NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

In its Q3 earnings call, Papa John’s predicted Q4 sales would fail to meet targets due to controversial protests within the NFL and the pizza company’s role as an official league sponsor. It turned out to be true—fourth quarter spending was down year-over-year—but maybe not for the reason then-CEO John Schnatter expected.

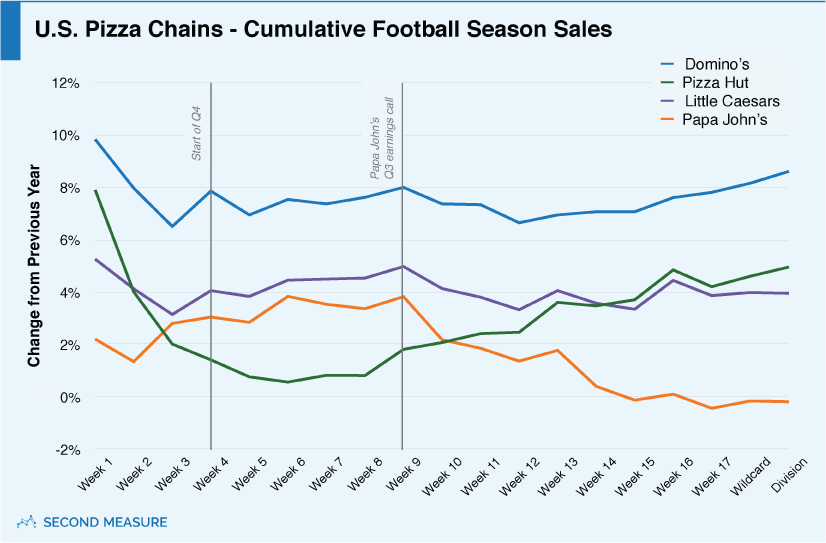

During the call, Schnatter described the NFL’s handling of the national anthem protests as “an example of poor leadership,” and blamed the league and its declining TV ratings for Papa John’s underwhelming third-quarter growth. The company expected slow growth to continue throughout the fourth quarter, but the situation seems to have worsened. In fact, the Q3 earnings call appears to have been the turning point, as year-over-year average spending at Papa John’s declined over the weeks that followed.

Schnatter’s lament that the NFL’s controversy should have been “nipped in the bud” a year and a half ago drew major press coverage, and the company’s stock fell 11 percent within 24 hours of the earnings call. The hits kept coming the next day when white nationalists christened the chain “the official pizza of the alt-right.” Papa John’s tweeted an apology more than a week later, which ended up sparking fresh criticism from consumers. Schnatter has since resigned as CEO.

Adding insult to injury, other pizza chains and NFL sponsors categorically denied that the NFL controversy impacted sales. All these Papa John’s publicity fumbles have left an opening for competitors to rake in the dough. Since the Q3 earnings call, Domino’s has seen 9 percent year-over-year sales growth, and spending at Pizza Hut has risen 8 percent. Sales have also been up at Little Caesars, by 4 percent.

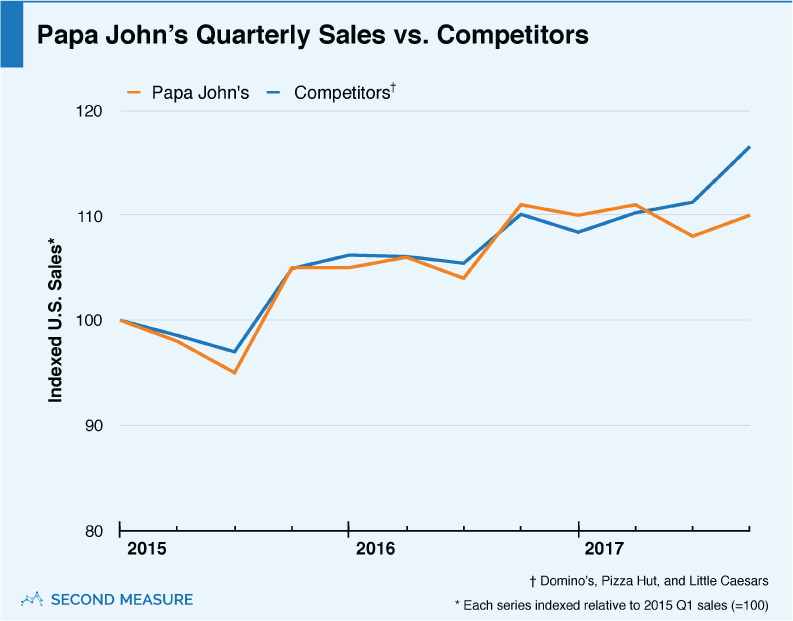

As part of its Q3 earnings release, Papa John’s lowered its 2017 North American sales outlook in the face of slow comparable growth. Additional struggles for the company couldn’t have come at a worse time. While Q4 is typically the biggest quarter for pizza chains, Papa John’s 2017 Q4 sales fell short of both Q1 and Q2 sales. Second Measure’s observed year-over-year sales, which strongly correlate with Papa John’s comparable growth, show fourth-quarter spending at Papa John’s was down by 2 percent from 2016. Among competitors, sales grew 6 percent over the same period.

To see how else you can slice the data on pizza sales, request a demo today.

Oh, and we’re hiring.