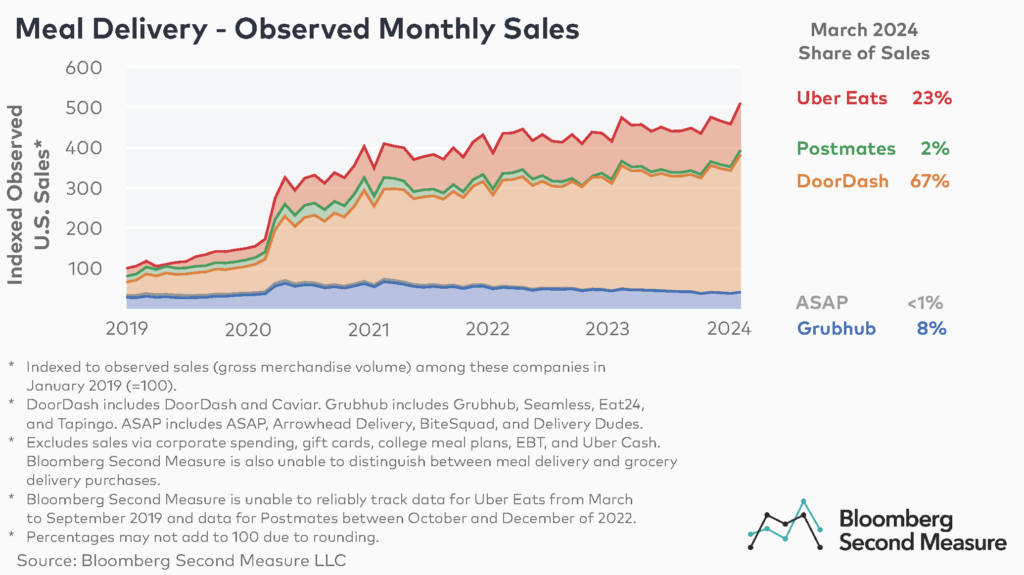

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Bloomberg Second Measure’s consumer transaction data analytics show that in April 2020, combined observed sales for major meal delivery services grew 162 percent year-over-year and 59 percent compared to the previous month. The meal delivery industry as a whole is continuing to see some growth, though at much lower rates than those pandemic peaks. Our data analytics show that in March 2024, observed sales for major meal delivery services grew 8 percent year-over-year, collectively.

Bloomberg Second Measure’s transaction data analytics show that in March 2024, DoorDash (NASDAQ: DASH) and its subsidiary Caviar earned 67 percent of observed U.S. consumers’ meal delivery sales. DoorDash made its public market debut with one of the biggest IPOs of 2020, and accounted for an increasing percentage of market share during the COVID-19 pandemic.

Among the companies in our analysis, Uber Eats came in second place with 23 percent of observed sales in March 2024. It is worth noting that our observed sales metrics may differ from publicly reported earnings for a number of reasons. First, Bloomberg Second Measure is unable to reliably track data for Uber Eats from March to September 2019. Additionally, Bloomberg Second Measure’s data analytics do not include Uber Eats’ purchases made using Uber Cash or purchases made by corporate customers, an area where meal delivery services are reportedly making inroads. Our analysis includes debit and credit card purchases from a panel of millions of U.S. consumers.

At the end of November 2020, Uber (NYSE: UBER) acquired Postmates in an attempt to consolidate market share. Postmates earned 2 percent of the U.S. meal delivery market in March 2024, bringing Uber’s total observed market share to 25 percent. Notably, Bloomberg Second Measure is unable to reliably track Postmates between October and December of 2022.

Grubhub and its other third-party delivery subsidiaries, which include Seamless, Eat24, and Tapingo, came in at 8 percent of observed U.S. meal delivery consumer spending in March 2024. (Purchases made through LevelUp, which Grubhub acquired in late 2018, are not included in our analysis. Neither are college student meal plan purchases made through Tapingo.) Grubhub was acquired by Just Eat Takeaway in June 2021.

