NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Recently, Bloomberg published an article about Blue Apron’s possible IPO. In just 3.5 years, Blue Apron reached profitability and a $2 billion valuation[1]. With over 8 million meal-kits being delivered to customers each month[2], many investors are wondering: How does Blue Apron stack up against its competitors?

- Which meal-kit service commands the greatest market share and growth rates?

- Do customers make repeat purchases?

- Are new customers spending more than before?

The Competition

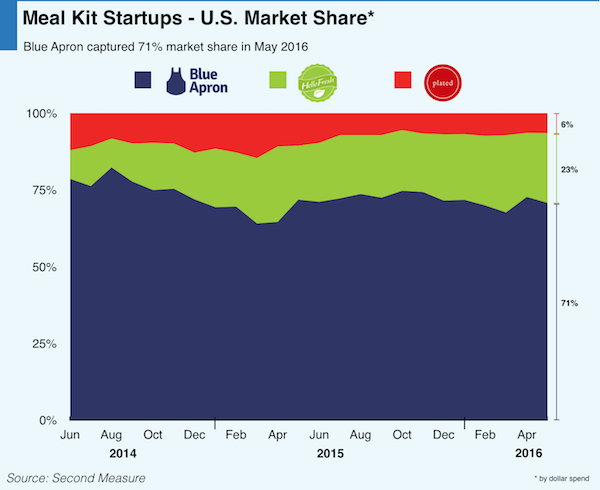

Examining Blue Apron’s domestic sales relative to its two closest competitors, HelloFresh and Plated, Blue Apron commands a 71% U.S. market share as of May 2016.

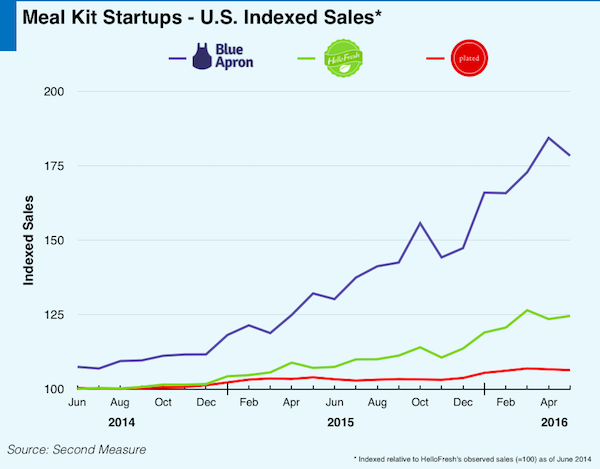

Over the past two years, HelloFresh had a higher compound monthly growth rate (CMGR) – 14.5% compared to Blue Apron’s 9.8%. However, Blue Apron is still the dominant player in the meal-kit space in the United States with more than 3 times the observed sales of HelloFresh.

Customer Retention

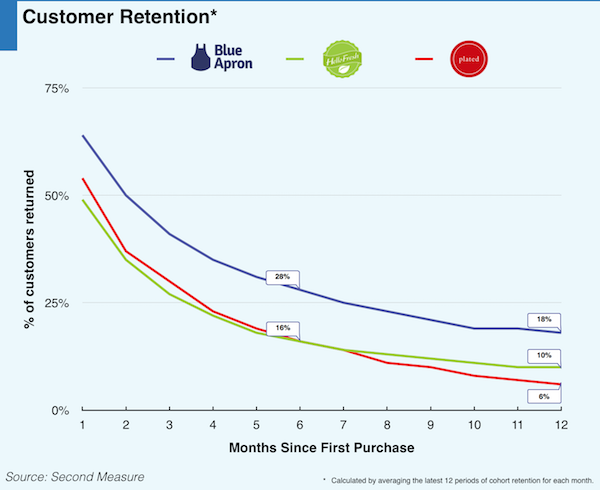

More importantly, are customers coming back? 28% of Blue Apron customers remain subscribed to the service 6 months after their first purchase.

On the other hand, Plated and HelloFresh’s 6-month customer retention are both 16%. Blue Apron is more successful in retaining its customers.

Total Spend per Customer

Higher retention may come at the cost of decreased customer lifetime value (LTV). For example, companies with aggressive customer retention strategies may heavily subsidize repeat purchases through promotions, which could reduce LTV.

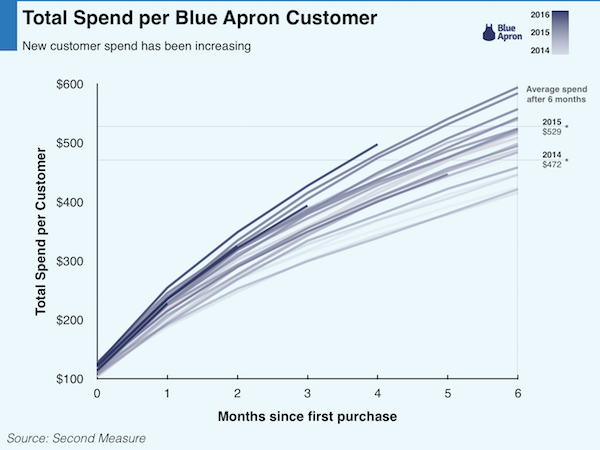

Customers who joined Blue Apron in 2016 are spending more than new customers from previous years.

Customers who joined Blue Apron in 2015 spent, on average, $529 at the end of 6 months. In contrast, customers who joined in 2014 spent just $472. Blue Apron has managed to extract more revenue from newer customers while increasing customer retention.

Blue Apron is the frontrunner in the domestic meal-kit space with the highest market share, retention rates, and customer spend, but with HelloFresh steadily gaining, they face the challenge of maintaining market share while pursuing both mainstream adoption and sustainable unit economics.

To take a deeper look into Blue Apron’s performance (geographic distribution of customers, sales breakdown of meal plans, customer overlap with competitors), request a demo.