NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

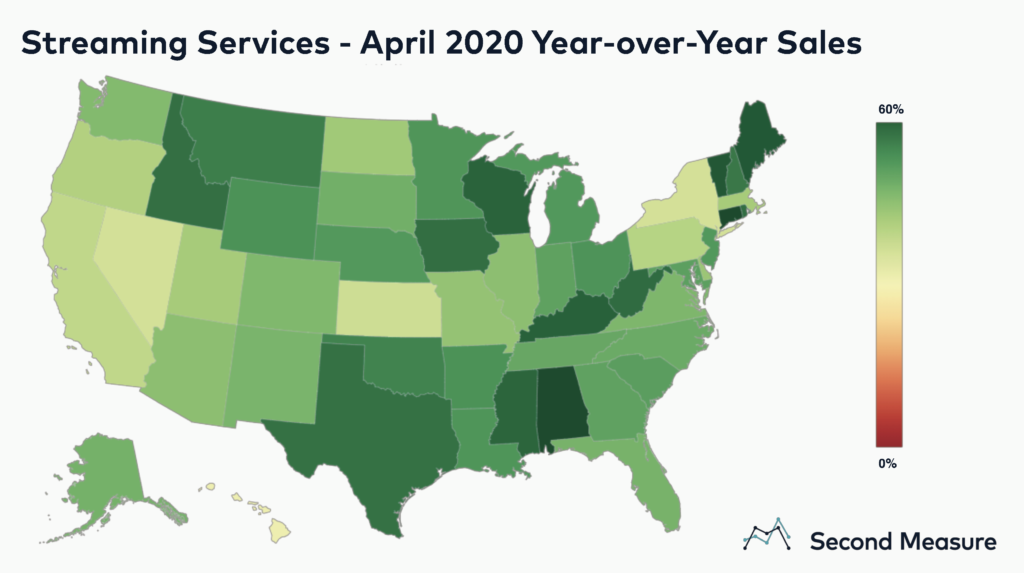

As U.S. consumers stay home amid the pandemic, they are flocking to streaming services for entertainment. The streaming industry’s sales grew 47 percent year-over-year in April 2020 compared to a 39 percent year-over-year sales increase in April 2019. Mandatory stay-at-home-orders, combined with the entry of a new market player, Disney+, and the rising popularity of socially-distant gatherings like Netflix parties, have led to the industry’s growing success.

Streaming sales have risen more in certain states than others. In six states, including Connecticut and Alabama, sales at streaming services have grown by more than 60 percent year-over-year. Meanwhile, growth has been slower in states like Hawaii, New York, and Nevada.

