NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

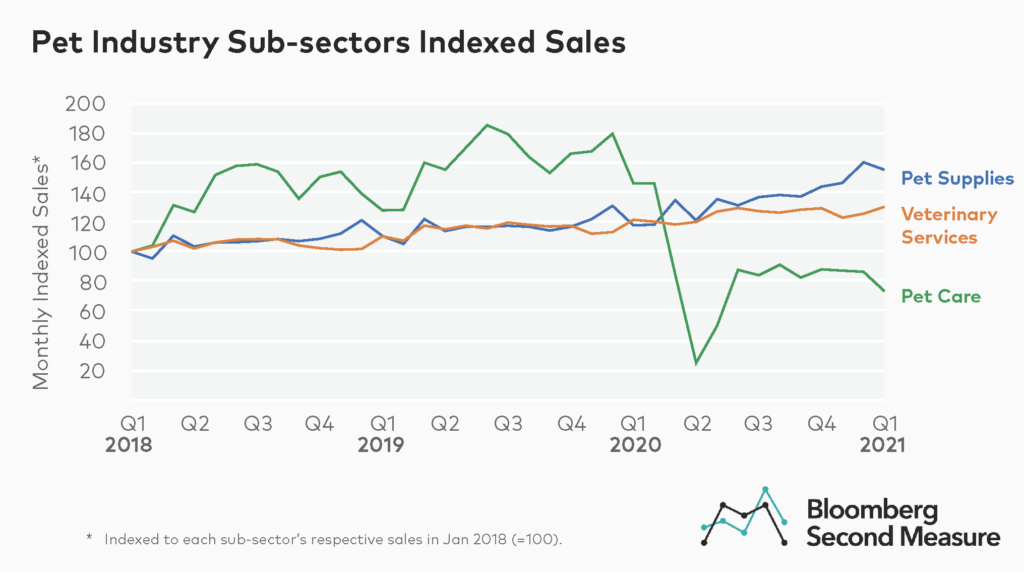

Since restrictions on social gatherings were introduced in March 2020, many U.S. consumers have turned to animal adoption to keep themselves company during the coronavirus pandemic. The pet industry as a whole observed 18 percent growth from March to December of 2020, with most of this growth driven by the pet supplies sector.

Sales for the pet supplies sector have increased in the COVID-19 era. Meanwhile, pet care companies (dog walking, dog hotels, pet vacations and entertainment services) have been dealt a huge blow, as consumers have stayed home and sought new ways to keep their furry friends entertained. Year-over-year growth for pet care companies dropped 47 percent in March 2020 and has not fully recovered. By contrast, pet supplies companies and veterinary services initially took a hit, but have since more or less recovered. In December 2020, pet supplies witnessed 22 percent year-over-year growth, compared to 8 percent in December 2019.

Pet care companies, which were once the rising stars of the pet industry and collectively enjoyed 17 percent average monthly year-over-year growth in 2019 (almost twice as much as pet supply and vet companies), saw average monthly year-over-year growth of -43 percent in 2020. As of January 2021, sales levels for pet care companies are half of what they were a year ago.

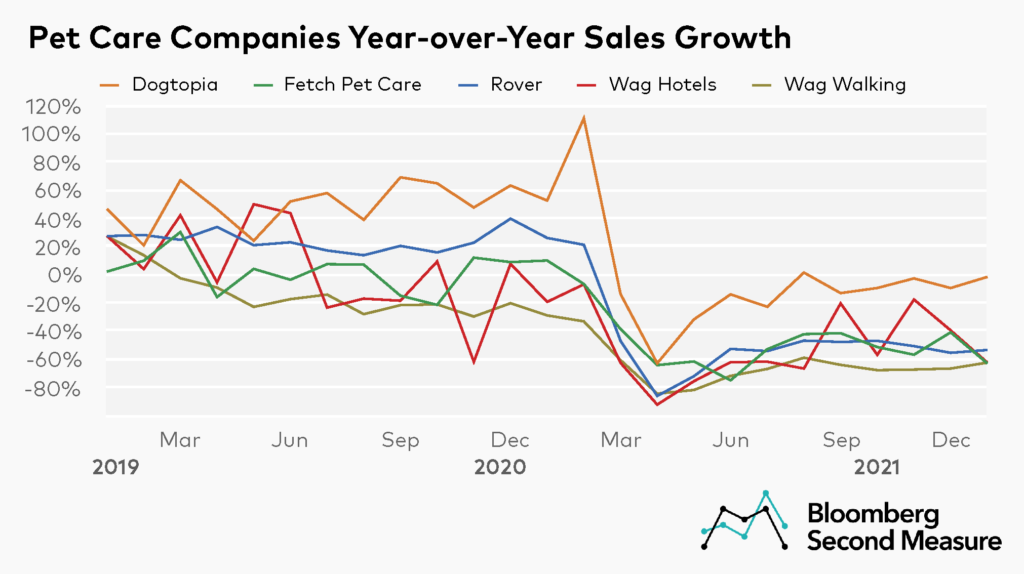

Dogtopia’s sales bounding back the most

Of the pet services companies in our dataset, Dogtopia has shown the strongest recovery. Year-over-year growth for the company, which offers dog daycare, spa, grooming, and boarding services, has rebounded by over 60 percent, from -63 percent in April 2020 to -2 percent by January 2021. The company also outperformed its competitors prior to the introduction of shelter-in-place orders. Its average monthly year-over-year growth for the trailing 12 months leading up to March 2020 stood at 58 percent, while that of its competitors stood at 1 percent.