-over-year increase in people cooking with its kits. And, when it comes to seeking out home chefs willing to sample its meals, HelloFresh outperforms the competition. Over the past year, Blue Apron attracted just over two-thirds as many new customers as HelloFresh.

But getting people to try meal kits is expensive, which means keeping them coming back is essential to recouping marketing dollars. Over the past two years, Blue Apron has seen more customers return after their first year than HelloFresh—but by a smaller margin than our previous analysis found. On average, Blue Apron now retains 13 percent of its customers from 12 months prior, while HelloFresh’s retention rate rose to 11 percent over the same period.

Meal kits face waning demand for delivery

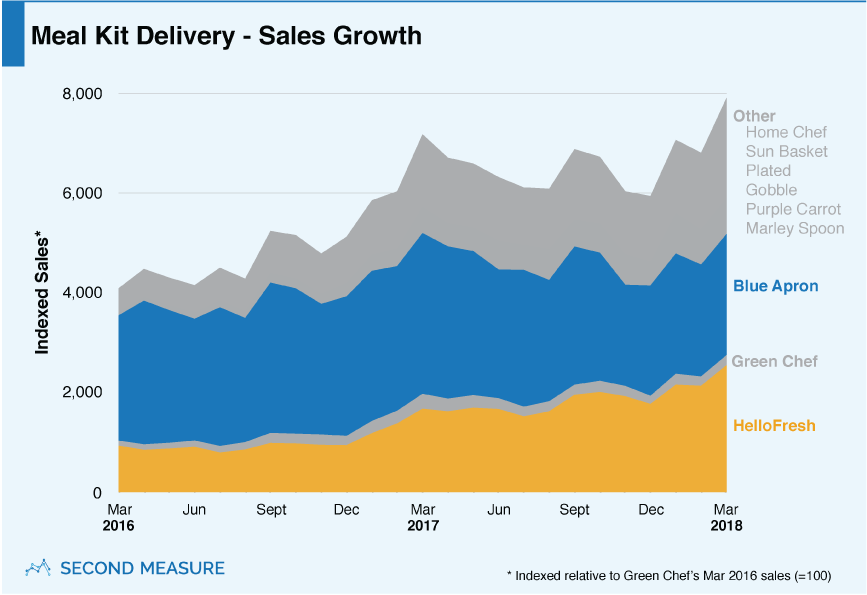

HelloFresh has shipped meals to only 2 percent of American consumers but, despite a largely untapped market, growth is slowing down for meal kit delivery. Last month saw year-over-year sales growth of just 10 percent for major meal kit companies, while sales grew by 76 percent year over year in March 2017. Potential customers claim a high price point, rather than lack of access, has kept them from cooking with a kit.

While delivery-based brands face a spending slowdown, a fresh crop of suppliers are getting in the game. By selling store-brand meal kits, supermarkets can eliminate delivery costs and leverage their existing supply chains to save on ingredients. In the past year, a handful of grocers, including Walmart, have entered the market. Amazon also looms over the industry—its meal kits became available last summer for delivery in select locations and are among the top sellers at Amazon Go, its cashierless, brick-and-mortar outpost in Seattle.

To compete, the pioneers of meal kit delivery are moving into brick and mortar as well. Acquired by Albertsons last fall, Plated meals have started their in-store rollout. Blue Apron is following suit, but it may be late to the party. As grocery store aisles grow more crowded, an innovative partnership with Airbnb might hold out hope for Blue Apron’s struggling stock.

Keep up on the latest in meal kit trends by starting your demo today.

Oh, and we’re hiring.