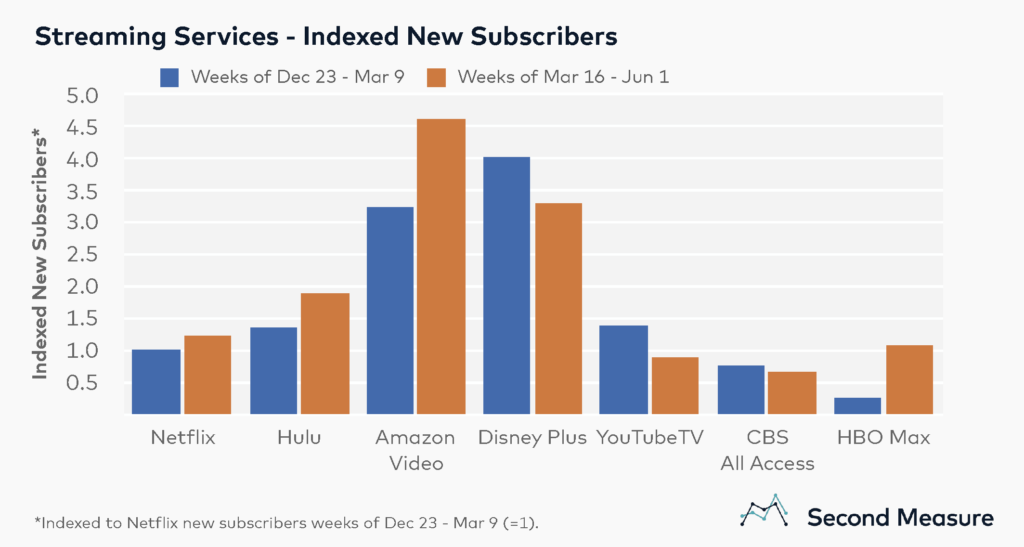

Streaming subscriptions spiked when lockdown started

For most streaming services, nationwide customer growth surged at the beginning of mandatory shelter-in-place regulations. An analysis of new customers over two 12-week periods before and after the week of March 16 (when many states started sheltering-in-place) revealed that—with the exception of YouTubeTV and CBS All Access—streaming companies saw a larger number of new sign-ups after shelter-in-place orders went into effect.

HBO Max led the pack with over 300 percent growth in new customers between March 16 and June 1, compared to the 12 weeks immediately prior to March 16. HBO Max debuted on May 27, adding a trove of Time Warner Media content to the platform’s previous identity: HBO Now.

At Amazon Video, most of its growth can be traced to a large spike in the four-week period starting March 16, when each week new customers nearly doubled, or more, year-over-year. Amazon Video transactions include movie purchases and rentals made through the service in addition to a la carte subscriptions, and excludes complimentary Video subscriptions associated with Amazon Prime membership.

New market entrant Disney+ saw new customer growth fall nearly 20 percent, due in part to the fact that the service observed a surge in new customers in the months after it was first introduced in November 2019.

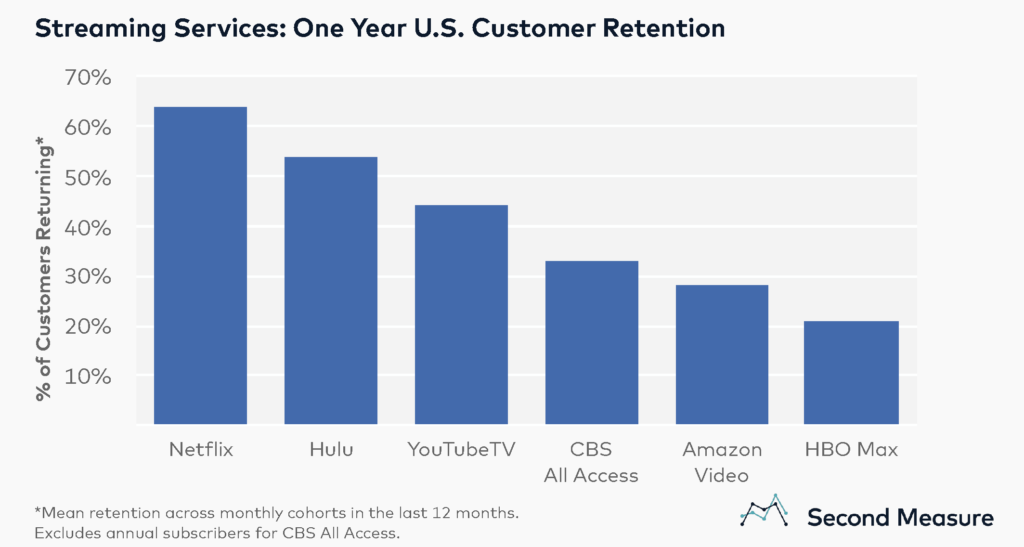

Netflix retention is higher than other streaming services

Some streaming services boast higher customer retention over a 12-month period. Netflix and Hulu outpace their competitors in terms of monthly customer retention, with retention rates of 64 percent and 54 percent respectively. Meanwhile, Amazon Video and CBS All Access have retention rates hovering around 30 percent.