One of the industry’s smaller services, ASAP (known as Waitr prior to its rebrand in 2022) and its subsidiaries Bite Squad, Arrowhead Delivery, and Delivery Dudes, earned less than 1 percent of observed U.S. sales in March 2024. Notably, in April 2024, ASAP ceased operations and filed for Chapter 7 bankruptcy.

Notably, the data represents observed gross merchandise volume through these companies, not company revenue. Bloomberg Second Measure data is also unable to distinguish between meal delivery and grocery delivery sales through these companies.

Subscription meals have appeal

As meal delivery services look for new ways to grow in cities big and small, one emerging answer is subscriptions. Postmates launched Postmates Unlimited in 2016, while DoorDash and Grubhub followed suit with their own subscription options in 2018 and 2020, respectively. In November 2021, Uber also launched its new “Uber One” subscription plan, which offers benefits for both rides and delivery services.

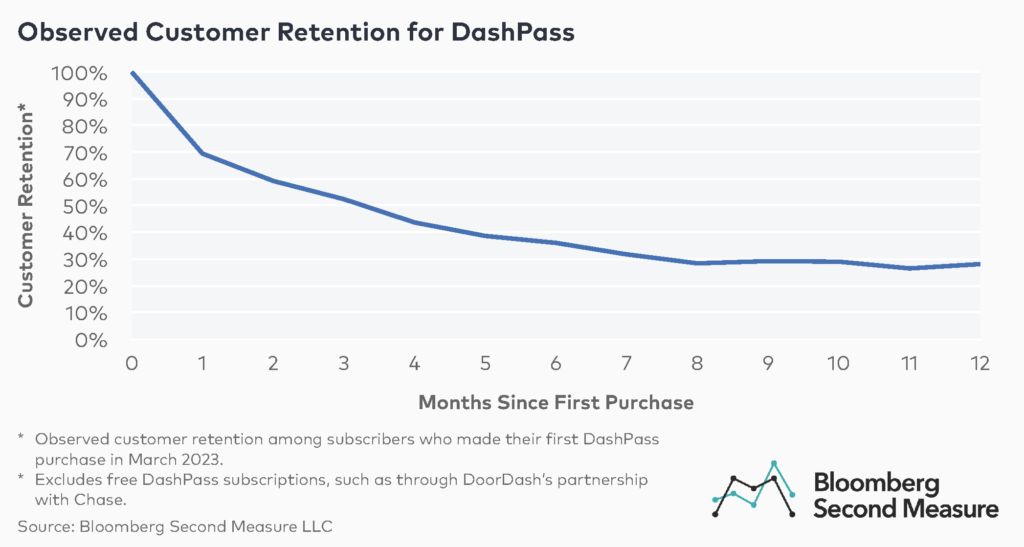

Among subscribers who signed up for DoorDash’s DashPass in March 2023, 69 percent remained subscribed after one month. The six-month observed customer retention rate for DashPass subscribers in this cohort was 36 percent and the 12-month retention rate was 28 percent. In April 2022, DoorDash also launched DashPass for Students, which offers the subscription’s benefits at a reduced price.

Notably, in December 2019, DoorDash also partnered with Chase to give free DashPass memberships to millions of credit card holders. In March 2023, Doordash expanded its partnership with Chase by launching a co-branded credit card. Additionally, in early 2023, DoorDash began offering free memberships through partnerships with Chegg and Roku. These free memberships are not included in Bloomberg Second Measure’s data.

Meal delivery services vie for partnerships

Another popular growth strategy for meal delivery companies has been forming partnerships with the nation’s top chain restaurants. (Though many services have also been in the news for listing restaurants that do not want partnerships.). Major meal delivery companies including Uber Eats, Postmates and Doordash also signed partnerships with chains like McDonald’s and Starbucks. In 2020, DoorDash officially teamed up with Little Caesars Pizza, a brand that has never previously offered delivery. In April 2023, DoorDash announced that its DashMart online convenience stores will offer Blue Apron’s Heat & Eat meals in 11 markets, including New York. Meanwhile, in July 2023, Domino’s Pizza, a company that previously resisted working with meal delivery companies, announced its deal with Uber Eats and Postmates.

