NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

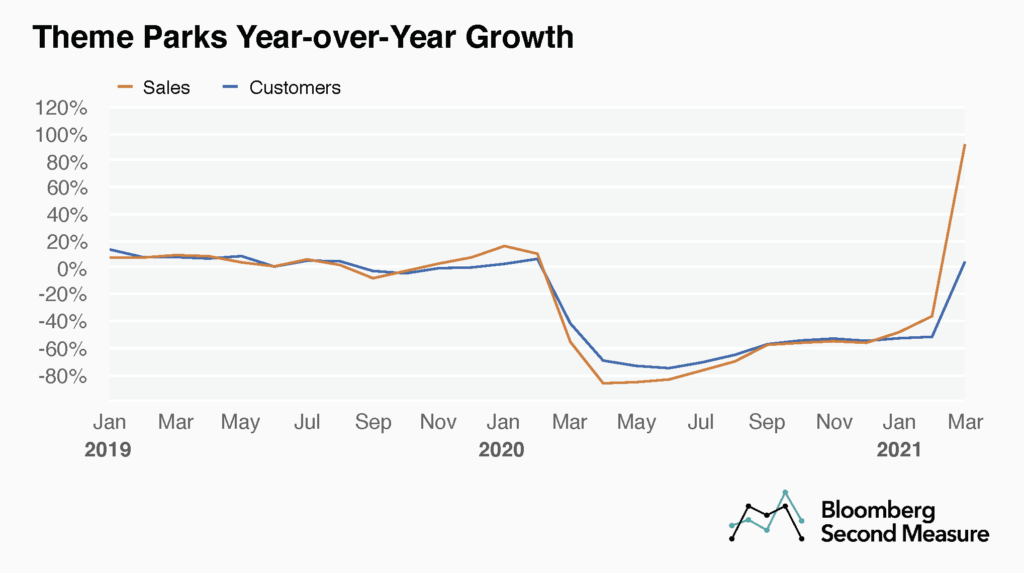

Consumer transaction data reveals that theme parks across the U. S. have been on the road to recovery, with both ticket sales and customer counts on the rise, after having been hit hard by shelter-in-place orders in March 2020. The industry witnessed a 55 percent decline in sales year-over-year in March 2020, and has since bounced back with 92 percent year-over-year sales growth in March 2021.

Theme parks saw observed customers fall by a lesser magnitude year-over-year between April to September of 2020. The monthly average year-over-year growth in observed customers stood at -69 percent compared to -77 percent for observed sales, a trend that was perhaps due to parks looking to alternative ways of maintaining customer traffic, like Disney World’s NBA bubble.

Sales growth started to outpace customer growth at the tail end of 2020. Between December 2020 and March 2021, average monthly year-over-year growth in sales stood at -12 percent versus -39 percent for observed customers, as vaccines roll out across the U.S.

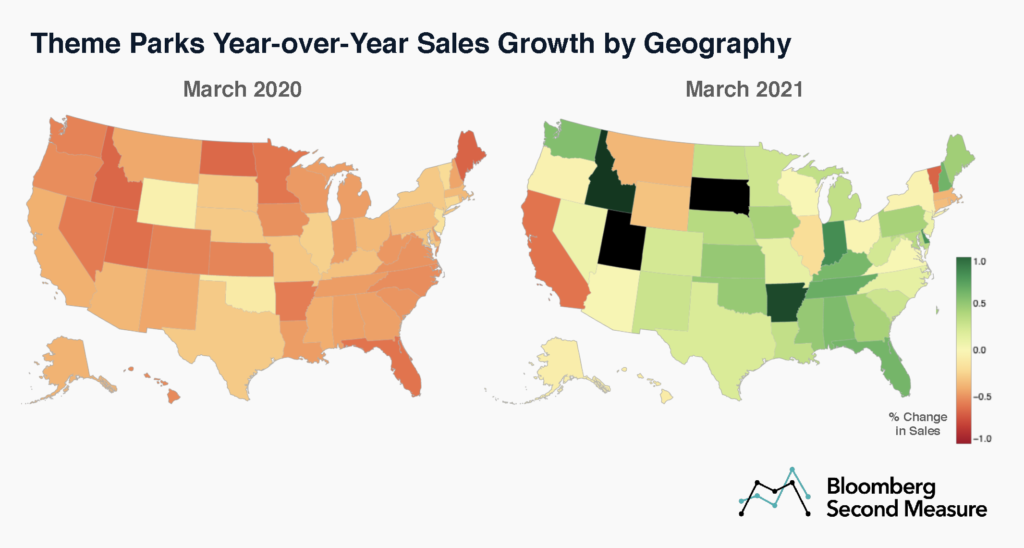

Parks in some states recovering faster than others

States that have reopened faster showed stronger year-over-year growth in March 2021. In Utah and Arkansas, year-over-year theme park sales growth stood at 598 percent and 464 percent, respectively. By contrast, California, Vermont, and Hawaii remain the only states to have witnessed a double-digit decline in year-over-year growth. Among this group, California’s year-over-year sales growth stood at -47 percent, around twice that of Vermont and Hawaii, which saw growth figures of -25 and -20 percent, respectively.

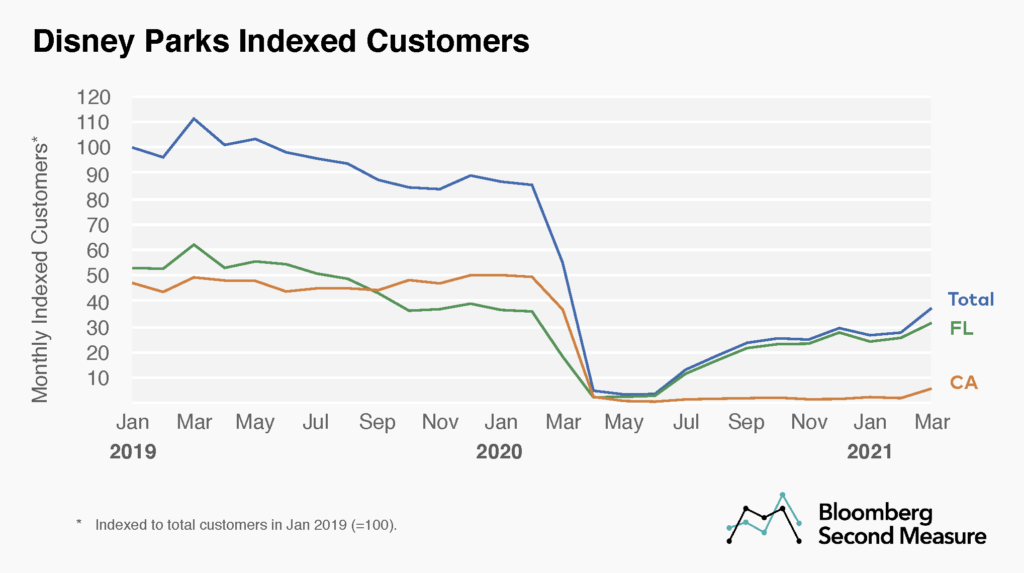

Florida driving Disney parks’ recovery

For the industry’s largest player, Disney Parks, nearly all of its recovery since March 2020 can be attributed to a single park—Disney World in Orlando, Florida. For a brief period between March and May of 2020, observed customers at both parks hovered around zero, but customer counts increased in June, as the Florida park re-opened, while California’s Disneyland remained shuttered due to state and local regulations. In March 2021, Disney’s California park constituted 16 percent of total customers, falling from 67 percent a year earlier.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.