NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Throughout the COVID-19 pandemic, Shake Shack (NYSE: SHAK) has been revamping its omnichannel strategy. The fast casual burger chain has launched features such as curbside pickup and delivery through its own app to facilitate online ordering, and is looking to further expand its retail footprint in 2022 by opening drive-thrus and 50 new locations, primarily in suburban areas.

Consumer transaction data shows that Shake Shack’s online sales as a percentage of total U.S. sales has been on the rise over the past two years. At the same time, Shake Shack sales in certain metro areas like Boston and Philadelphia have seen stronger-than-average growth during this time period, with the opening of new retail locations being a potential factor.

Shake Shack’s online sales have grown during the pandemic

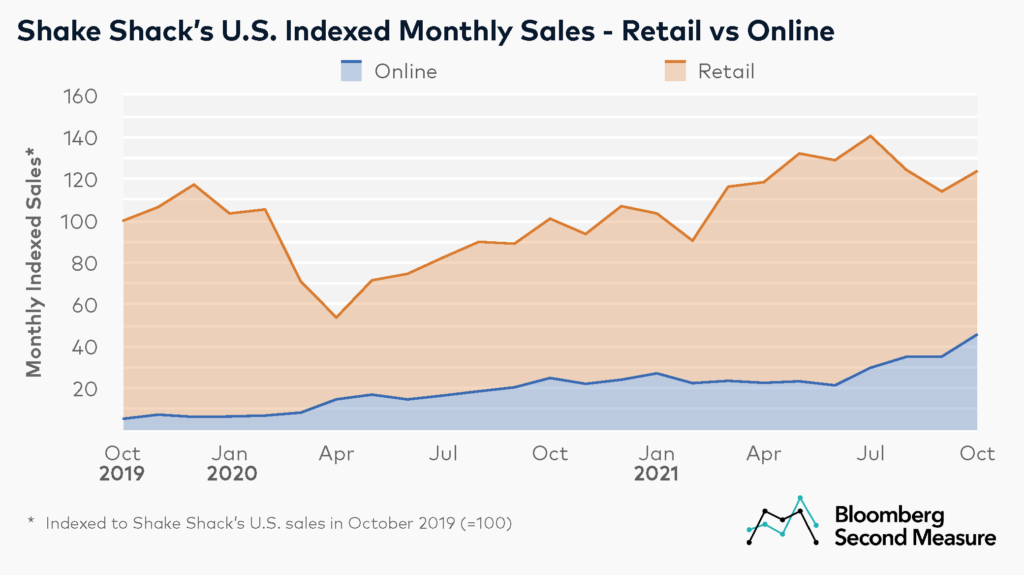

Shake Shack’s U.S. sales decreased at the onset of shelter-in-place orders. Between February and April of 2020, U.S. sales at Shake Shack declined 49 percent, but sales have since exceeded pre-pandemic levels. In October 2021, Shake Shack’s U.S. sales were 23 percent higher than the year before and 24 percent higher than two years ago.

Similar to other fast casual restaurants during the pandemic, Shake Shack has seen an increasing percentage of U.S. sales take place online. In October 2021, 37 percent of U.S. sales originated from the online channel, compared to 5 percent two years earlier. Between October 2019 and October 2021, online U.S. sales at Shake Shack grew 752 percent, while retail U.S. sales declined 17 percent. It is worth noting that sales in our analysis are for U.S. orders only and exclude international sales.

Doubling down on its digital channels, Shake Shack is launching items that are exclusively available for online orders as well as offering early access to limited-time favorites such as Black Truffle Burger and Garlic Parmesan Fries. In March 2021, Shake Shack formed an exclusive partnership with Uber Eats to fulfill delivery orders placed within Shake Shack’s own app. Shake Shack can also be ordered through other meal delivery companies.

Sales in the Boston and Philadelphia metro areas are growing faster than the national average

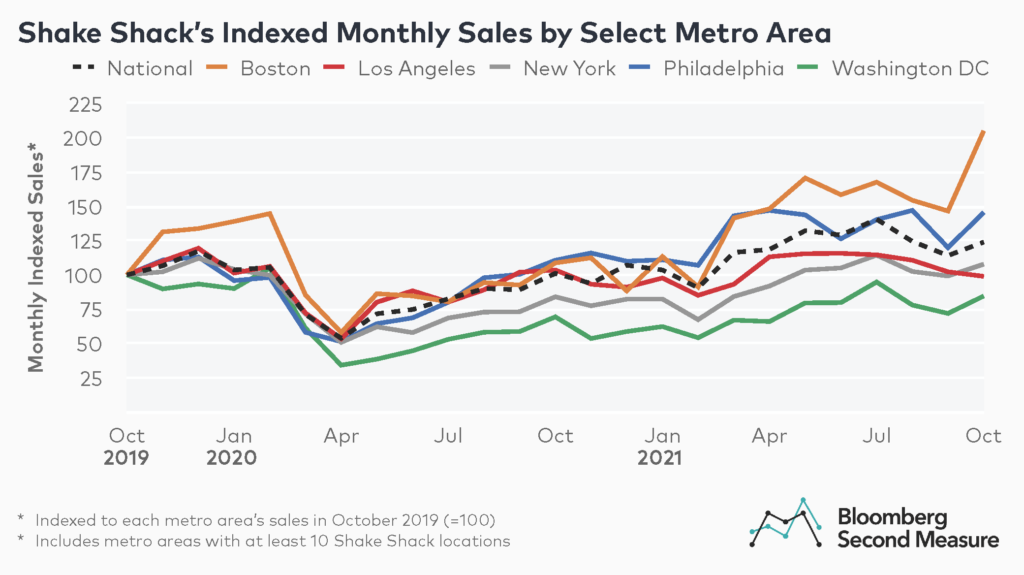

At a local level, Shake Shack sales in certain metro areas are recovering faster than others. Between October 2019 and October 2021, Shake Shack’s national sales increased 24 percent.

Among the metro areas where Shake Shack has at least 10 retail locations, only the Boston and Philadelphia metro areas had sales growth above the national rate in this time frame, with increases of 105 percent and 46 percent, respectively. One potential factor in the Boston area’s strong sales growth is the opening of new restaurants in the Boston suburbs in the second half of 2021, including at the Burlington Mall, Somerville, and new Encore Boston Harbor casino.

In the New York metro area, where the company was founded, sales grew 8 percent between October 2019 and October 2021. Conversely, sales in the Los Angeles and Washington D.C. metro areas have not yet reached pre-pandemic levels. Los Angeles sales in October 2021 were 1 percent lower than they were two years ago, while Washington D.C. sales were 15 percent lower.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.