Aside from restaurant and meal kit company partnerships, meal delivery companies are seeking ways to diversify their existing business. During the pandemic, Uber Eats launched a U.S. grocery delivery service and piloted same-day delivery with Costco. The company also expanded its prescription delivery partnership with Nimble. Additionally, in early 2021, it acquired alcohol delivery company Drizly. However, at the beginning of 2024 Uber announced its plans to shut it down.

DoorDash has partnerships with CVS as well as regional and national convenience stores for the delivery of household essentials. DoorDash also partnered with Albertsons to expand its grocery delivery offerings and reportedly engaged in talks to buy Instacart. In September 2021, DoorDash also announced that it was adding alcohol delivery to its app. More recently, in November 2023, it also added consumer electronics, by partnering with Best Buy. In 2024, the company plans further expansion into retail and grocery.

In 2022, Grubhub teamed up with Amazon to offer a free year of its Grubhub+ subscription to Amazon Prime members, and later that year partnered with rapid delivery company GoPuff for the delivery of alcohol, grocery, and essential items. The company also launched a number of initiatives aimed at capturing college students. In December 2022, Grubhub teamed up with Kiwibot to provide robot delivery services at college campuses across the U.S., and in March 2023, the company announced an expansion of its partnership with Transact, that will allow students to pay for meal delivery with their campus cards.

ASAP, on the other hand, has sought to differentiate itself from its larger competitors through its foray into cannabis delivery and exclusive partnerships with major sports stadiums.

Meal delivery providers respond to challenges posed by rising operational costs

Faced with inflationary pressures in 2021 and 2022, meal delivery companies responded in different ways. For example, Uber Eats implemented a fuel surcharge for consumers, starting in March 2022. DoorDash launched a gas rewards program for drivers to aid with rising fuel costs, while Grubhub boosted driver pay per mile. At the end of 2022, DoorDash also announced layoffs in an effort to improve efficiency. In June 2023, the company introduced several changes to its app, with the aim of reducing driver churn and acquisition costs. During its FY23 Q3 earnings call, DoorDash highlighted this as one of the factors contributing to the company’s record adjusted earnings.

Fewer customers are loyal to a single meal delivery service

Despite overall industry growth, the battle for customers is getting more intense because fewer of today’s diners are loyal to just one service. (Grubhub’s former CEO cited “promiscuous customers” as a hindrance to his company’s growth.) As more restaurants form exclusive delivery partnerships and meal delivery services offer incentives like memberships and discounts, more diners are going to have to hop between apps to cover all their favorite takeout spots and find the best deals. The least loyal customers, it seems, will also be the most well fed.

Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest post in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

The data included in these materials are for illustrative purposes only. The Bloomberg Second Measure services are made available by Bloomberg Second Measure LLC (“BBSM”). BBSM’s parent company, Bloomberg L.P. (“BLP”), provides BBSM with global marketing and operational support. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BBSM, BLP or their affiliates, or as investment advice or recommendations by BBSM, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. BLOOMBERG, BLOOMBERG SECOND MEASURE, BLOOMBERG TERMINAL, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG TRADEBOOK, BLOOMBERG BONDTRADER, BLOOMBERG TELEVISION, BLOOMBERG RADIO, BLOOMBERG.COM and BLOOMBERG ANYWHERE are trademarks and service marks of Bloomberg Finance L.P., a Delaware limited partnership, or its subsidiaries. Absence of any trademark or service mark from this list does not waive Bloomberg Finance L.P.’s or its affiliates’ intellectual property rights in that name, mark or logo. All rights reserved. © 2023 Bloomberg.